Saman Haratizadeh

NETpred: Network-based modeling and prediction of multiple connected market indices

Dec 02, 2022

Abstract:Market prediction plays a major role in supporting financial decisions. An emerging approach in this domain is to use graphical modeling and analysis to for prediction of next market index fluctuations. One important question in this domain is how to construct an appropriate graphical model of the data that can be effectively used by a semi-supervised GNN to predict index fluctuations. In this paper, we introduce a framework called NETpred that generates a novel heterogeneous graph representing multiple related indices and their stocks by using several stock-stock and stock-index relation measures. It then thoroughly selects a diverse set of representative nodes that cover different parts of the state space and whose price movements are accurately predictable. By assigning initial predicted labels to such a set of nodes, NETpred makes sure that the subsequent GCN model can be successfully trained using a semi-supervised learning process. The resulting model is then used to predict the stock labels which are finally aggregated to infer the labels for all the index nodes in the graph. Our comprehensive set of experiments shows that NETpred improves the performance of the state-of-the-art baselines by 3%-5% in terms of F-score measure on different well-known data sets.

STAR: A Session-Based Time-Aware Recommender System

Nov 11, 2022Abstract:Session-Based Recommenders (SBRs) aim to predict users' next preferences regard to their previous interactions in sessions while there is no historical information about them. Modern SBRs utilize deep neural networks to map users' current interest(s) during an ongoing session to a latent space so that their next preference can be predicted. Although state-of-art SBR models achieve satisfactory results, most focus on studying the sequence of events inside sessions while ignoring temporal details of those events. In this paper, we examine the potential of session temporal information in enhancing the performance of SBRs, conceivably by reflecting the momentary interests of anonymous users or their mindset shifts during sessions. We propose the STAR framework, which utilizes the time intervals between events within sessions to construct more informative representations for items and sessions. Our mechanism revises session representation by embedding time intervals without employing discretization. Empirical results on Yoochoose and Diginetica datasets show that the suggested method outperforms the state-of-the-art baseline models in Recall and MRR criteria.

Attention-Based Recommendation On Graphs

Jan 04, 2022

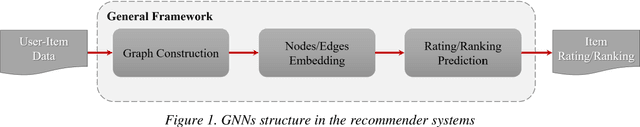

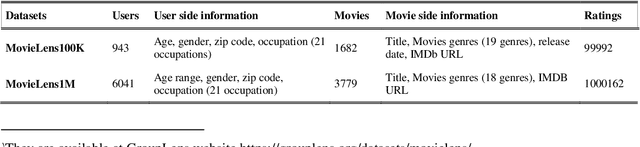

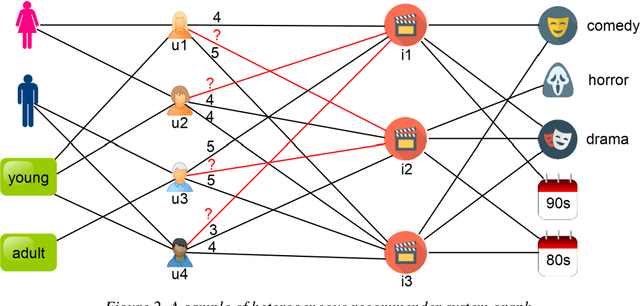

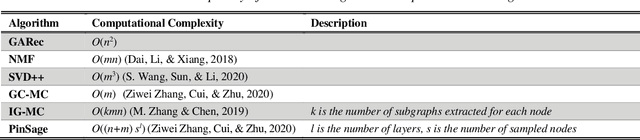

Abstract:Graph Neural Networks (GNN) have shown remarkable performance in different tasks. However, there are a few studies about GNN on recommender systems. GCN as a type of GNNs can extract high-quality embeddings for different entities in a graph. In a collaborative filtering task, the core problem is to find out how informative an entity would be for predicting the future behavior of a target user. Using an attention mechanism, we can enable GCNs to do such an analysis when the underlying data is modeled as a graph. In this study, we proposed GARec as a model-based recommender system that applies an attention mechanism along with a spatial GCN on a recommender graph to extract embeddings for users and items. The attention mechanism tells GCN how much a related user or item should affect the final representation of the target entity. We compared the performance of GARec against some baseline algorithms in terms of RMSE. The presented method outperforms existing model-based, non-graph neural networks and graph neural networks in different MovieLens datasets.

Representation Extraction and Deep Neural Recommendation for Collaborative Filtering

Dec 09, 2020

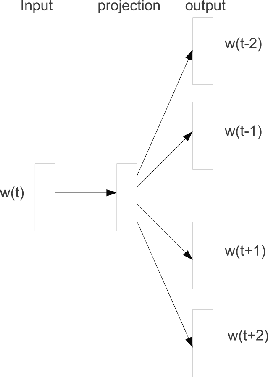

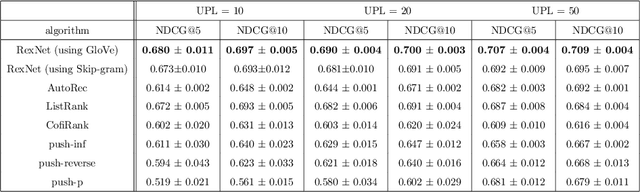

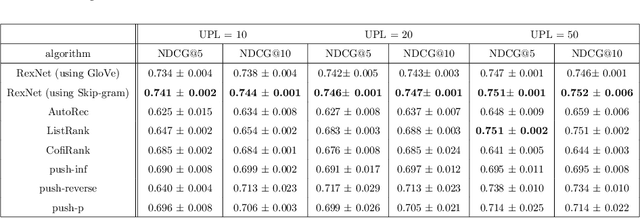

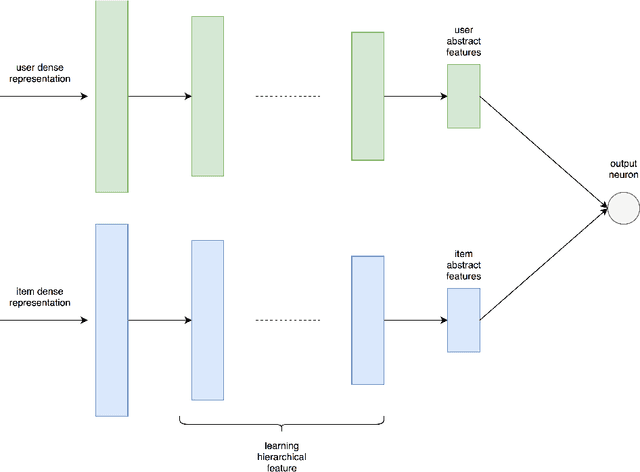

Abstract:Many Deep Learning approaches solve complicated classification and regression problems by hierarchically constructing complex features from the raw input data. Although a few works have investigated the application of deep neural networks in recommendation domain, they mostly extract entity features by exploiting unstructured auxiliary data such as visual and textual information, and when it comes to using user-item rating matrix, feature extraction is done by using matrix factorization. As matrix factorization has some limitations, some works have been done to replace it with deep neural network. but these works either need to exploit unstructured data such item's reviews or images, or are specially designed to use implicit data and don't take user-item rating matrix into account. In this paper, we investigate the usage of novel representation learning algorithms to extract users and items representations from rating matrix, and offer a deep neural network for Collaborative Filtering. Our proposed approach is a modular algorithm consisted of two main phases: REpresentation eXtraction and a deep neural NETwork (RexNet). Using two joint and parallel neural networks in RexNet enables it to extract a hierarchy of features for each entity in order to predict the degree of interest of users to items. The resulted predictions are then used for the final recommendation. Unlike other deep learning recommendation approaches, RexNet is not dependent to unstructured auxiliary data such as visual and textual information, instead, it uses only the user-item rate matrix as its input. We evaluated RexNet in an extensive set of experiments against state of the art recommendation methods. The results show that RexNet significantly outperforms the baseline algorithms in a variety of data sets with different degrees of density.

Embedding Ranking-Oriented Recommender System Graphs

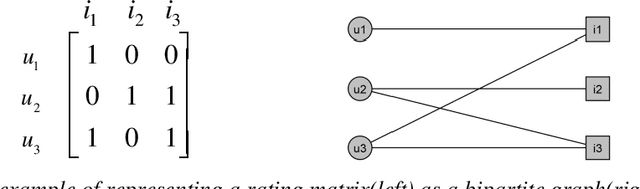

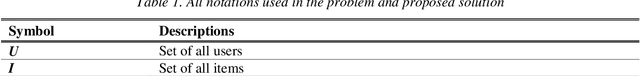

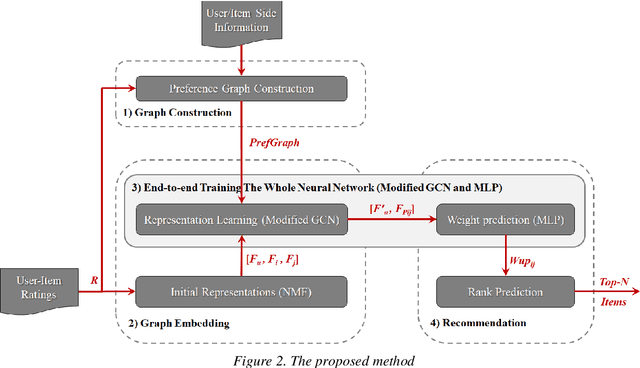

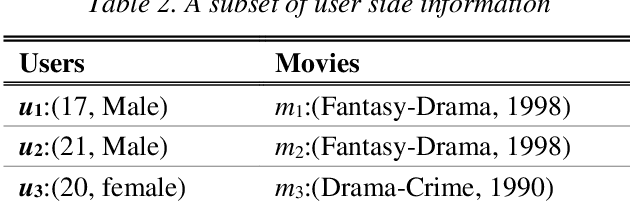

Jul 31, 2020

Abstract:Graph-based recommender systems (GRSs) analyze the structural information in the graphical representation of data to make better recommendations, especially when the direct user-item relation data is sparse. Ranking-oriented GRSs that form a major class of recommendation systems, mostly use the graphical representation of preference (or rank) data for measuring node similarities, from which they can infer a recommendation list using a neighborhood-based mechanism. In this paper, we propose PGRec, a novel graph-based ranking-oriented recommendation framework. PGRec models the preferences of the users over items, by a novel graph structure called PrefGraph. This graph is then exploited by an improved embedding approach, taking advantage of both factorization and deep learning methods, to extract vectors representing users, items, and preferences. The resulting embedding are then used for predicting users' unknown pairwise preferences from which the final recommendation lists are inferred. We have evaluated the performance of the proposed method against the state of the art model-based and neighborhood-based recommendation methods, and our experiments show that PGRec outperforms the baseline algorithms up to 3.2% in terms of NDCG@10 in different MovieLens datasets.

U-CNNpred: A Universal CNN-based Predictor for Stock Markets

Nov 28, 2019

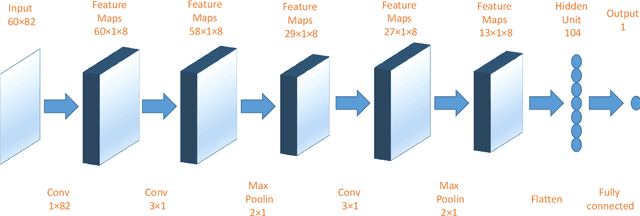

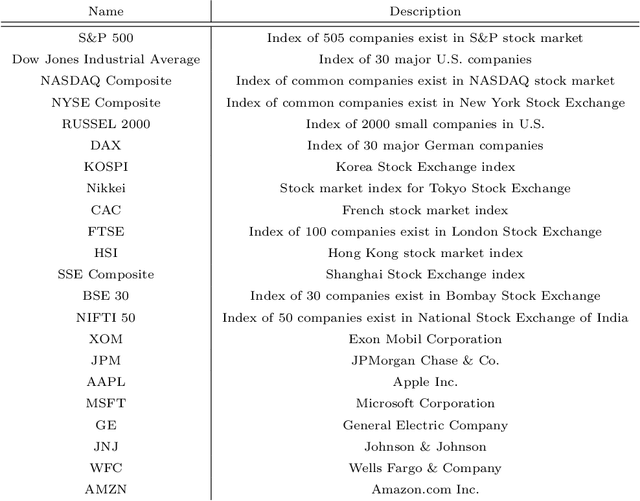

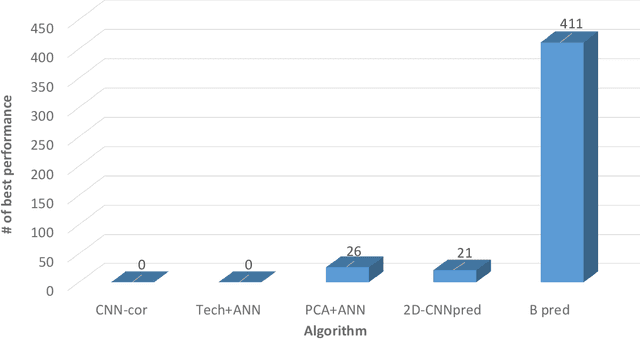

Abstract:The performance of financial market prediction systems depends heavily on the quality of features it is using. While researchers have used various techniques for enhancing the stock specific features, less attention has been paid to extracting features that represent general mechanism of financial markets. In this paper, we investigate the importance of extracting such general features in stock market prediction domain and show how it can improve the performance of financial market prediction. We present a framework called U-CNNpred, that uses a CNN-based structure. A base model is trained in a specially designed layer-wise training procedure over a pool of historical data from many financial markets, in order to extract the common patterns from different markets. Our experiments, in which we have used hundreds of stocks in S\&P 500 as well as 14 famous indices around the world, show that this model can outperform baseline algorithms when predicting the directional movement of the markets for which it has been trained for. We also show that the base model can be fine-tuned for predicting new markets and achieve a better performance compared to the state of the art baseline algorithms that focus on constructing market-specific models from scratch.

GEMRank: Global Entity Embedding For Collaborative Filtering

Nov 05, 2018

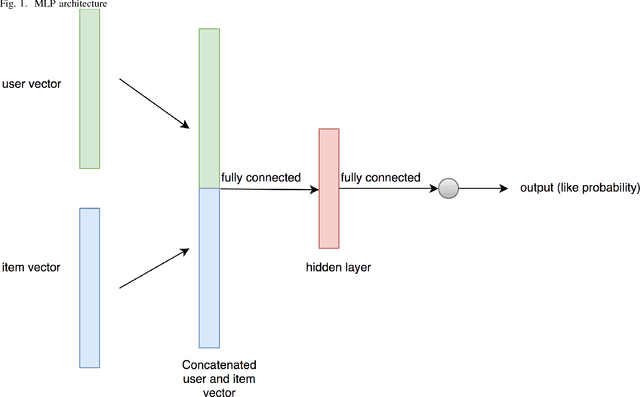

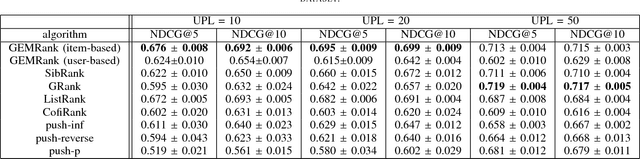

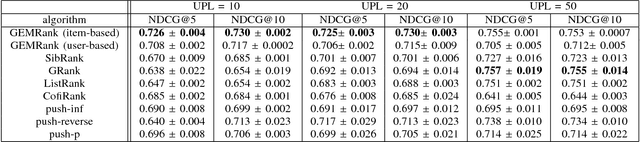

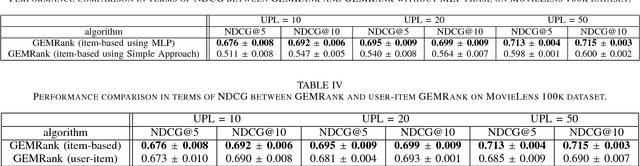

Abstract:Recently, word embedding algorithms have been applied to map the entities of recommender systems, such as users and items, to new feature spaces using textual element-context relations among them. Unlike many other domains, this approach has not achieved a desired performance in collaborative filtering problems, probably due to unavailability of appropriate textual data. In this paper we propose a new recommendation framework, called GEMRank that can be applied when the user-item matrix is the sole available souce of information. It uses the concept of profile co-occurrence for defining relations among entities and applies a factorization method for embedding the users and items. GEMRank then feeds the extracted representations to a neural network model to predict user-item like/dislike relations which the final recommendations are made based on. We evaluated GEMRank in an extensive set of experiments against state of the art recommendation methods. The results show that GEMRank significantly outperforms the baseline algorithms in a variety of data sets with different degrees of density.

CNNPred: CNN-based stock market prediction using several data sources

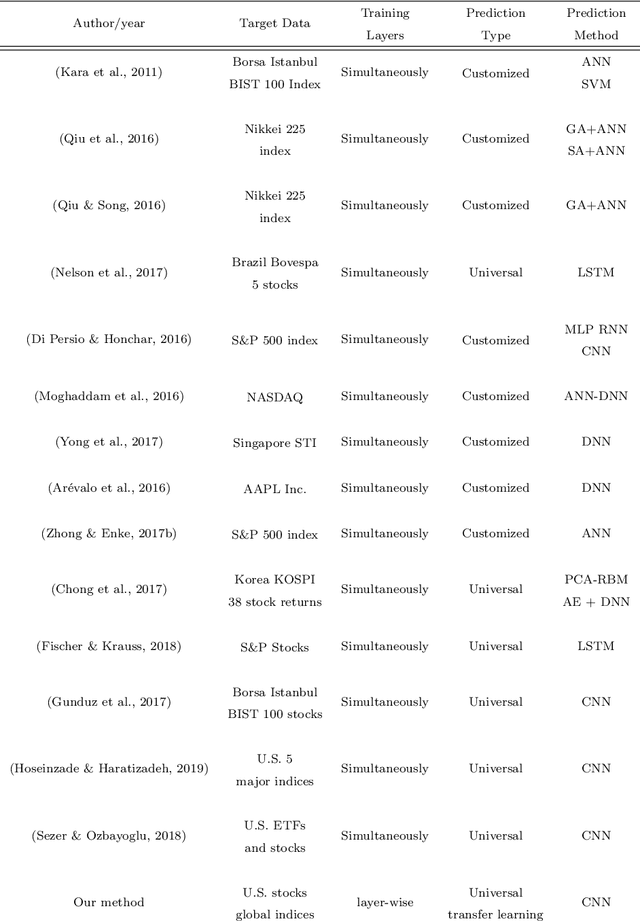

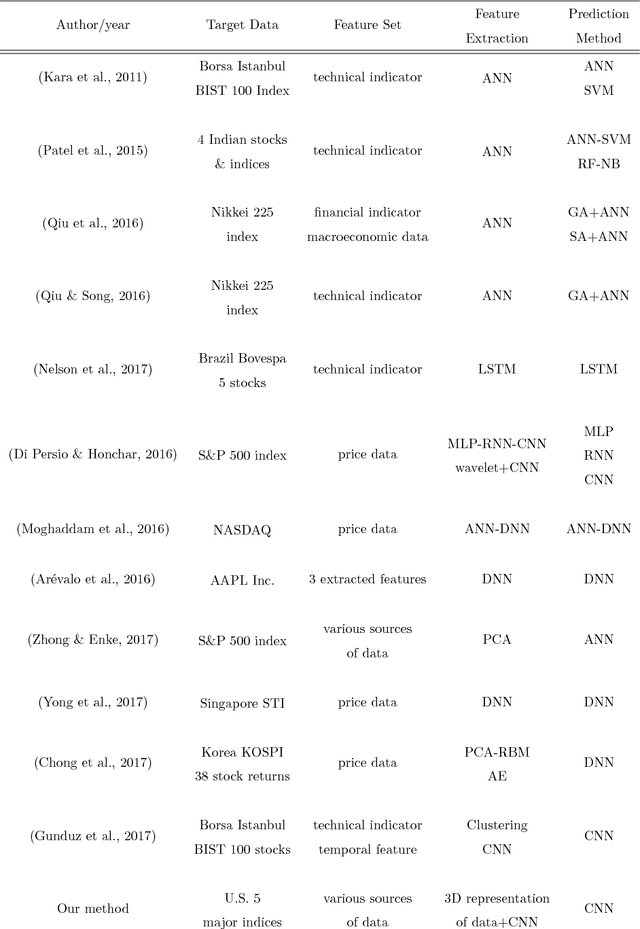

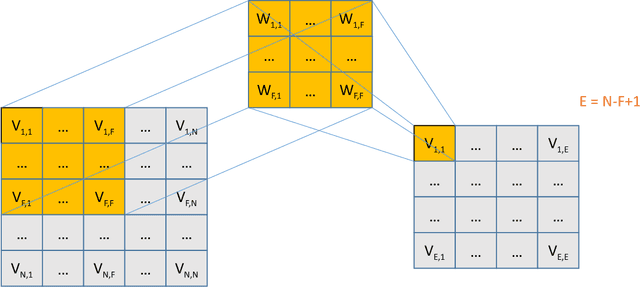

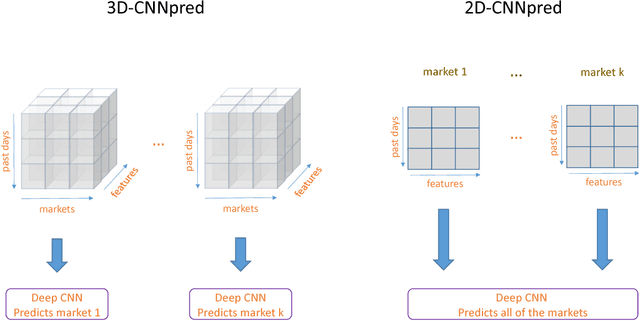

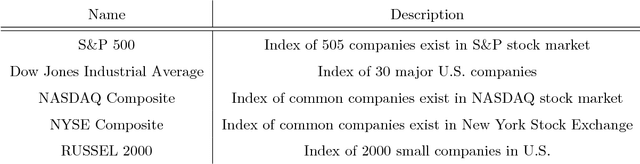

Oct 21, 2018

Abstract:Feature extraction from financial data is one of the most important problems in market prediction domain for which many approaches have been suggested. Among other modern tools, convolutional neural networks (CNN) have recently been applied for automatic feature selection and market prediction. However, in experiments reported so far, less attention has been paid to the correlation among different markets as a possible source of information for extracting features. In this paper, we suggest a CNN-based framework with specially designed CNNs, that can be applied on a collection of data from a variety of sources, including different markets, in order to extract features for predicting the future of those markets. The suggested framework has been applied for predicting the next day's direction of movement for the indices of S&P 500, NASDAQ, DJI, NYSE, and RUSSELL markets based on various sets of initial features. The evaluations show a significant improvement in prediction's performance compared to the state of the art baseline algorithms.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge