Xiao-jun Zeng

Real-time Automatic M-mode Echocardiography Measurement with Panel Attention from Local-to-Global Pixels

Aug 15, 2023

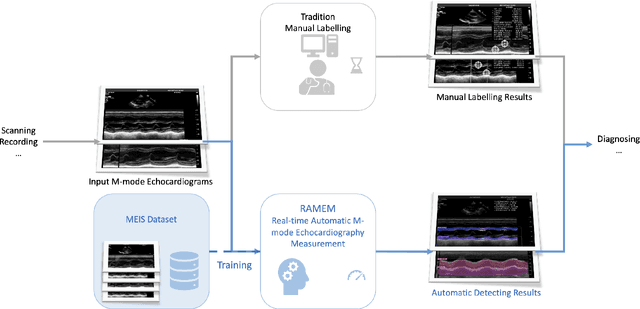

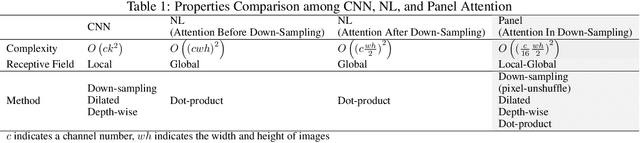

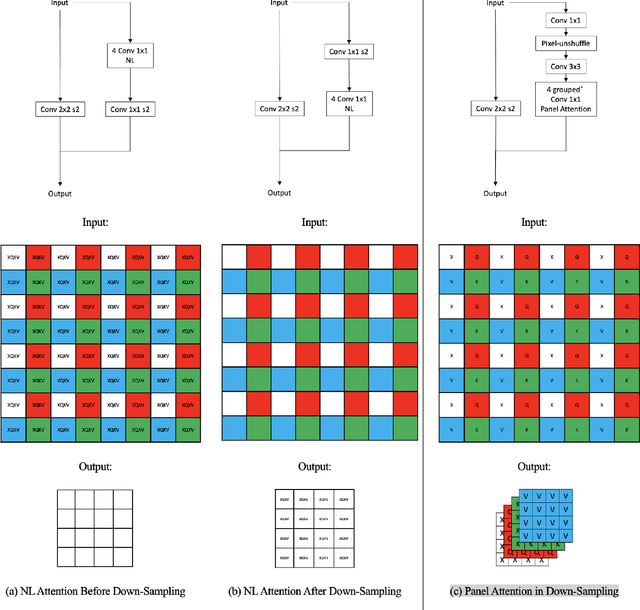

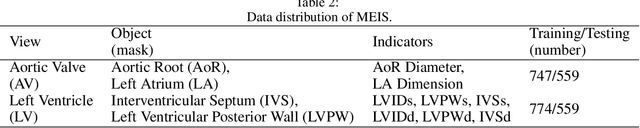

Abstract:Motion mode (M-mode) recording is an essential part of echocardiography to measure cardiac dimension and function. However, the current diagnosis cannot build an automatic scheme, as there are three fundamental obstructs: Firstly, there is no open dataset available to build the automation for ensuring constant results and bridging M-mode echocardiography with real-time instance segmentation (RIS); Secondly, the examination is involving the time-consuming manual labelling upon M-mode echocardiograms; Thirdly, as objects in echocardiograms occupy a significant portion of pixels, the limited receptive field in existing backbones (e.g., ResNet) composed from multiple convolution layers are inefficient to cover the period of a valve movement. Existing non-local attentions (NL) compromise being unable real-time with a high computation overhead or losing information from a simplified version of the non-local block. Therefore, we proposed RAMEM, a real-time automatic M-mode echocardiography measurement scheme, contributes three aspects to answer the problems: 1) provide MEIS, a dataset of M-mode echocardiograms for instance segmentation, to enable consistent results and support the development of an automatic scheme; 2) propose panel attention, local-to-global efficient attention by pixel-unshuffling, embedding with updated UPANets V2 in a RIS scheme toward big object detection with global receptive field; 3) develop and implement AMEM, an efficient algorithm of automatic M-mode echocardiography measurement enabling fast and accurate automatic labelling among diagnosis. The experimental results show that RAMEM surpasses existing RIS backbones (with non-local attention) in PASCAL 2012 SBD and human performances in real-time MEIS tested. The code of MEIS and dataset are available at https://github.com/hanktseng131415go/RAME.

Adaptive Weighting Scheme for Automatic Time-Series Data Augmentation

Feb 16, 2021

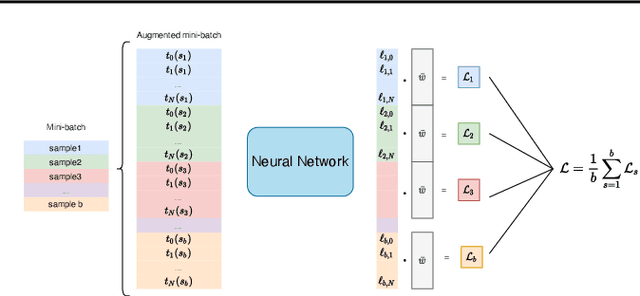

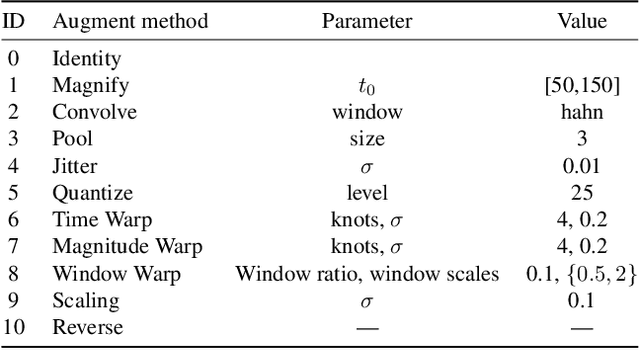

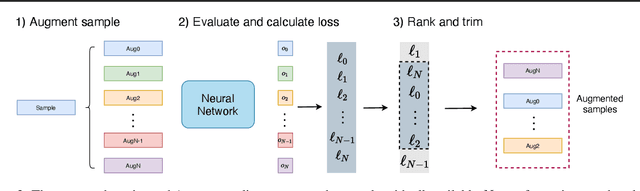

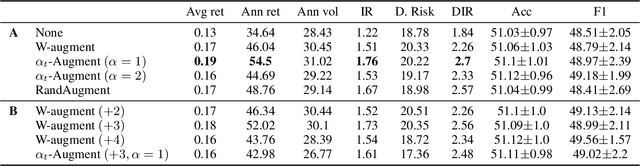

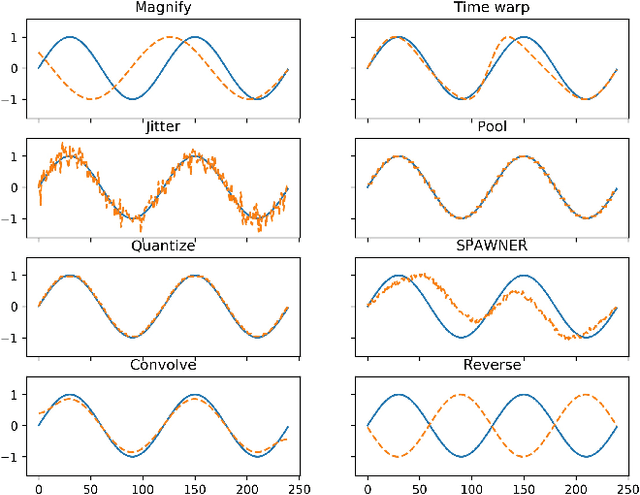

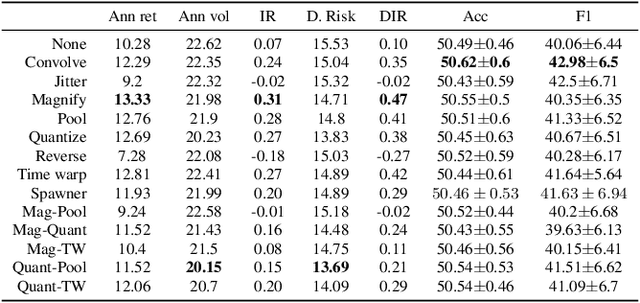

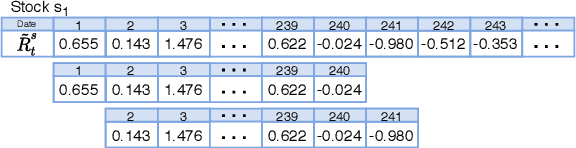

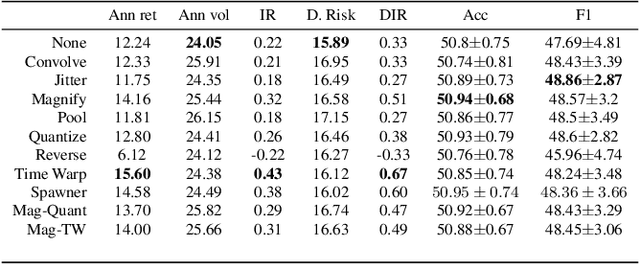

Abstract:Data augmentation methods have been shown to be a fundamental technique to improve generalization in tasks such as image, text and audio classification. Recently, automated augmentation methods have led to further improvements on image classification and object detection leading to state-of-the-art performances. Nevertheless, little work has been done on time-series data, an area that could greatly benefit from automated data augmentation given the usually limited size of the datasets. We present two sample-adaptive automatic weighting schemes for data augmentation: the first learns to weight the contribution of the augmented samples to the loss, and the second method selects a subset of transformations based on the ranking of the predicted training loss. We validate our proposed methods on a large, noisy financial dataset and on time-series datasets from the UCR archive. On the financial dataset, we show that the methods in combination with a trading strategy lead to improvements in annualized returns of over 50$\%$, and on the time-series data we outperform state-of-the-art models on over half of the datasets, and achieve similar performance in accuracy on the others.

Evaluating data augmentation for financial time series classification

Oct 28, 2020

Abstract:Data augmentation methods in combination with deep neural networks have been used extensively in computer vision on classification tasks, achieving great success; however, their use in time series classification is still at an early stage. This is even more so in the field of financial prediction, where data tends to be small, noisy and non-stationary. In this paper we evaluate several augmentation methods applied to stocks datasets using two state-of-the-art deep learning models. The results show that several augmentation methods significantly improve financial performance when used in combination with a trading strategy. For a relatively small dataset ($\approx30K$ samples), augmentation methods achieve up to $400\%$ improvement in risk adjusted return performance; for a larger stock dataset ($\approx300K$ samples), results show up to $40\%$ improvement.

A novel dynamic asset allocation system using Feature Saliency Hidden Markov models for smart beta investing

Feb 28, 2019

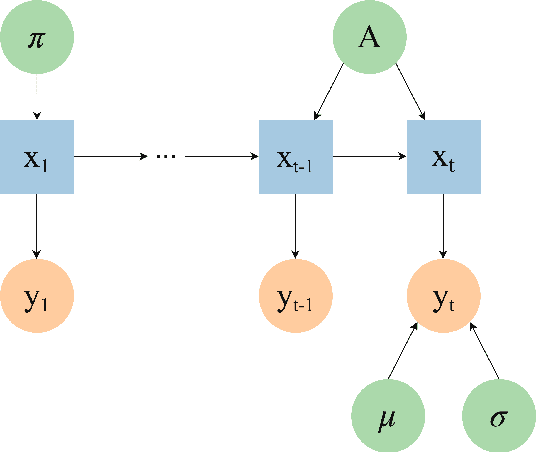

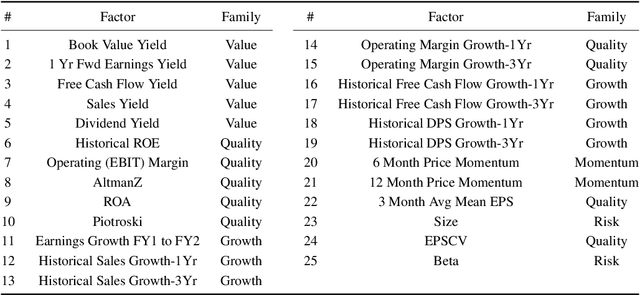

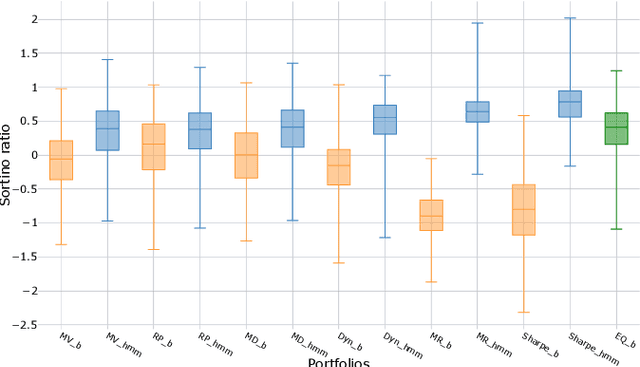

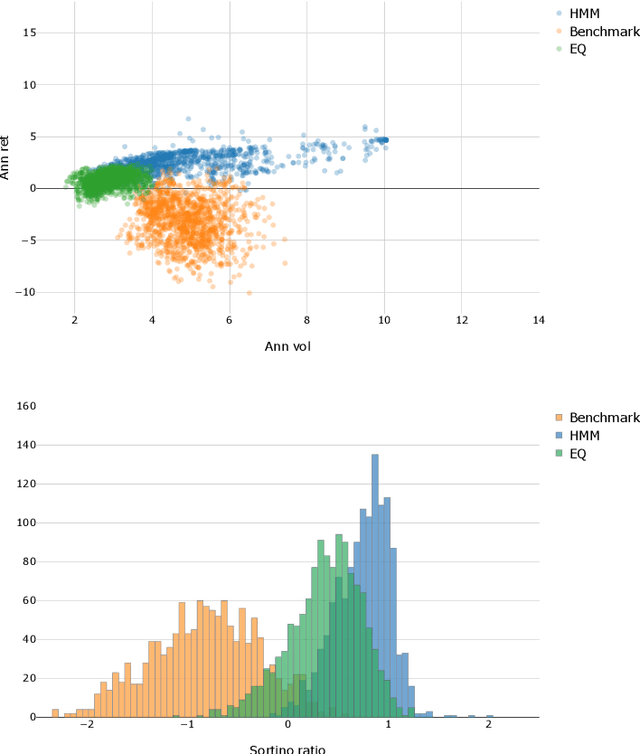

Abstract:The financial crisis of 2008 generated interest in more transparent, rules-based strategies for portfolio construction, with Smart beta strategies emerging as a trend among institutional investors. While they perform well in the long run, these strategies often suffer from severe short-term drawdown (peak-to-trough decline) with fluctuating performance across cycles. To address cyclicality and underperformance, we build a dynamic asset allocation system using Hidden Markov Models (HMMs). We test our system across multiple combinations of smart beta strategies and the resulting portfolios show an improvement in risk-adjusted returns, especially on more return oriented portfolios (up to 50$\%$ in excess of market annually). In addition, we propose a novel smart beta allocation system based on the Feature Saliency HMM (FSHMM) algorithm that performs feature selection simultaneously with the training of the HMM, to improve regime identification. We evaluate our systematic trading system with real life assets using MSCI indices; further, the results (up to 60$\%$ in excess of market annually) show model performance improvement with respect to portfolios built using full feature HMMs.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge