Jichang Zhao

Space-Invariant Projection in Streaming Network Embedding

Mar 11, 2023

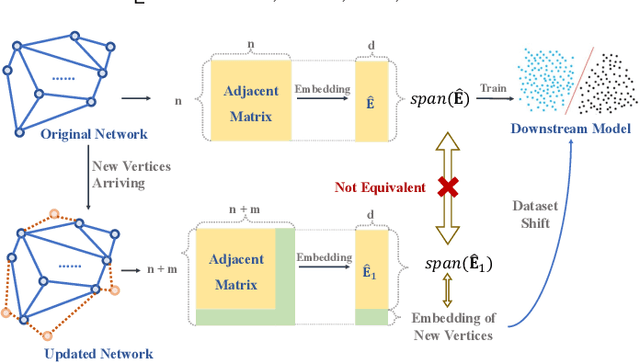

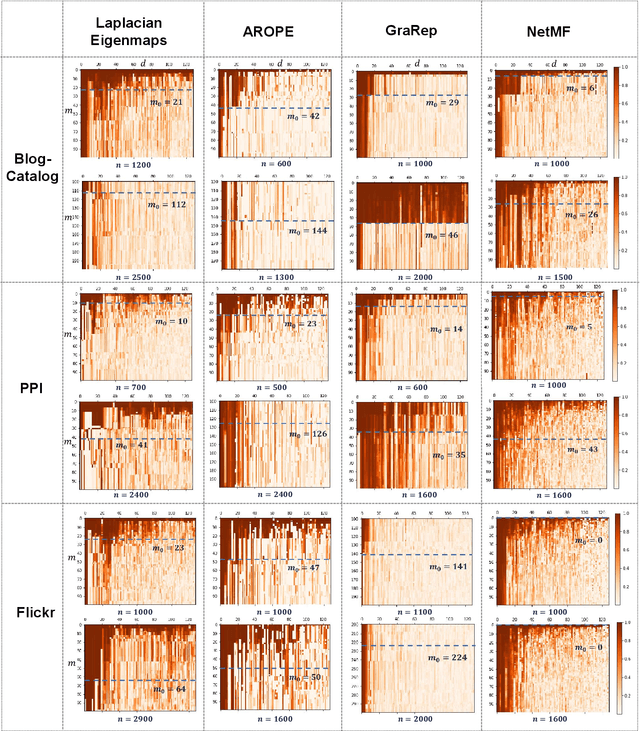

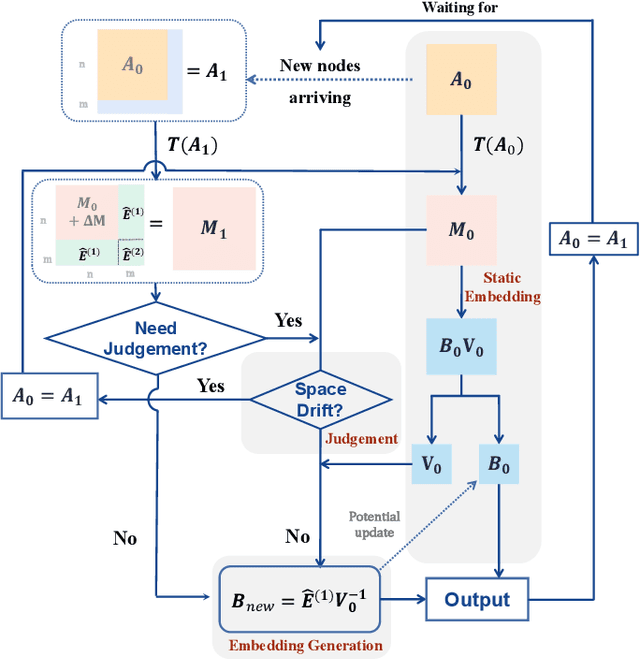

Abstract:Newly arriving nodes in dynamics networks would gradually make the node embedding space drifted and the retraining of node embedding and downstream models indispensable. An exact threshold size of these new nodes, below which the node embedding space will be predicatively maintained, however, is rarely considered in either theory or experiment. From the view of matrix perturbation theory, a threshold of the maximum number of new nodes that keep the node embedding space approximately equivalent is analytically provided and empirically validated. It is therefore theoretically guaranteed that as the size of newly arriving nodes is below this threshold, embeddings of these new nodes can be quickly derived from embeddings of original nodes. A generation framework, Space-Invariant Projection (SIP), is accordingly proposed to enables arbitrary static MF-based embedding schemes to embed new nodes in dynamics networks fast. The time complexity of SIP is linear with the network size. By combining SIP with four state-of-the-art MF-based schemes, we show that SIP exhibits not only wide adaptability but also strong empirical performance in terms of efficiency and efficacy on the node classification task in three real datasets.

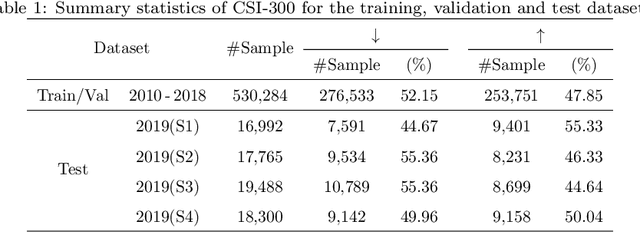

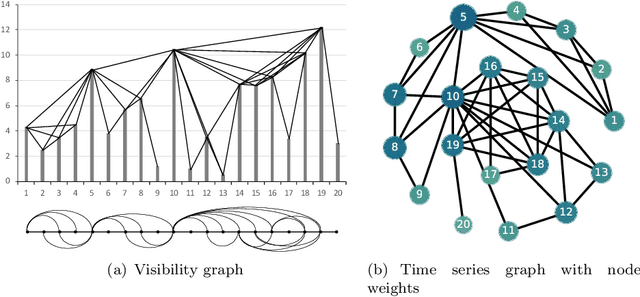

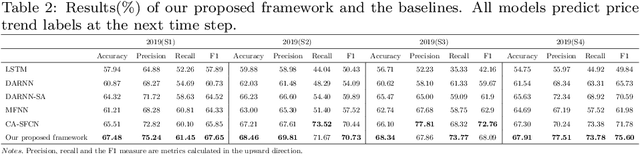

Price graphs: Utilizing the structural information of financial time series for stock prediction

Jun 11, 2021

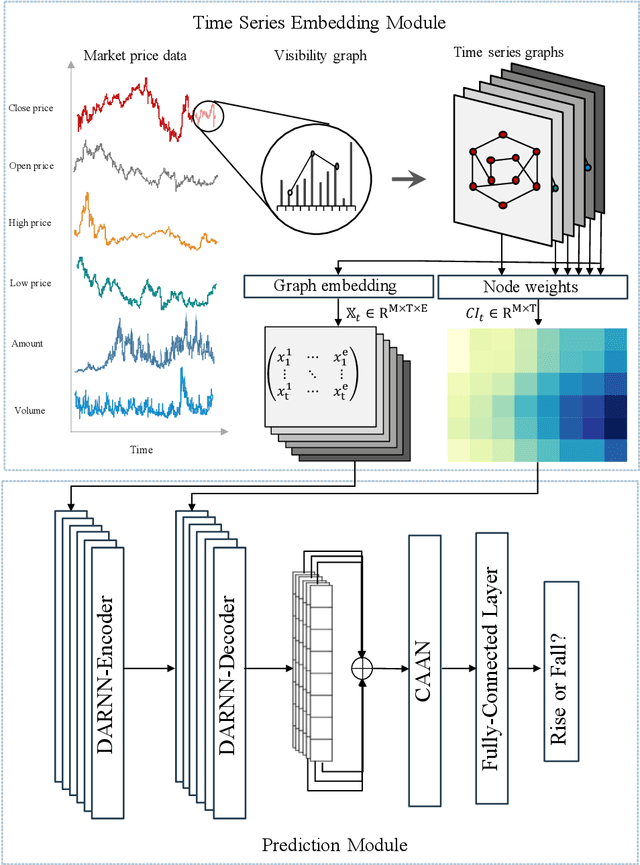

Abstract:Stock prediction, with the purpose of forecasting the future price trends of stocks, is crucial for maximizing profits from stock investments. While great research efforts have been devoted to exploiting deep neural networks for improved stock prediction, two major issues still exist in recent studies. First, the capture of long-range dependencies in time series is not sufficiently addressed. Second, the chaotic property of financial time series fundamentally lowers prediction performance. In this study, we propose a novel framework to address both issues regarding stock prediction. Specifically, in terms of transforming time series into complex networks, we convert market price series into graphs. Then, structural information, referring to associations among temporal points and the node weights, is extracted from the mapped graphs to resolve the problems regarding long-range dependencies and the chaotic property. We take graph embeddings to represent the associations among temporal points as the prediction model inputs. Node weights are used as a priori knowledge to enhance the learning of temporal attention. The effectiveness of our proposed framework is validated using real-world stock data, and our approach obtains the best performance among several state-of-the-art benchmarks. Moreover, in the conducted trading simulations, our framework further obtains the highest cumulative profits. Our results supplement the existing applications of complex network methods in the financial realm and provide insightful implications for investment applications regarding decision support in financial markets.

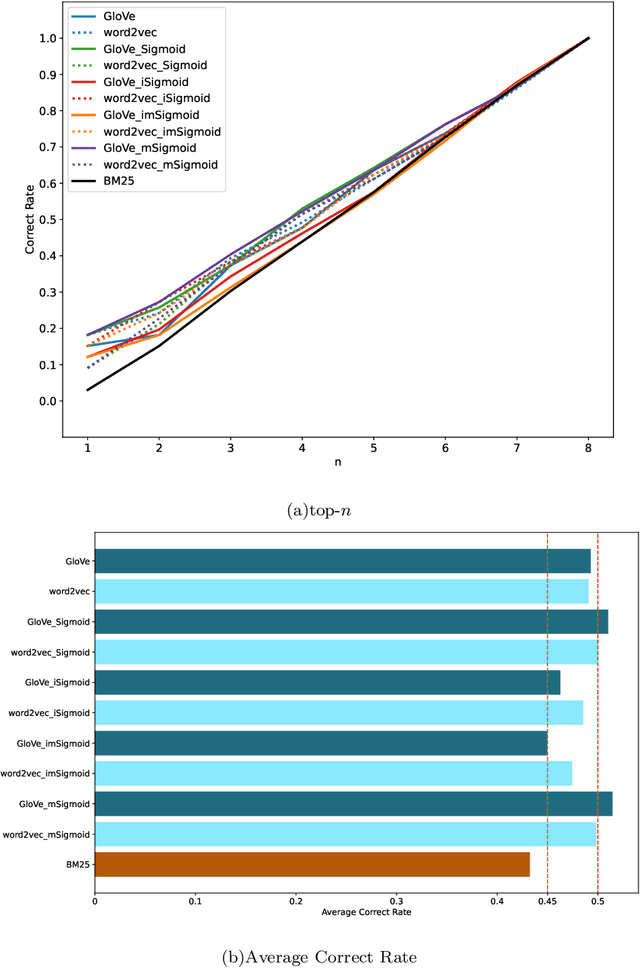

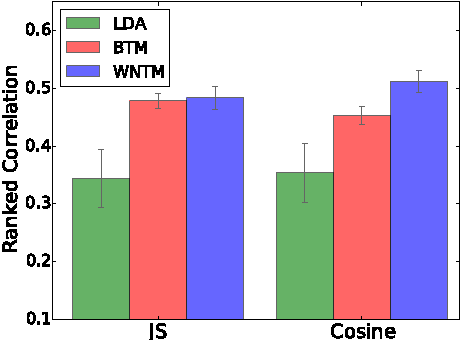

Positive emotions help rank negative reviews in e-commerce

May 20, 2020

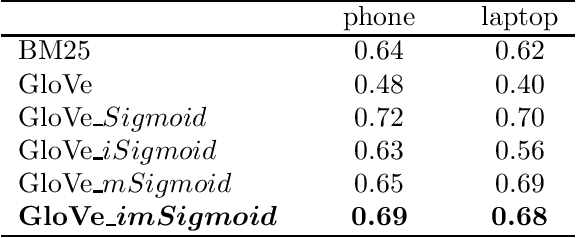

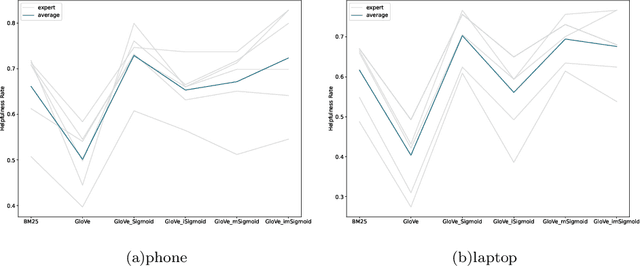

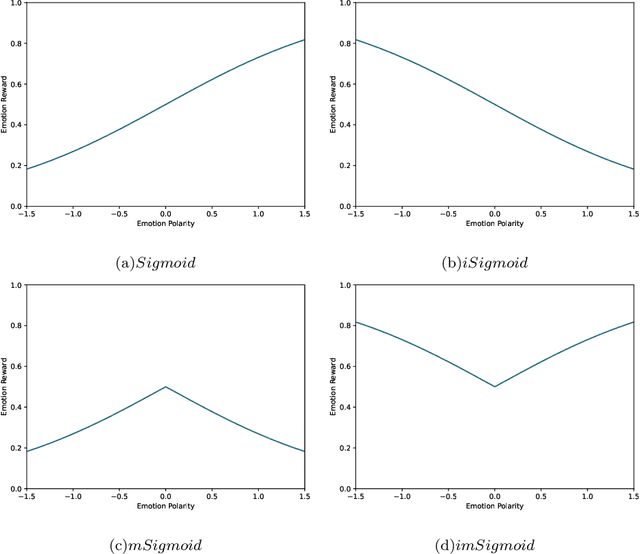

Abstract:Negative reviews, the poor ratings in postpurchase evaluation, play an indispensable role in e-commerce, especially in shaping future sales and firm equities. However, extant studies seldom examine their potential value for sellers and producers in enhancing capabilities of providing better services and products. For those who exploited the helpfulness of reviews in the view of e-commerce keepers, the ranking approaches were developed for customers instead. To fill this gap, in terms of combining description texts and emotion polarities, the aim of the ranking method in this study is to provide the most helpful negative reviews under a certain product attribute for online sellers and producers. By applying a more reasonable evaluating procedure, experts with related backgrounds are hired to vote for the ranking approaches. Our ranking method turns out to be more reliable for ranking negative reviews for sellers and producers, demonstrating a better performance than the baselines like BM25 with a result of 8% higher. In this paper, we also enrich the previous understandings of emotions in valuing reviews. Specifically, it is surprisingly found that positive emotions are more helpful rather than negative emotions in ranking negative reviews. The unexpected strengthening from positive emotions in ranking suggests that less polarized reviews on negative experience in fact offer more rational feedbacks and thus more helpfulness to the sellers and producers. The presented ranking method could provide e-commerce practitioners with an efficient and effective way to leverage negative reviews from online consumers.

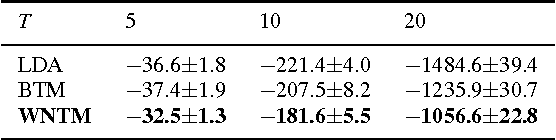

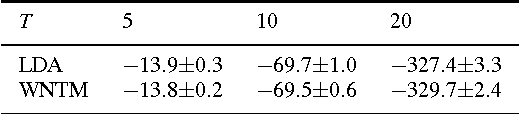

Word Network Topic Model: A Simple but General Solution for Short and Imbalanced Texts

Dec 17, 2014

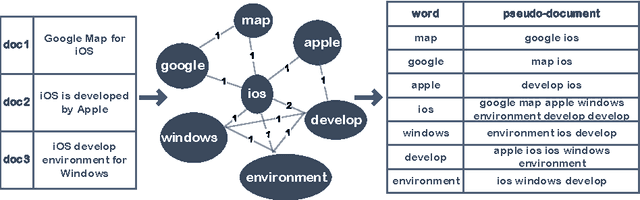

Abstract:The short text has been the prevalent format for information of Internet in recent decades, especially with the development of online social media, whose millions of users generate a vast number of short messages everyday. Although sophisticated signals delivered by the short text make it a promising source for topic modeling, its extreme sparsity and imbalance brings unprecedented challenges to conventional topic models like LDA and its variants. Aiming at presenting a simple but general solution for topic modeling in short texts, we present a word co-occurrence network based model named WNTM to tackle the sparsity and imbalance simultaneously. Different from previous approaches, WNTM models the distribution over topics for each word instead of learning topics for each document, which successfully enhance the semantic density of data space without importing too much time or space complexity. Meanwhile, the rich contextual information preserved in the word-word space also guarantees its sensitivity in identifying rare topics with convincing quality. Furthermore, employing the same Gibbs sampling with LDA makes WNTM easily to be extended to various application scenarios. Extensive validations on both short and normal texts testify the outperformance of WNTM as compared to baseline methods. And finally we also demonstrate its potential in precisely discovering newly emerging topics or unexpected events in Weibo at pretty early stages.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge