Kojin Oshiba

Llama-3.1-FoundationAI-SecurityLLM-Reasoning-8B Technical Report

Jan 28, 2026Abstract:We present Foundation-Sec-8B-Reasoning, the first open-source native reasoning model for cybersecurity. Built upon our previously released Foundation-Sec-8B base model (derived from Llama-3.1-8B-Base), the model is trained through a two-stage process combining supervised fine-tuning (SFT) and reinforcement learning from verifiable rewards (RLVR). Our training leverages proprietary reasoning data spanning cybersecurity analysis, instruction-following, and mathematical reasoning. Evaluation across 10 cybersecurity benchmarks and 10 general-purpose benchmarks demonstrates performance competitive with significantly larger models on cybersecurity tasks while maintaining strong general capabilities. The model shows effective generalization on multi-hop reasoning tasks and strong safety performance when deployed with appropriate system prompts and guardrails. This work demonstrates that domain-specialized reasoning models can achieve strong performance on specialized tasks while maintaining broad general capabilities. We release the model publicly at https://huggingface.co/fdtn-ai/Foundation-Sec-8B-Reasoning.

Llama-3.1-FoundationAI-SecurityLLM-Base-8B Technical Report

Apr 28, 2025

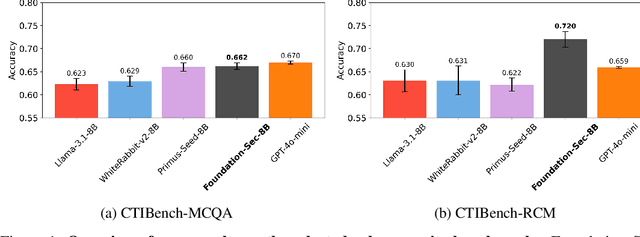

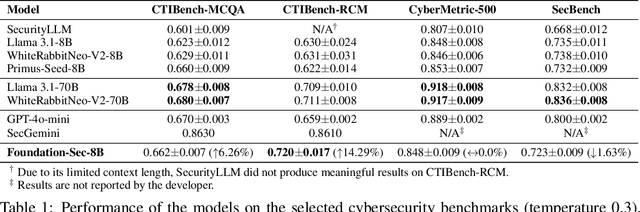

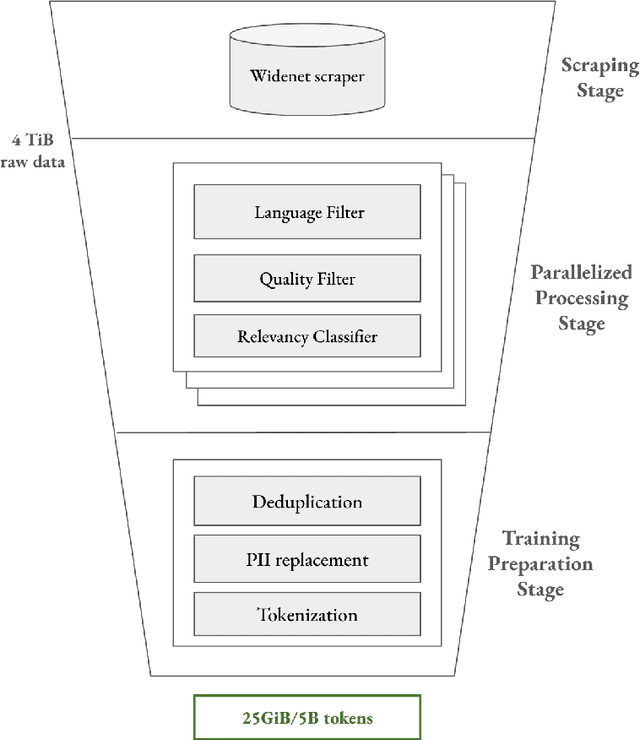

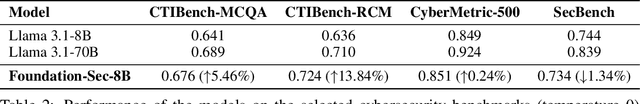

Abstract:As transformer-based large language models (LLMs) increasingly permeate society, they have revolutionized domains such as software engineering, creative writing, and digital arts. However, their adoption in cybersecurity remains limited due to challenges like scarcity of specialized training data and complexity of representing cybersecurity-specific knowledge. To address these gaps, we present Foundation-Sec-8B, a cybersecurity-focused LLM built on the Llama 3.1 architecture and enhanced through continued pretraining on a carefully curated cybersecurity corpus. We evaluate Foundation-Sec-8B across both established and new cybersecurity benchmarks, showing that it matches Llama 3.1-70B and GPT-4o-mini in certain cybersecurity-specific tasks. By releasing our model to the public, we aim to accelerate progress and adoption of AI-driven tools in both public and private cybersecurity contexts.

Adversarial Attacks on Binary Image Recognition Systems

Oct 22, 2020

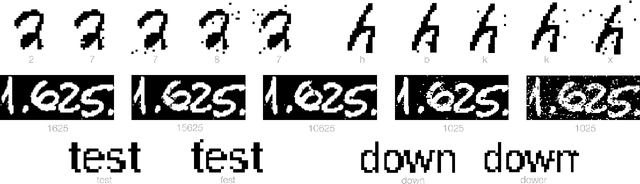

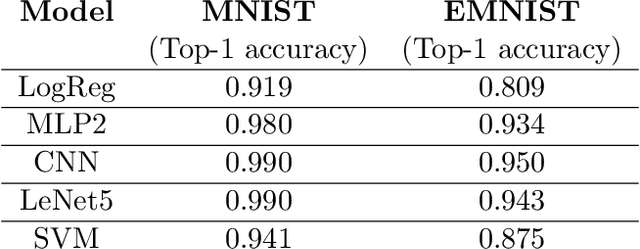

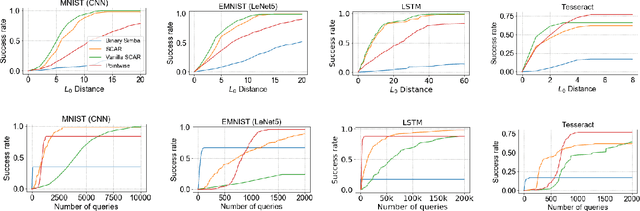

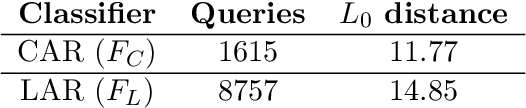

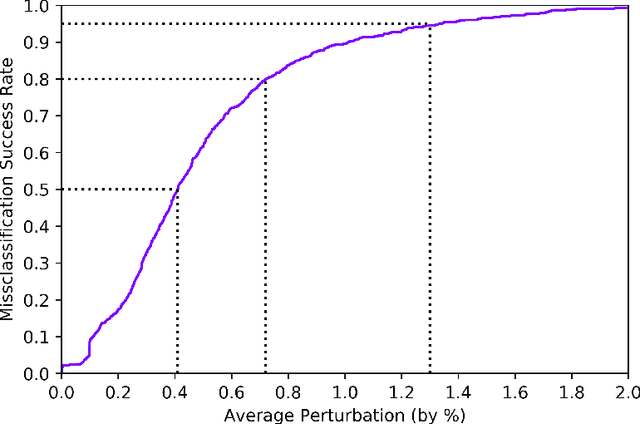

Abstract:We initiate the study of adversarial attacks on models for binary (i.e. black and white) image classification. Although there has been a great deal of work on attacking models for colored and grayscale images, little is known about attacks on models for binary images. Models trained to classify binary images are used in text recognition applications such as check processing, license plate recognition, invoice processing, and many others. In contrast to colored and grayscale images, the search space of attacks on binary images is extremely restricted and noise cannot be hidden with minor perturbations in each pixel. Thus, the optimization landscape of attacks on binary images introduces new fundamental challenges. In this paper we introduce a new attack algorithm called SCAR, designed to fool classifiers of binary images. We show that SCAR significantly outperforms existing $L_0$ attacks applied to the binary setting and use it to demonstrate the vulnerability of real-world text recognition systems. SCAR's strong performance in practice contrasts with the existence of classifiers that are provably robust to large perturbations. In many cases, altering a single pixel is sufficient to trick Tesseract, a popular open-source text recognition system, to misclassify a word as a different word in the English dictionary. We also license software from providers of check processing systems to most of the major US banks and demonstrate the vulnerability of check recognitions for mobile deposits. These systems are substantially harder to fool since they classify both the handwritten amounts in digits and letters, independently. Nevertheless, we generalize SCAR to design attacks that fool state-of-the-art check processing systems using unnoticeable perturbations that lead to misclassification of deposit amounts. Consequently, this is a powerful method to perform financial fraud.

Predicting Choice with Set-Dependent Aggregation

Jun 14, 2019

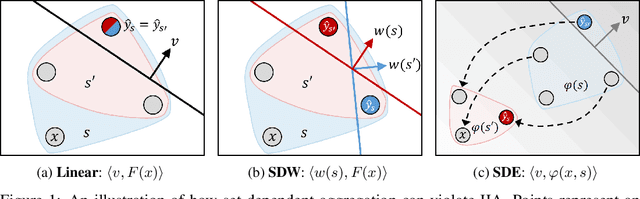

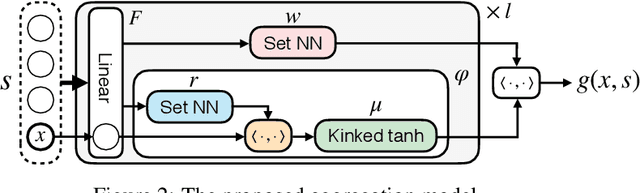

Abstract:Providing users with alternatives to choose from is an essential component in many online platforms, making the accurate prediction of choice vital to their success. A renewed interest in learning choice models has led to significant progress in modeling power, but most current methods are either limited in the types of choice behavior they capture, cannot be applied to large-scale data, or both. Here we propose a learning framework for predicting choice that is accurate, versatile, theoretically grounded, and scales well. Our key modeling point is that to account for how humans choose, predictive models must capture certain set-related invariances. Building on recent results in economics, we derive a class of models that can express any behavioral choice pattern, enjoy favorable sample complexity guarantees, and can be efficiently trained end-to-end. Experiments on three large choice datasets demonstrate the utility of our approach.

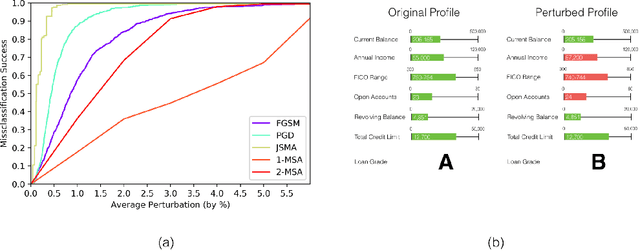

Robust Classification of Financial Risk

Nov 27, 2018

Abstract:Algorithms are increasingly common components of high-impact decision-making, and a growing body of literature on adversarial examples in laboratory settings indicates that standard machine learning models are not robust. This suggests that real-world systems are also susceptible to manipulation or misclassification, which especially poses a challenge to machine learning models used in financial services. We use the loan grade classification problem to explore how machine learning models are sensitive to small changes in user-reported data, using adversarial attacks documented in the literature and an original, domain-specific attack. Our work shows that a robust optimization algorithm can build models for financial services that are resistant to misclassification on perturbations. To the best of our knowledge, this is the first study of adversarial attacks and defenses for deep learning in financial services.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge