Zhiyu Cao

ICR: Iterative Clarification and Rewriting for Conversational Search

Sep 05, 2025

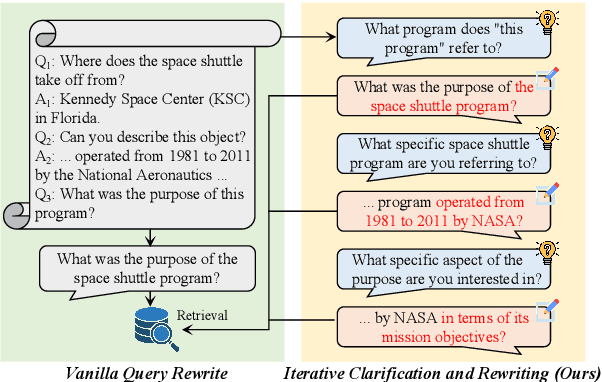

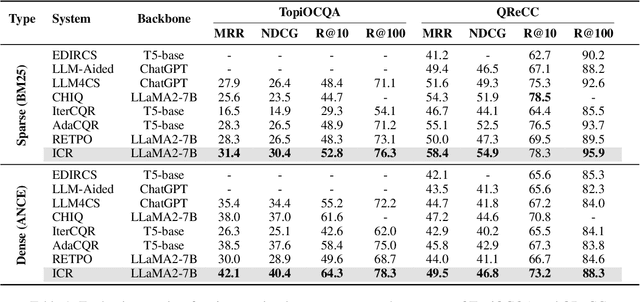

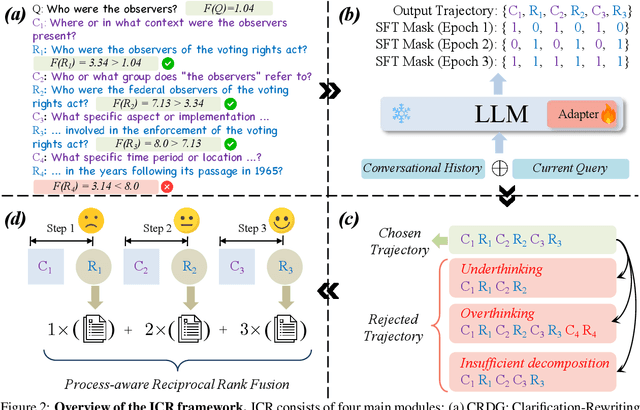

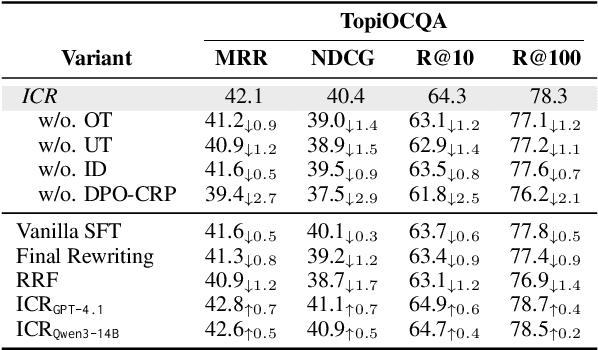

Abstract:Most previous work on Conversational Query Rewriting employs an end-to-end rewriting paradigm. However, this approach is hindered by the issue of multiple fuzzy expressions within the query, which complicates the simultaneous identification and rewriting of multiple positions. To address this issue, we propose a novel framework ICR (Iterative Clarification and Rewriting), an iterative rewriting scheme that pivots on clarification questions. Within this framework, the model alternates between generating clarification questions and rewritten queries. The experimental results show that our ICR can continuously improve retrieval performance in the clarification-rewriting iterative process, thereby achieving state-of-the-art performance on two popular datasets.

Two-stage Incomplete Utterance Rewriting on Editing Operation

Mar 20, 2025Abstract:Previous work on Incomplete Utterance Rewriting (IUR) has primarily focused on generating rewritten utterances based solely on dialogue context, ignoring the widespread phenomenon of coreference and ellipsis in dialogues. To address this issue, we propose a novel framework called TEO (\emph{Two-stage approach on Editing Operation}) for IUR, in which the first stage generates editing operations and the second stage rewrites incomplete utterances utilizing the generated editing operations and the dialogue context. Furthermore, an adversarial perturbation strategy is proposed to mitigate cascading errors and exposure bias caused by the inconsistency between training and inference in the second stage. Experimental results on three IUR datasets show that our TEO outperforms the SOTA models significantly.

Incomplete Utterance Rewriting with Editing Operation Guidance and Utterance Augmentation

Mar 20, 2025Abstract:Although existing fashionable generation methods on Incomplete Utterance Rewriting (IUR) can generate coherent utterances, they often result in the inclusion of irrelevant and redundant tokens in rewritten utterances due to their inability to focus on critical tokens in dialogue context. Furthermore, the limited size of the training datasets also contributes to the insufficient training of the IUR model. To address the first issue, we propose a multi-task learning framework EO-IUR (Editing Operation-guided Incomplete Utterance Rewriting) that introduces the editing operation labels generated by sequence labeling module to guide generation model to focus on critical tokens. Furthermore, we introduce a token-level heterogeneous graph to represent dialogues. To address the second issue, we propose a two-dimensional utterance augmentation strategy, namely editing operation-based incomplete utterance augmentation and LLM-based historical utterance augmentation. The experimental results on three datasets demonstrate that our EO-IUR outperforms previous state-of-the-art (SOTA) baselines in both open-domain and task-oriented dialogue. The code will be available at https://github.com/Dewset/EO-IUR.

Large Language Model in Financial Regulatory Interpretation

May 10, 2024Abstract:This study explores the innovative use of Large Language Models (LLMs) as analytical tools for interpreting complex financial regulations. The primary objective is to design effective prompts that guide LLMs in distilling verbose and intricate regulatory texts, such as the Basel III capital requirement regulations, into a concise mathematical framework that can be subsequently translated into actionable code. This novel approach aims to streamline the implementation of regulatory mandates within the financial reporting and risk management systems of global banking institutions. A case study was conducted to assess the performance of various LLMs, demonstrating that GPT-4 outperforms other models in processing and collecting necessary information, as well as executing mathematical calculations. The case study utilized numerical simulations with asset holdings -- including fixed income, equities, currency pairs, and commodities -- to demonstrate how LLMs can effectively implement the Basel III capital adequacy requirements.

Modeling Inverse Demand Function with Explainable Dual Neural Networks

Jul 26, 2023

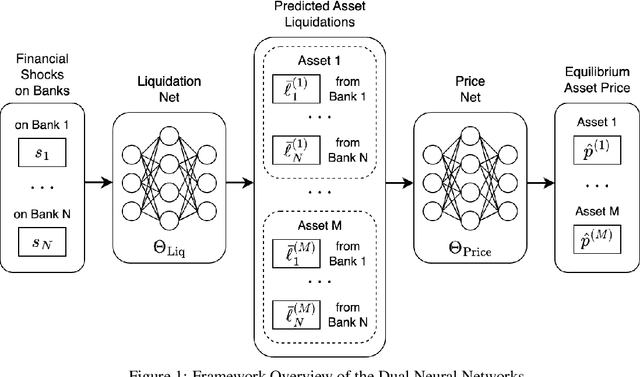

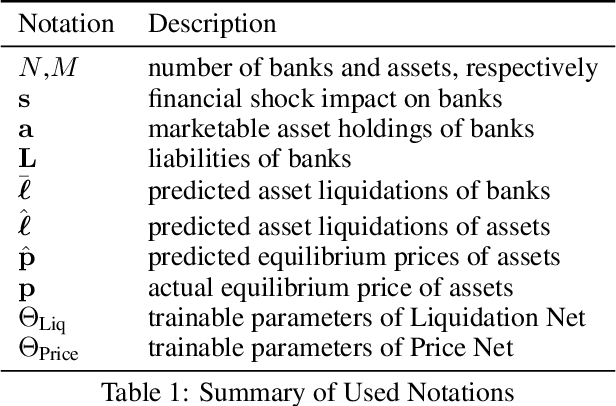

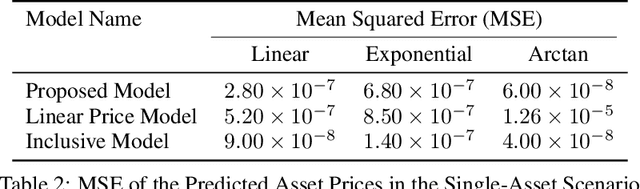

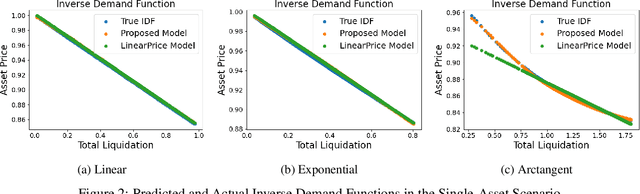

Abstract:Financial contagion has been widely recognized as a fundamental risk to the financial system. Particularly potent is price-mediated contagion, wherein forced liquidations by firms depress asset prices and propagate financial stress, enabling crises to proliferate across a broad spectrum of seemingly unrelated entities. Price impacts are currently modeled via exogenous inverse demand functions. However, in real-world scenarios, only the initial shocks and the final equilibrium asset prices are typically observable, leaving actual asset liquidations largely obscured. This missing data presents significant limitations to calibrating the existing models. To address these challenges, we introduce a novel dual neural network structure that operates in two sequential stages: the first neural network maps initial shocks to predicted asset liquidations, and the second network utilizes these liquidations to derive resultant equilibrium prices. This data-driven approach can capture both linear and non-linear forms without pre-specifying an analytical structure; furthermore, it functions effectively even in the absence of observable liquidation data. Experiments with simulated datasets demonstrate that our model can accurately predict equilibrium asset prices based solely on initial shocks, while revealing a strong alignment between predicted and true liquidations. Our explainable framework contributes to the understanding and modeling of price-mediated contagion and provides valuable insights for financial authorities to construct effective stress tests and regulatory policies.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge