Chih-Min Lin

Error Controlled Actor-Critic

Sep 07, 2021

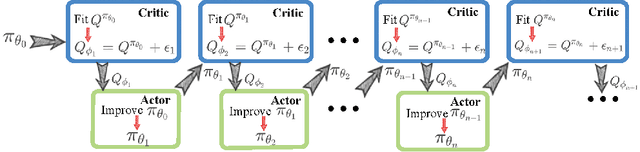

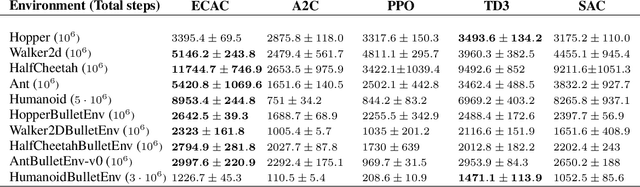

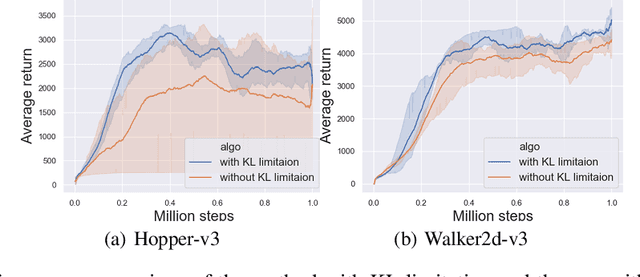

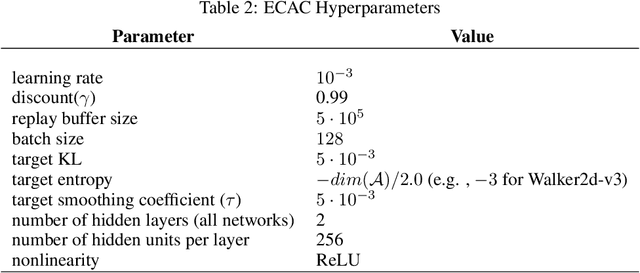

Abstract:On error of value function inevitably causes an overestimation phenomenon and has a negative impact on the convergence of the algorithms. To mitigate the negative effects of the approximation error, we propose Error Controlled Actor-critic which ensures confining the approximation error in value function. We present an analysis of how the approximation error can hinder the optimization process of actor-critic methods.Then, we derive an upper boundary of the approximation error of Q function approximator and find that the error can be lowered by restricting on the KL-divergence between every two consecutive policies when training the policy. The results of experiments on a range of continuous control tasks demonstrate that the proposed actor-critic algorithm apparently reduces the approximation error and significantly outperforms other model-free RL algorithms.

Task Augmentation by Rotating for Meta-Learning

Feb 08, 2020

Abstract:Data augmentation is one of the most effective approaches for improving the accuracy of modern machine learning models, and it is also indispensable to train a deep model for meta-learning. In this paper, we introduce a task augmentation method by rotating, which increases the number of classes by rotating the original images 90, 180 and 270 degrees, different from traditional augmentation methods which increase the number of images. With a larger amount of classes, we can sample more diverse task instances during training. Therefore, task augmentation by rotating allows us to train a deep network by meta-learning methods with little over-fitting. Experimental results show that our approach is better than the rotation for increasing the number of images and achieves state-of-the-art performance on miniImageNet, CIFAR-FS, and FC100 few-shot learning benchmarks. The code is available on \url{www.github.com/AceChuse/TaskLevelAug}.

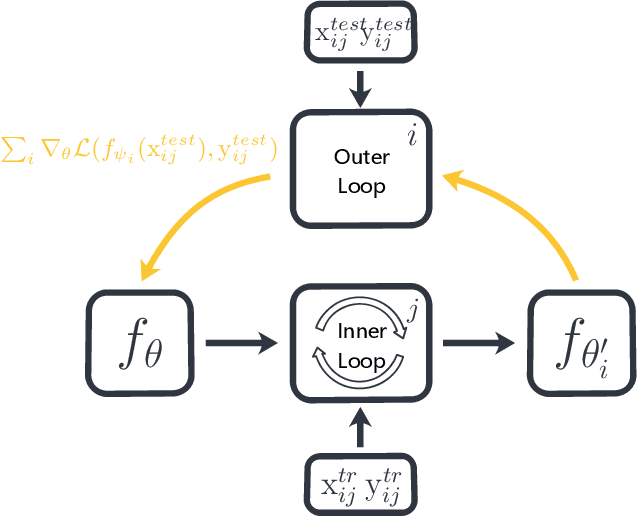

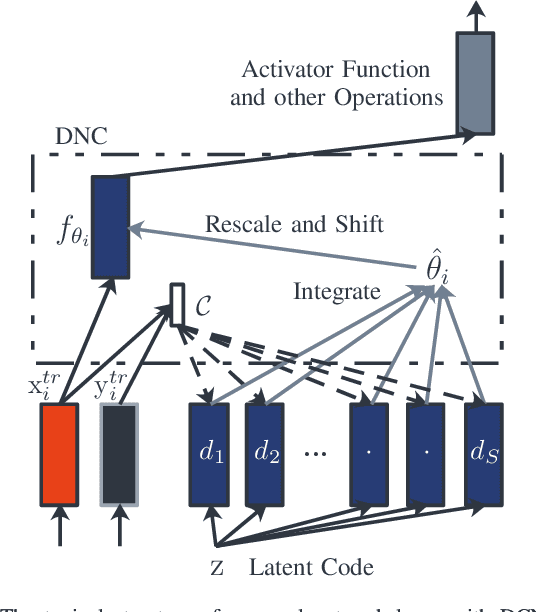

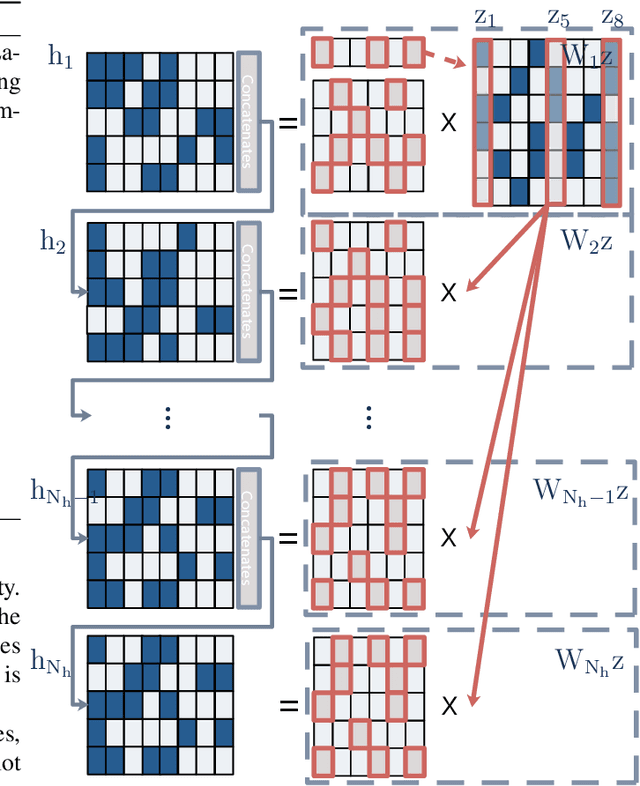

Decoder Choice Network for Meta-Learning

Sep 25, 2019

Abstract:Meta-learning has been widely used for implementing few-shot learning and fast model adaptation. One kind of meta-learning methods attempt to learn how to control the gradient descent process in order to make the gradient-based learning have high speed and generalization. This work proposes a method that controls the gradient descent process of the model parameters of a neural network by limiting the model parameters in a low-dimensional latent space. The main challenge of this idea is that a decoder with too many parameters is required. This work designs a decoder with typical structure and shares a part of weights in the decoder to reduce the number of the required parameters. Besides, this work has introduced ensemble learning to work with the proposed approach for improving performance. The results show that the proposed approach is witnessed by the superior performance over the Omniglot classification and the miniImageNet classification tasks.

Stock Prices Prediction using Deep Learning Models

Sep 25, 2019

Abstract:Financial markets have a vital role in the development of modern society. They allow the deployment of economic resources. Changes in stock prices reflect changes in the market. In this study, we focus on predicting stock prices by deep learning model. This is a challenge task, because there is much noise and uncertainty in information that is related to stock prices. So this work uses sparse autoencoders with one-dimension (1-D) residual convolutional networks which is a deep learning model, to de-noise the data. Long-short term memory (LSTM) is then used to predict the stock price. The prices, indices and macroeconomic variables in past are the features used to predict the next day's price. Experiment results show that 1-D residual convolutional networks can de-noise data and extract deep features better than a model that combines wavelet transforms (WT) and stacked autoencoders (SAEs). In addition, we compare the performances of model with two different forecast targets of stock price: absolute stock price and price rate of change. The results show that predicting stock price through price rate of change is better than predicting absolute prices directly.

Gradient Boost with Convolution Neural Network for Stock Forecast

Sep 19, 2019

Abstract:Market economy closely connects aspects to all walks of life. The stock forecast is one of task among studies on the market economy. However, information on markets economy contains a lot of noise and uncertainties, which lead economy forecasting to become a challenging task. Ensemble learning and deep learning are the most methods to solve the stock forecast task. In this paper, we present a model combining the advantages of two methods to forecast the change of stock price. The proposed method combines CNN and GBoost. The experimental results on six market indexes show that the proposed method has better performance against current popular methods.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge