Evaluating data augmentation for financial time series classification

Paper and Code

Oct 28, 2020

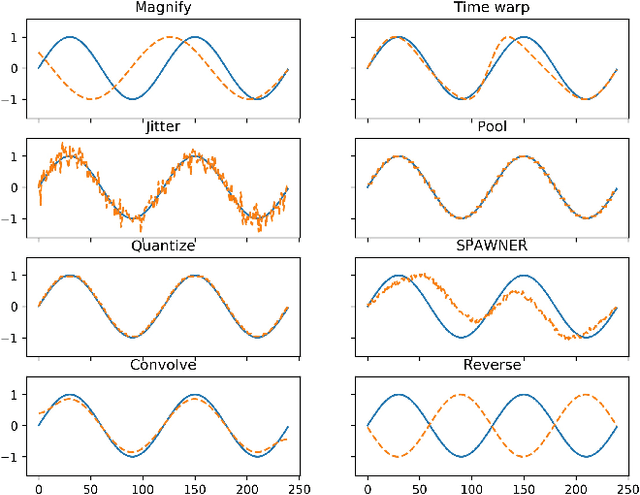

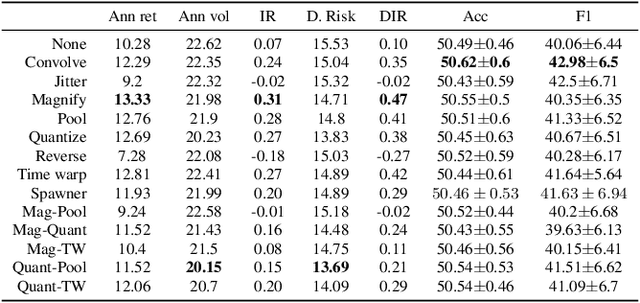

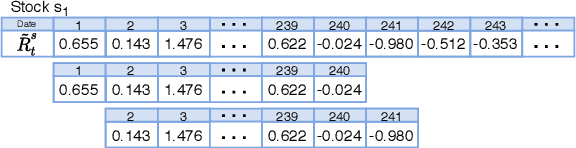

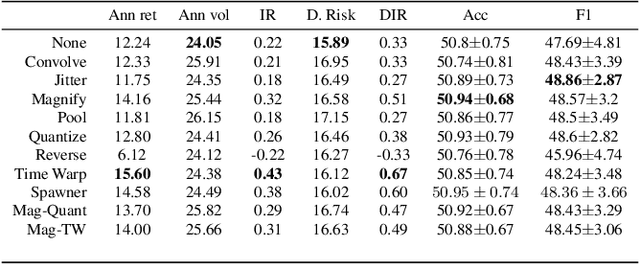

Data augmentation methods in combination with deep neural networks have been used extensively in computer vision on classification tasks, achieving great success; however, their use in time series classification is still at an early stage. This is even more so in the field of financial prediction, where data tends to be small, noisy and non-stationary. In this paper we evaluate several augmentation methods applied to stocks datasets using two state-of-the-art deep learning models. The results show that several augmentation methods significantly improve financial performance when used in combination with a trading strategy. For a relatively small dataset ($\approx30K$ samples), augmentation methods achieve up to $400\%$ improvement in risk adjusted return performance; for a larger stock dataset ($\approx300K$ samples), results show up to $40\%$ improvement.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge