Price graphs: Utilizing the structural information of financial time series for stock prediction

Paper and Code

Jun 11, 2021

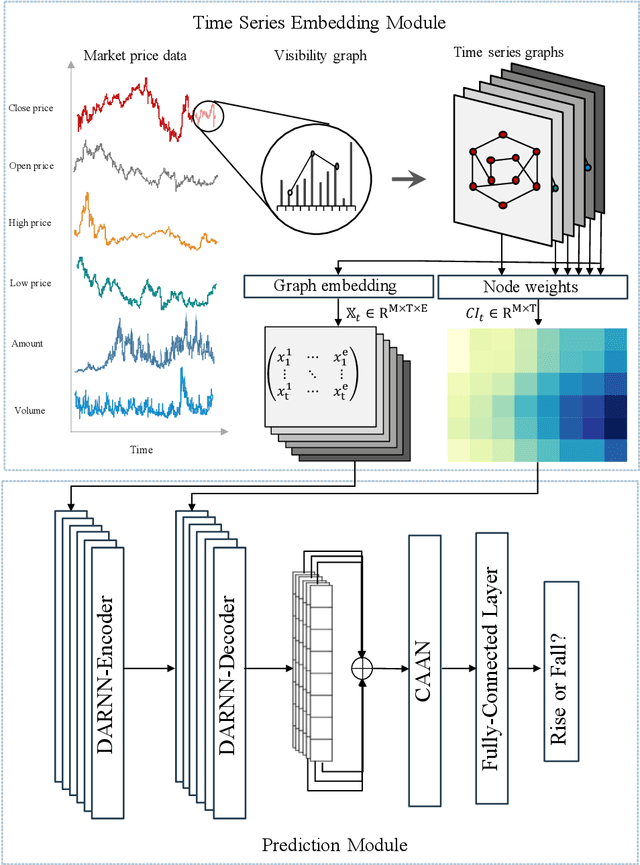

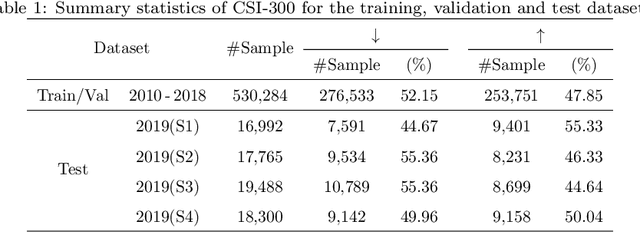

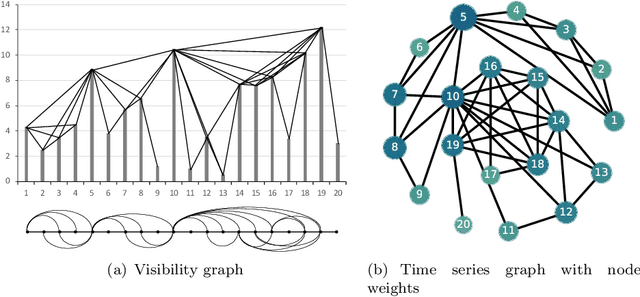

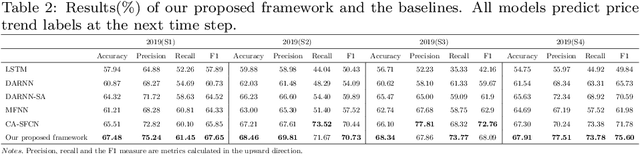

Stock prediction, with the purpose of forecasting the future price trends of stocks, is crucial for maximizing profits from stock investments. While great research efforts have been devoted to exploiting deep neural networks for improved stock prediction, two major issues still exist in recent studies. First, the capture of long-range dependencies in time series is not sufficiently addressed. Second, the chaotic property of financial time series fundamentally lowers prediction performance. In this study, we propose a novel framework to address both issues regarding stock prediction. Specifically, in terms of transforming time series into complex networks, we convert market price series into graphs. Then, structural information, referring to associations among temporal points and the node weights, is extracted from the mapped graphs to resolve the problems regarding long-range dependencies and the chaotic property. We take graph embeddings to represent the associations among temporal points as the prediction model inputs. Node weights are used as a priori knowledge to enhance the learning of temporal attention. The effectiveness of our proposed framework is validated using real-world stock data, and our approach obtains the best performance among several state-of-the-art benchmarks. Moreover, in the conducted trading simulations, our framework further obtains the highest cumulative profits. Our results supplement the existing applications of complex network methods in the financial realm and provide insightful implications for investment applications regarding decision support in financial markets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge