Dixing Xu

AIDE: AI-Driven Exploration in the Space of Code

Feb 18, 2025Abstract:Machine learning, the foundation of modern artificial intelligence, has driven innovations that have fundamentally transformed the world. Yet, behind advancements lies a complex and often tedious process requiring labor and compute intensive iteration and experimentation. Engineers and scientists developing machine learning models spend much of their time on trial-and-error tasks instead of conceptualizing innovative solutions or research hypotheses. To address this challenge, we introduce AI-Driven Exploration (AIDE), a machine learning engineering agent powered by large language models (LLMs). AIDE frames machine learning engineering as a code optimization problem, and formulates trial-and-error as a tree search in the space of potential solutions. By strategically reusing and refining promising solutions, AIDE effectively trades computational resources for enhanced performance, achieving state-of-the-art results on multiple machine learning engineering benchmarks, including our Kaggle evaluations, OpenAI MLE-Bench and METRs RE-Bench.

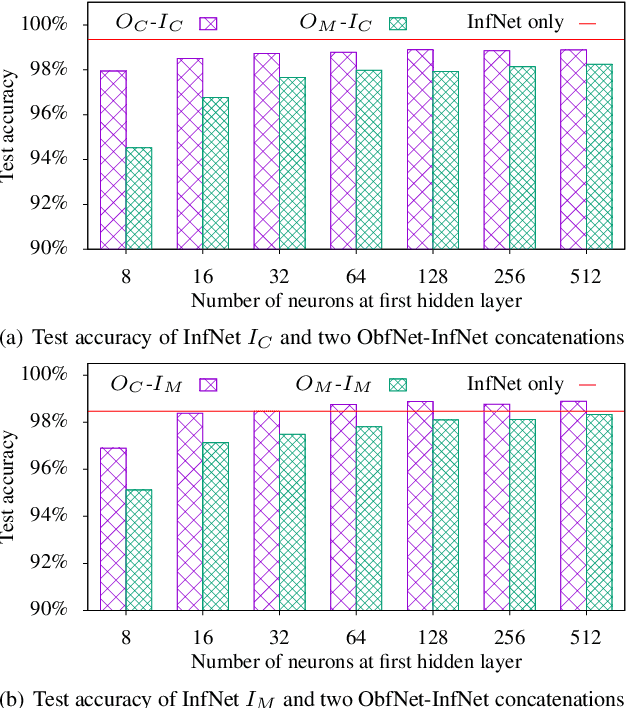

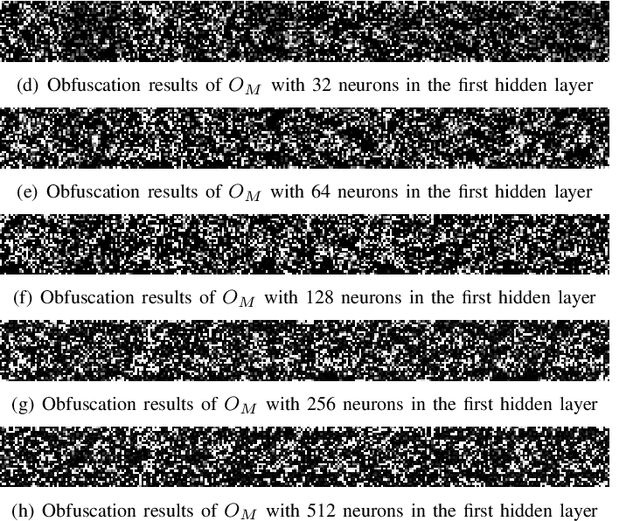

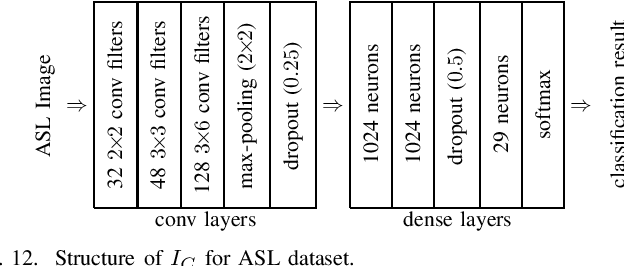

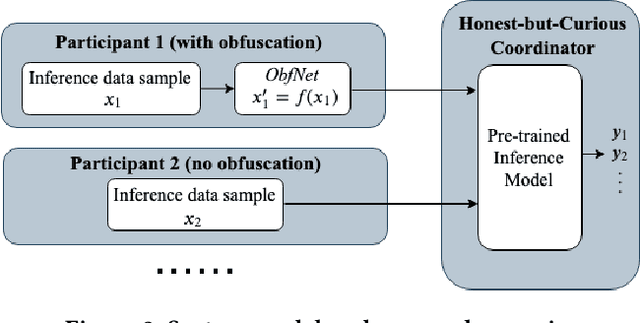

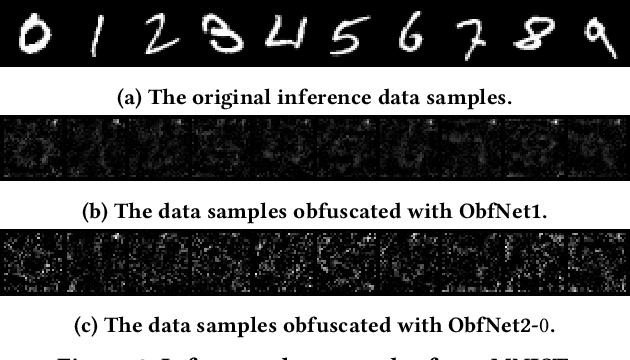

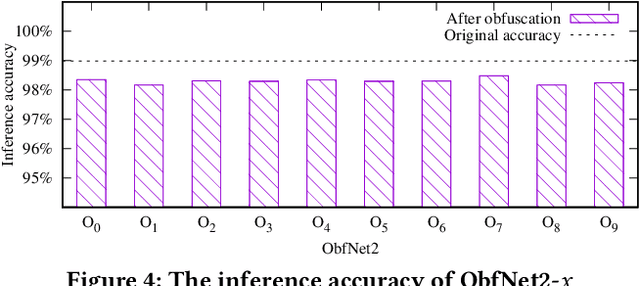

Lightweight and Unobtrusive Privacy Preservation for Remote Inference via Edge Data Obfuscation

Dec 20, 2019

Abstract:The growing momentum of instrumenting the Internet of Things (IoT) with advanced machine learning techniques such as deep neural networks (DNNs) faces two practical challenges of limited compute power of edge devices and the need of protecting the confidentiality of the DNNs. The remote inference scheme that executes the DNNs on the server-class or cloud backend can address the above two challenges. However, it brings the concern of leaking the privacy of the IoT devices' users to the curious backend since the user-generated/related data is to be transmitted to the backend. This work develops a lightweight and unobtrusive approach to obfuscate the data before being transmitted to the backend for remote inference. In this approach, the edge device only needs to execute a small-scale neural network, incurring light compute overhead. Moreover, the edge device does not need to inform the backend on whether the data is obfuscated, making the protection unobtrusive. We apply the approach to three case studies of free spoken digit recognition, handwritten digit recognition, and American sign language recognition. The evaluation results obtained from the case studies show that our approach prevents the backend from obtaining the raw forms of the inference data while maintaining the DNN's inference accuracy at the backend.

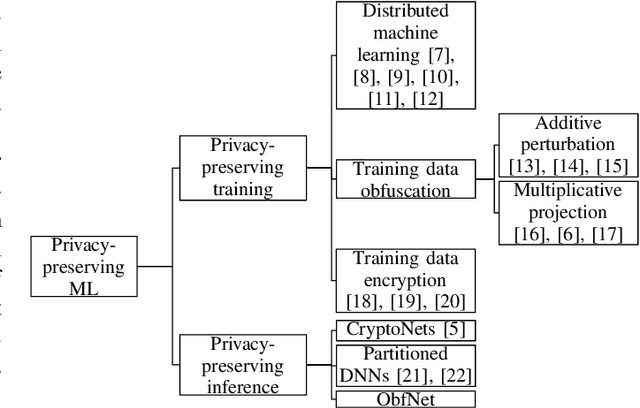

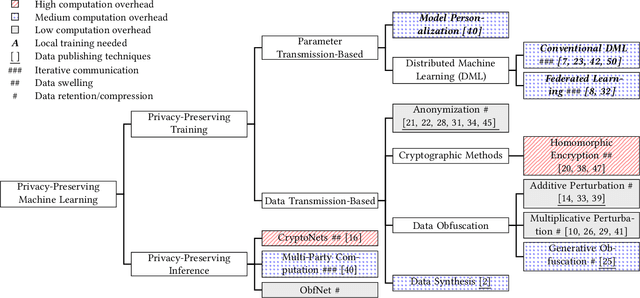

Challenges of Privacy-Preserving Machine Learning in IoT

Sep 21, 2019

Abstract:The Internet of Things (IoT) will be a main data generation infrastructure for achieving better system intelligence. However, the extensive data collection and processing in IoT also engender various privacy concerns. This paper provides a taxonomy of the existing privacy-preserving machine learning approaches developed in the context of cloud computing and discusses the challenges of applying them in the context of IoT. Moreover, we present a privacy-preserving inference approach that runs a lightweight neural network at IoT objects to obfuscate the data before transmission and a deep neural network in the cloud to classify the obfuscated data. Evaluation based on the MNIST dataset shows satisfactory performance.

A Deep Reinforcement Learning Framework for the Financial Portfolio Management Problem

Jul 16, 2017

Abstract:Financial portfolio management is the process of constant redistribution of a fund into different financial products. This paper presents a financial-model-free Reinforcement Learning framework to provide a deep machine learning solution to the portfolio management problem. The framework consists of the Ensemble of Identical Independent Evaluators (EIIE) topology, a Portfolio-Vector Memory (PVM), an Online Stochastic Batch Learning (OSBL) scheme, and a fully exploiting and explicit reward function. This framework is realized in three instants in this work with a Convolutional Neural Network (CNN), a basic Recurrent Neural Network (RNN), and a Long Short-Term Memory (LSTM). They are, along with a number of recently reviewed or published portfolio-selection strategies, examined in three back-test experiments with a trading period of 30 minutes in a cryptocurrency market. Cryptocurrencies are electronic and decentralized alternatives to government-issued money, with Bitcoin as the best-known example of a cryptocurrency. All three instances of the framework monopolize the top three positions in all experiments, outdistancing other compared trading algorithms. Although with a high commission rate of 0.25% in the backtests, the framework is able to achieve at least 4-fold returns in 50 days.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge