Shengliang Lu

Live Graph Lab: Towards Open, Dynamic and Real Transaction Graphs with NFT

Oct 19, 2023Abstract:Numerous studies have been conducted to investigate the properties of large-scale temporal graphs. Despite the ubiquity of these graphs in real-world scenarios, it's usually impractical for us to obtain the whole real-time graphs due to privacy concerns and technical limitations. In this paper, we introduce the concept of {\it Live Graph Lab} for temporal graphs, which enables open, dynamic and real transaction graphs from blockchains. Among them, Non-fungible tokens (NFTs) have become one of the most prominent parts of blockchain over the past several years. With more than \$40 billion market capitalization, this decentralized ecosystem produces massive, anonymous and real transaction activities, which naturally forms a complicated transaction network. However, there is limited understanding about the characteristics of this emerging NFT ecosystem from a temporal graph analysis perspective. To mitigate this gap, we instantiate a live graph with NFT transaction network and investigate its dynamics to provide new observations and insights. Specifically, through downloading and parsing the NFT transaction activities, we obtain a temporal graph with more than 4.5 million nodes and 124 million edges. Then, a series of measurements are presented to understand the properties of the NFT ecosystem. Through comparisons with social, citation, and web networks, our analyses give intriguing findings and point out potential directions for future exploration. Finally, we also study machine learning models in this live graph to enrich the current datasets and provide new opportunities for the graph community. The source codes and dataset are available at https://livegraphlab.github.io.

ETGraph: A Pioneering Dataset Bridging Ethereum and Twitter

Oct 17, 2023

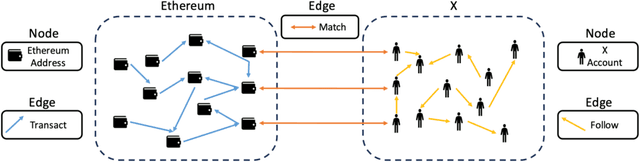

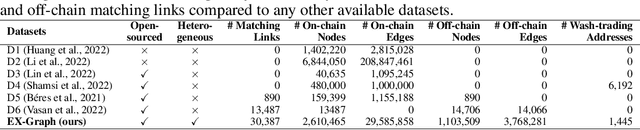

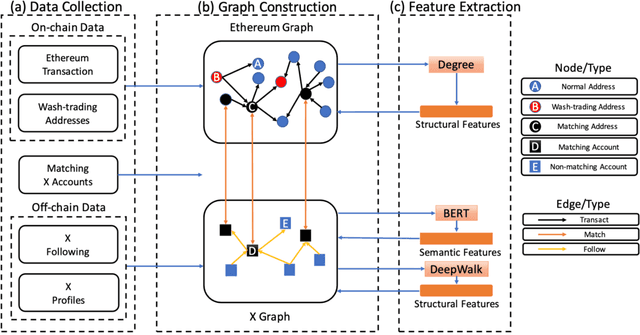

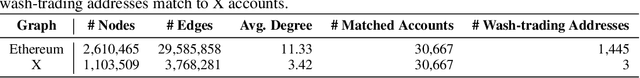

Abstract:While numerous public blockchain datasets are available, their utility is constrained by a singular focus on blockchain data. This constraint limits the incorporation of relevant social network data into blockchain analysis, thereby diminishing the breadth and depth of insight that can be derived. To address the above limitation, we introduce ETGraph, a novel dataset that authentically links Ethereum and Twitter, marking the first and largest dataset of its kind. ETGraph combines Ethereum transaction records (2 million nodes and 30 million edges) and Twitter following data (1 million nodes and 3 million edges), bonding 30,667 Ethereum addresses with verified Twitter accounts sourced from OpenSea. Detailed statistical analysis on ETGraph highlights the structural differences between Twitter-matched and non-Twitter-matched Ethereum addresses. Extensive experiments, including Ethereum link prediction, wash-trading Ethereum addresses detection, and Twitter-Ethereum matching link prediction, emphasize the significant role of Twitter data in enhancing Ethereum analysis. ETGraph is available at https://etgraph.deno.dev/.

BERT4ETH: A Pre-trained Transformer for Ethereum Fraud Detection

Mar 29, 2023

Abstract:As various forms of fraud proliferate on Ethereum, it is imperative to safeguard against these malicious activities to protect susceptible users from being victimized. While current studies solely rely on graph-based fraud detection approaches, it is argued that they may not be well-suited for dealing with highly repetitive, skew-distributed and heterogeneous Ethereum transactions. To address these challenges, we propose BERT4ETH, a universal pre-trained Transformer encoder that serves as an account representation extractor for detecting various fraud behaviors on Ethereum. BERT4ETH features the superior modeling capability of Transformer to capture the dynamic sequential patterns inherent in Ethereum transactions, and addresses the challenges of pre-training a BERT model for Ethereum with three practical and effective strategies, namely repetitiveness reduction, skew alleviation and heterogeneity modeling. Our empirical evaluation demonstrates that BERT4ETH outperforms state-of-the-art methods with significant enhancements in terms of the phishing account detection and de-anonymization tasks. The code for BERT4ETH is available at: https://github.com/git-disl/BERT4ETH.

Sequence-Based Target Coin Prediction for Cryptocurrency Pump-and-Dump

Apr 21, 2022

Abstract:As the pump-and-dump schemes (P&Ds) proliferate in the cryptocurrency market, it becomes imperative to detect such fraudulent activities in advance, to inform potentially susceptible investors before they become victims. In this paper, we focus on the target coin prediction task, i.e., to predict the pump probability of all coins listed in the target exchange before a pump. We conduct a comprehensive study of the latest P&Ds, investigate 709 events organized in Telegram channels from Jan. 2019 to Jan. 2022, and unearth some abnormal yet interesting patterns of P&Ds. Empirical analysis demonstrates that pumped coins exhibit intra-channel homogeneity and inter-channel heterogeneity, which inspires us to develop a novel sequence-based neural network named SNN. Specifically, SNN encodes each channel's pump history as a sequence representation via a positional attention mechanism, which filters useful information and alleviates the noise introduced when the sequence length is long. We also identify and address the coin-side cold-start problem in a practical setting. Extensive experiments show a lift of 1.6% AUC and 41.0% Hit Ratio@3 brought by our method, making it well-suited for real-world application. As a side contribution, we release the source code of our entire data science pipeline on GitHub, along with the dataset tailored for studying the latest P&Ds.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge