Alexander Stepikin

WWAggr: A Window Wasserstein-based Aggregation for Ensemble Change Point Detection

Jun 09, 2025

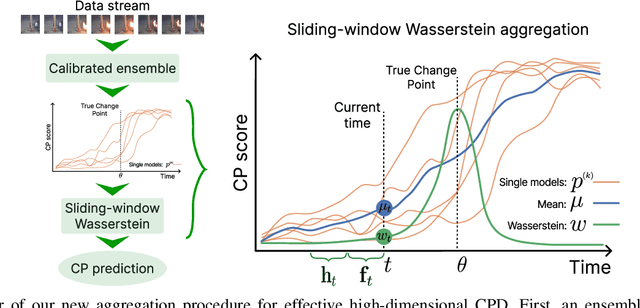

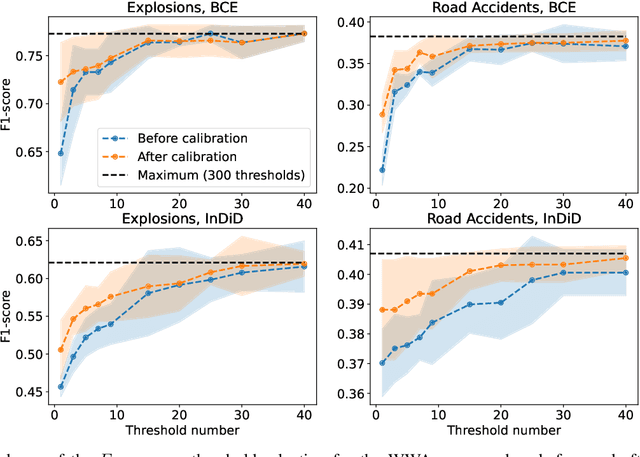

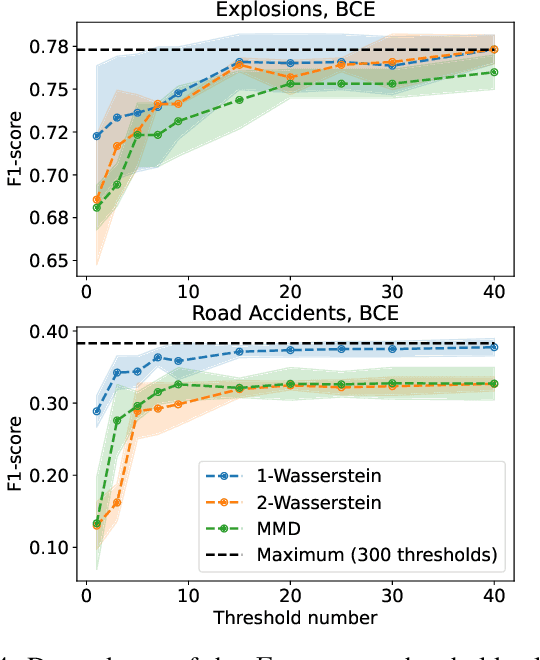

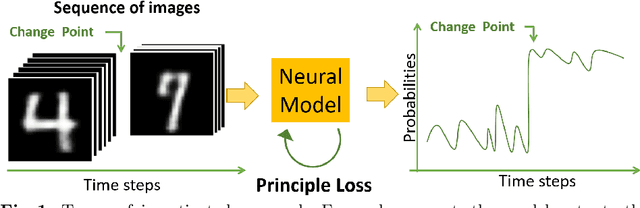

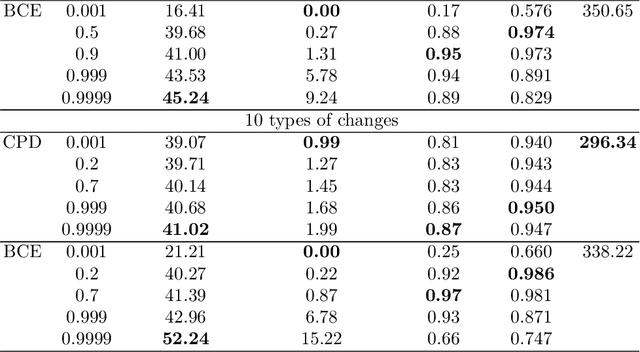

Abstract:Change Point Detection (CPD) aims to identify moments of abrupt distribution shifts in data streams. Real-world high-dimensional CPD remains challenging due to data pattern complexity and violation of common assumptions. Resorting to standalone deep neural networks, the current state-of-the-art detectors have yet to achieve perfect quality. Concurrently, ensembling provides more robust solutions, boosting the performance. In this paper, we investigate ensembles of deep change point detectors and realize that standard prediction aggregation techniques, e.g., averaging, are suboptimal and fail to account for problem peculiarities. Alternatively, we introduce WWAggr -- a novel task-specific method of ensemble aggregation based on the Wasserstein distance. Our procedure is versatile, working effectively with various ensembles of deep CPD models. Moreover, unlike existing solutions, we practically lift a long-standing problem of the decision threshold selection for CPD.

Universal representations for financial transactional data: embracing local, global, and external contexts

Apr 02, 2024

Abstract:Effective processing of financial transactions is essential for banking data analysis. However, in this domain, most methods focus on specialized solutions to stand-alone problems instead of constructing universal representations suitable for many problems. We present a representation learning framework that addresses diverse business challenges. We also suggest novel generative models that account for data specifics, and a way to integrate external information into a client's representation, leveraging insights from other customers' actions. Finally, we offer a benchmark, describing representation quality globally, concerning the entire transaction history; locally, reflecting the client's current state; and dynamically, capturing representation evolution over time. Our generative approach demonstrates superior performance in local tasks, with an increase in ROC-AUC of up to 14\% for the next MCC prediction task and up to 46\% for downstream tasks from existing contrastive baselines. Incorporating external information improves the scores by an additional 20\%.

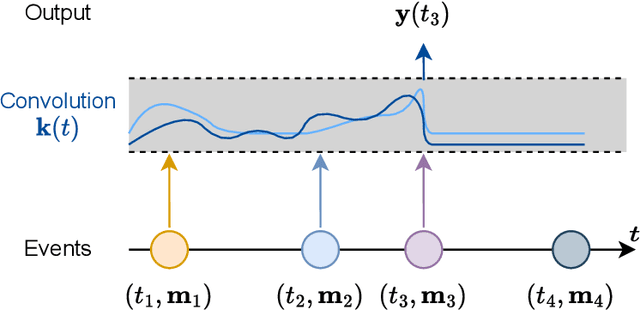

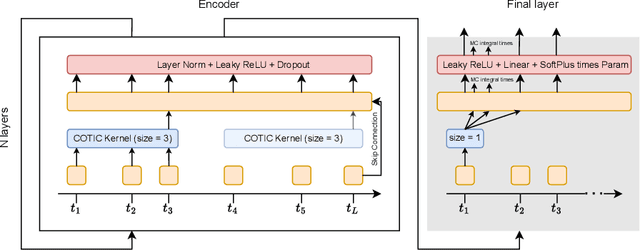

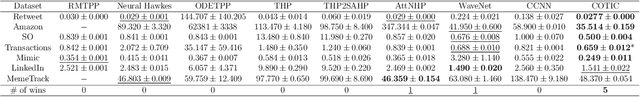

Continuous-time convolutions model of event sequences

Feb 13, 2023

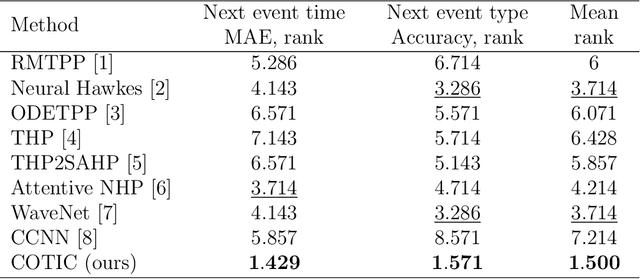

Abstract:Massive samples of event sequences data occur in various domains, including e-commerce, healthcare, and finance. There are two main challenges regarding inference of such data: computational and methodological. The amount of available data and the length of event sequences per client are typically large, thus it requires long-term modelling. Moreover, this data is often sparse and non-uniform, making classic approaches for time series processing inapplicable. Existing solutions include recurrent and transformer architectures in such cases. To allow continuous time, the authors introduce specific parametric intensity functions defined at each moment on top of existing models. Due to the parametric nature, these intensities represent only a limited class of event sequences. We propose the COTIC method based on a continuous convolution neural network suitable for non-uniform occurrence of events in time. In COTIC, dilations and multi-layer architecture efficiently handle dependencies between events. Furthermore, the model provides general intensity dynamics in continuous time - including self-excitement encountered in practice. The COTIC model outperforms existing approaches on majority of the considered datasets, producing embeddings for an event sequence that can be used to solve downstream tasks - e.g. predicting next event type and return time. The code of the proposed method can be found in the GitHub repository (https://github.com/VladislavZh/COTIC).

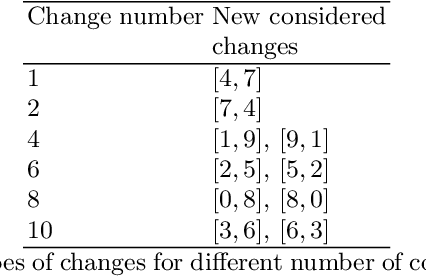

Deep learning model solves change point detection for multiple change types

Apr 15, 2022

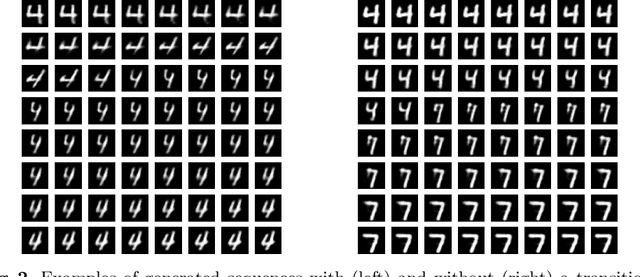

Abstract:A change points detection aims to catch an abrupt disorder in data distribution. Common approaches assume that there are only two fixed distributions for data: one before and another after a change point. Real-world data are richer than this assumption. There can be multiple different distributions before and after a change. We propose an approach that works in the multiple-distributions scenario. Our approach learn representations for semi-structured data suitable for change point detection, while a common classifiers-based approach fails. Moreover, our model is more robust, when predicting change points. The datasets used for benchmarking are sequences of images with and without change points in them.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge