Daniel Giebisch

Fauna Sprout: A lightweight, approachable, developer-ready humanoid robot

Jan 26, 2026Abstract:Recent advances in learned control, large-scale simulation, and generative models have accelerated progress toward general-purpose robotic controllers, yet the field still lacks platforms suitable for safe, expressive, long-term deployment in human environments. Most existing humanoids are either closed industrial systems or academic prototypes that are difficult to deploy and operate around people, limiting progress in robotics. We introduce Sprout, a developer platform designed to address these limitations through an emphasis on safety, expressivity, and developer accessibility. Sprout adopts a lightweight form factor with compliant control, limited joint torques, and soft exteriors to support safe operation in shared human spaces. The platform integrates whole-body control, manipulation with integrated grippers, and virtual-reality-based teleoperation within a unified hardware-software stack. An expressive head further enables social interaction -- a domain that remains underexplored on most utilitarian humanoids. By lowering physical and technical barriers to deployment, Sprout expands access to capable humanoid platforms and provides a practical basis for developing embodied intelligence in real human environments.

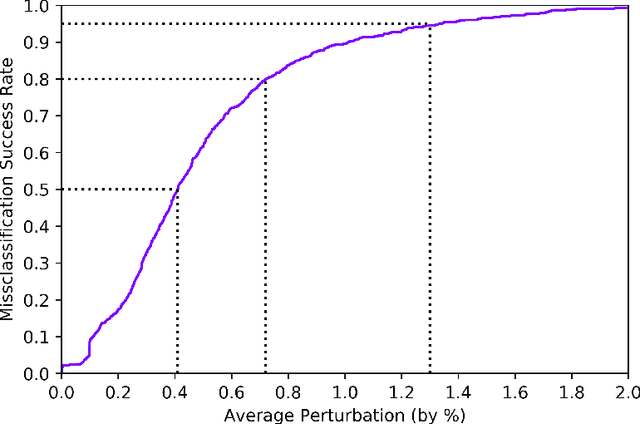

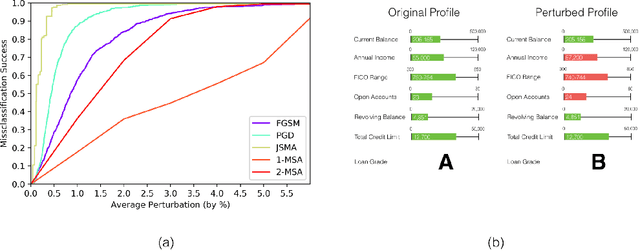

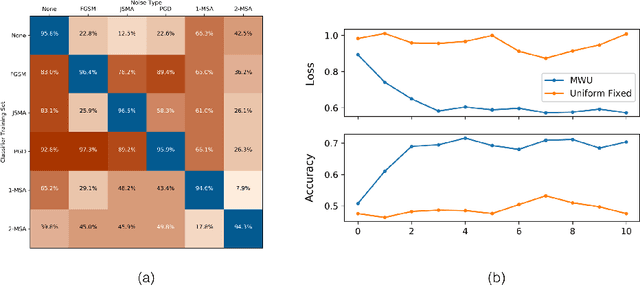

Robust Classification of Financial Risk

Nov 27, 2018

Abstract:Algorithms are increasingly common components of high-impact decision-making, and a growing body of literature on adversarial examples in laboratory settings indicates that standard machine learning models are not robust. This suggests that real-world systems are also susceptible to manipulation or misclassification, which especially poses a challenge to machine learning models used in financial services. We use the loan grade classification problem to explore how machine learning models are sensitive to small changes in user-reported data, using adversarial attacks documented in the literature and an original, domain-specific attack. Our work shows that a robust optimization algorithm can build models for financial services that are resistant to misclassification on perturbations. To the best of our knowledge, this is the first study of adversarial attacks and defenses for deep learning in financial services.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge