Robust Classification of Financial Risk

Paper and Code

Nov 27, 2018

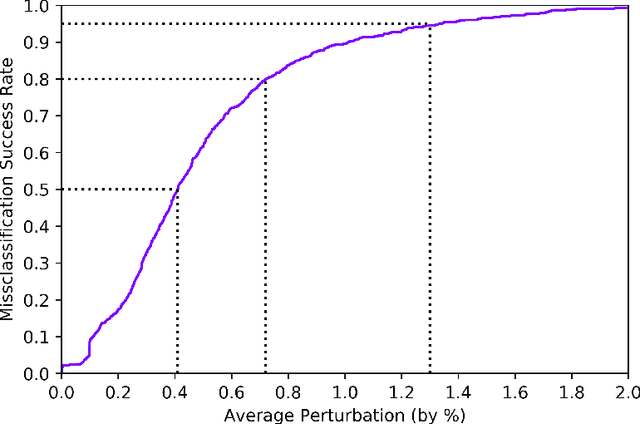

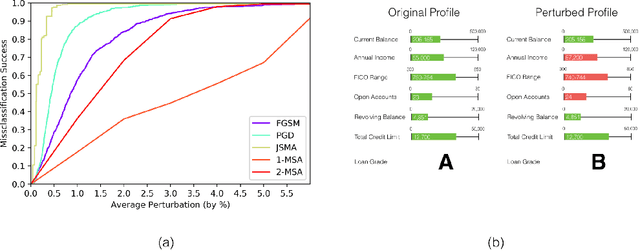

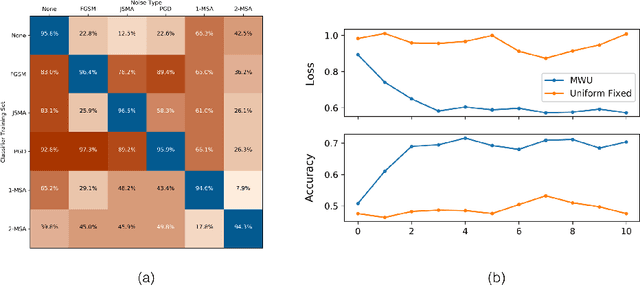

Algorithms are increasingly common components of high-impact decision-making, and a growing body of literature on adversarial examples in laboratory settings indicates that standard machine learning models are not robust. This suggests that real-world systems are also susceptible to manipulation or misclassification, which especially poses a challenge to machine learning models used in financial services. We use the loan grade classification problem to explore how machine learning models are sensitive to small changes in user-reported data, using adversarial attacks documented in the literature and an original, domain-specific attack. Our work shows that a robust optimization algorithm can build models for financial services that are resistant to misclassification on perturbations. To the best of our knowledge, this is the first study of adversarial attacks and defenses for deep learning in financial services.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge