Shengjie Guo

Prompting DirectSAM for Semantic Contour Extraction in Remote Sensing Images

Oct 08, 2024

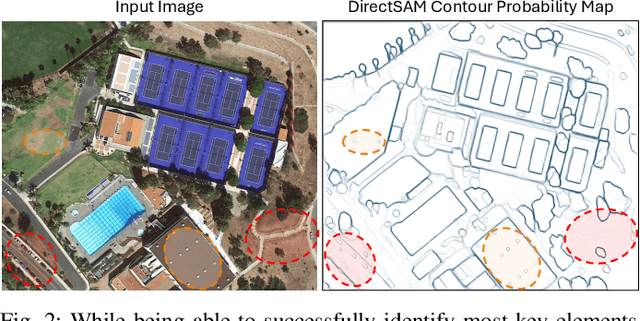

Abstract:The Direct Segment Anything Model (DirectSAM) excels in class-agnostic contour extraction. In this paper, we explore its use by applying it to optical remote sensing imagery, where semantic contour extraction-such as identifying buildings, road networks, and coastlines-holds significant practical value. Those applications are currently handled via training specialized small models separately on small datasets in each domain. We introduce a foundation model derived from DirectSAM, termed DirectSAM-RS, which not only inherits the strong segmentation capability acquired from natural images, but also benefits from a large-scale dataset we created for remote sensing semantic contour extraction. This dataset comprises over 34k image-text-contour triplets, making it at least 30 times larger than individual dataset. DirectSAM-RS integrates a prompter module: a text encoder and cross-attention layers attached to the DirectSAM architecture, which allows flexible conditioning on target class labels or referring expressions. We evaluate the DirectSAM-RS in both zero-shot and fine-tuning setting, and demonstrate that it achieves state-of-the-art performance across several downstream benchmarks.

RVRAE: A Dynamic Factor Model Based on Variational Recurrent Autoencoder for Stock Returns Prediction

Mar 04, 2024

Abstract:In recent years, the dynamic factor model has emerged as a dominant tool in economics and finance, particularly for investment strategies. This model offers improved handling of complex, nonlinear, and noisy market conditions compared to traditional static factor models. The advancement of machine learning, especially in dealing with nonlinear data, has further enhanced asset pricing methodologies. This paper introduces a groundbreaking dynamic factor model named RVRAE. This model is a probabilistic approach that addresses the temporal dependencies and noise in market data. RVRAE ingeniously combines the principles of dynamic factor modeling with the variational recurrent autoencoder (VRAE) from deep learning. A key feature of RVRAE is its use of a prior-posterior learning method. This method fine-tunes the model's learning process by seeking an optimal posterior factor model informed by future data. Notably, RVRAE is adept at risk modeling in volatile stock markets, estimating variances from latent space distributions while also predicting returns. Our empirical tests with real stock market data underscore RVRAE's superior performance compared to various established baseline methods.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge