Luc von Niederhäusern

Graph Feature Preprocessor: Real-time Extraction of Subgraph-based Features from Transaction Graphs

Feb 13, 2024

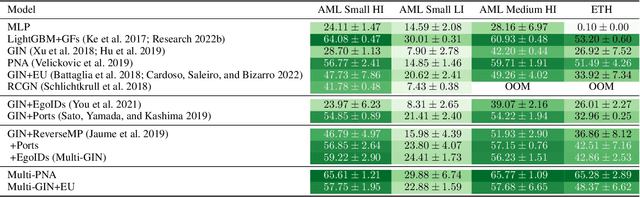

Abstract:In this paper, we present "Graph Feature Preprocessor", a software library for detecting typical money laundering and fraud patterns in financial transaction graphs in real time. These patterns are used to produce a rich set of transaction features for downstream machine learning training and inference tasks such as money laundering detection. We show that our enriched transaction features dramatically improve the prediction accuracy of gradient-boosting-based machine learning models. Our library exploits multicore parallelism, maintains a dynamic in-memory graph, and efficiently mines subgraph patterns in the incoming transaction stream, which enables it to be operated in a streaming manner. We evaluate our library using highly-imbalanced synthetic anti-money laundering (AML) and real-life Ethereum phishing datasets. In these datasets, the proportion of illicit transactions is very small, which makes the learning process challenging. Our solution, which combines our Graph Feature Preprocessor and gradient-boosting-based machine learning models, is able to detect these illicit transactions with higher minority-class F1 scores than standard graph neural networks. In addition, the end-to-end throughput rate of our solution executed on a multicore CPU outperforms the graph neural network baselines executed on a powerful V100 GPU. Overall, the combination of high accuracy, a high throughput rate, and low latency of our solution demonstrates the practical value of our library in real-world applications. Graph Feature Preprocessor has been integrated into IBM mainframe software products, namely "IBM Cloud Pak for Data on Z" and "AI Toolkit for IBM Z and LinuxONE".

Provably Powerful Graph Neural Networks for Directed Multigraphs

Jun 20, 2023

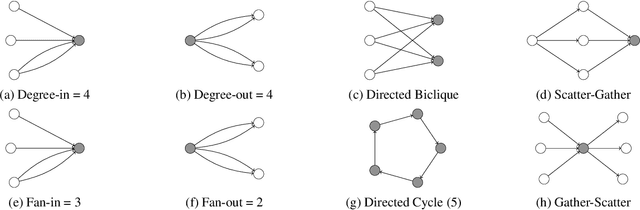

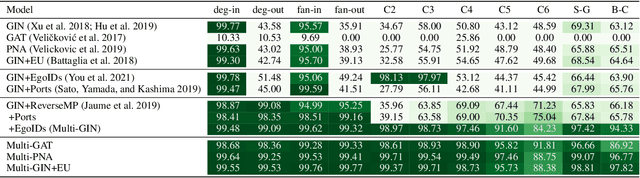

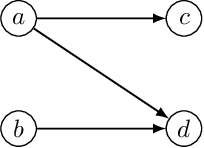

Abstract:This paper proposes a set of simple adaptations to transform standard message-passing Graph Neural Networks (GNN) into provably powerful directed multigraph neural networks. The adaptations include multigraph port numbering, ego IDs, and reverse message passing. We prove that the combination of these theoretically enables the detection of any directed subgraph pattern. To validate the effectiveness of our proposed adaptations in practice, we conduct experiments on synthetic subgraph detection tasks, which demonstrate outstanding performance with almost perfect results. Moreover, we apply our proposed adaptations to two financial crime analysis tasks. We observe dramatic improvements in detecting money laundering transactions, improving the minority-class F1 score of a standard message-passing GNN by up to 45%, and clearly outperforming tree-based and GNN baselines. Similarly impressive results are observed on a real-world phishing detection dataset, boosting a standard GNN's F1 score by over 15% and outperforming all baselines.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge