Ehsan Hoseinzade

Graph Neural Network Approach to Semantic Type Detection in Tables

Apr 30, 2024Abstract:This study addresses the challenge of detecting semantic column types in relational tables, a key task in many real-world applications. While language models like BERT have improved prediction accuracy, their token input constraints limit the simultaneous processing of intra-table and inter-table information. We propose a novel approach using Graph Neural Networks (GNNs) to model intra-table dependencies, allowing language models to focus on inter-table information. Our proposed method not only outperforms existing state-of-the-art algorithms but also offers novel insights into the utility and functionality of various GNN types for semantic type detection. The code is available at https://github.com/hoseinzadeehsan/GAIT

Representation Extraction and Deep Neural Recommendation for Collaborative Filtering

Dec 09, 2020

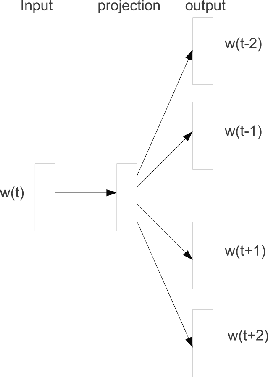

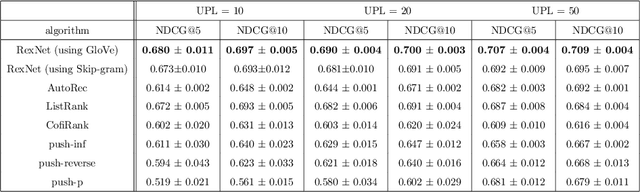

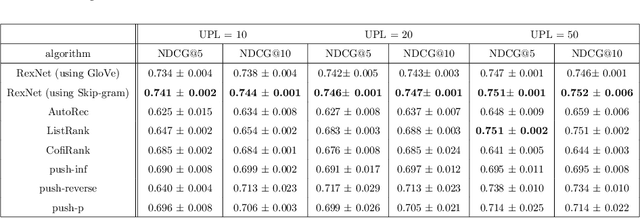

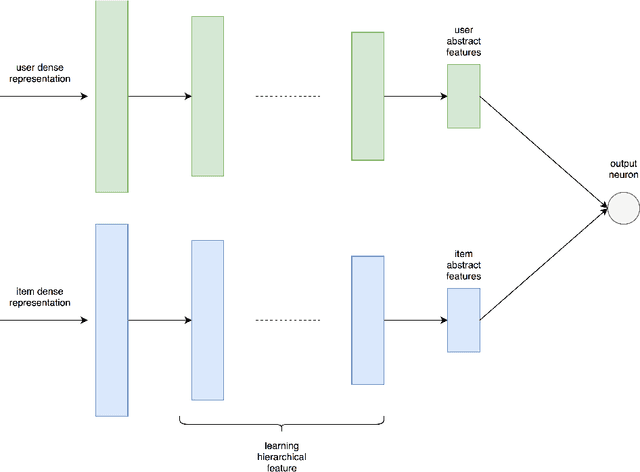

Abstract:Many Deep Learning approaches solve complicated classification and regression problems by hierarchically constructing complex features from the raw input data. Although a few works have investigated the application of deep neural networks in recommendation domain, they mostly extract entity features by exploiting unstructured auxiliary data such as visual and textual information, and when it comes to using user-item rating matrix, feature extraction is done by using matrix factorization. As matrix factorization has some limitations, some works have been done to replace it with deep neural network. but these works either need to exploit unstructured data such item's reviews or images, or are specially designed to use implicit data and don't take user-item rating matrix into account. In this paper, we investigate the usage of novel representation learning algorithms to extract users and items representations from rating matrix, and offer a deep neural network for Collaborative Filtering. Our proposed approach is a modular algorithm consisted of two main phases: REpresentation eXtraction and a deep neural NETwork (RexNet). Using two joint and parallel neural networks in RexNet enables it to extract a hierarchy of features for each entity in order to predict the degree of interest of users to items. The resulted predictions are then used for the final recommendation. Unlike other deep learning recommendation approaches, RexNet is not dependent to unstructured auxiliary data such as visual and textual information, instead, it uses only the user-item rate matrix as its input. We evaluated RexNet in an extensive set of experiments against state of the art recommendation methods. The results show that RexNet significantly outperforms the baseline algorithms in a variety of data sets with different degrees of density.

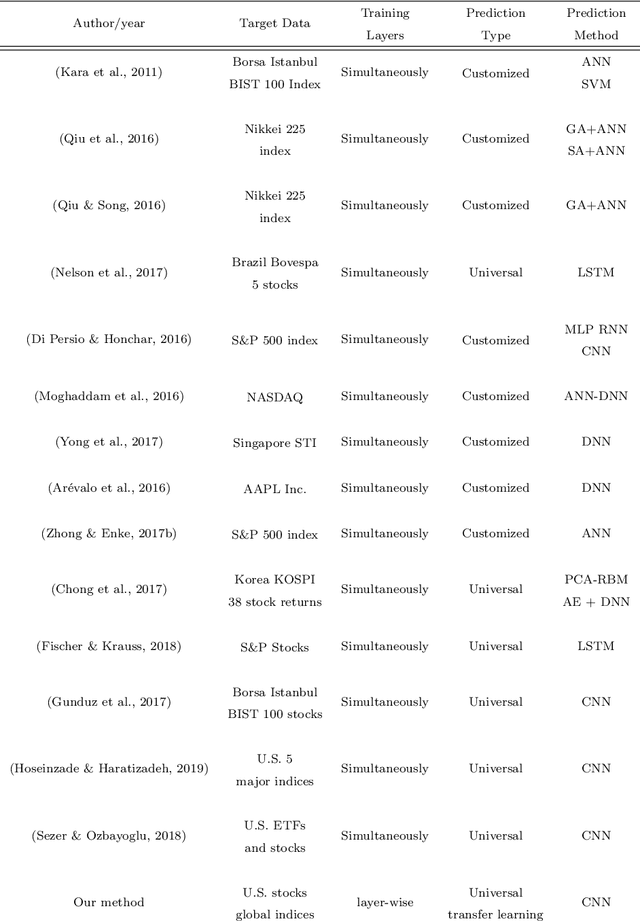

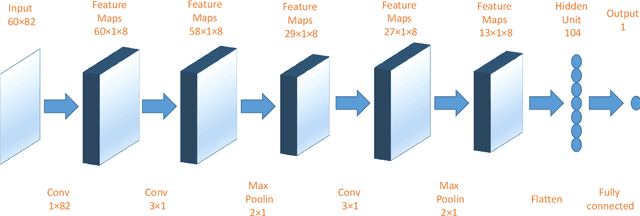

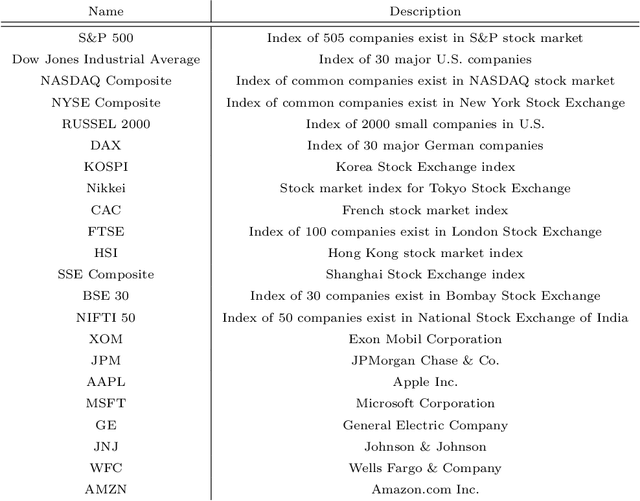

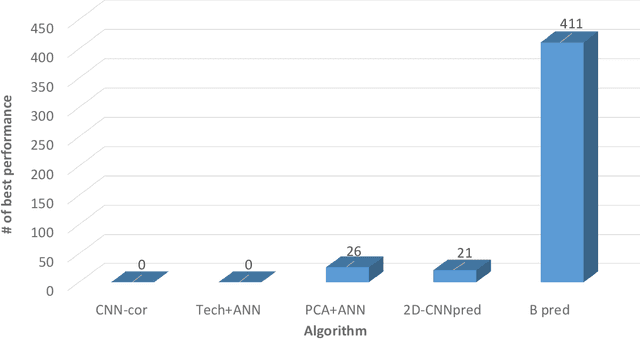

U-CNNpred: A Universal CNN-based Predictor for Stock Markets

Nov 28, 2019

Abstract:The performance of financial market prediction systems depends heavily on the quality of features it is using. While researchers have used various techniques for enhancing the stock specific features, less attention has been paid to extracting features that represent general mechanism of financial markets. In this paper, we investigate the importance of extracting such general features in stock market prediction domain and show how it can improve the performance of financial market prediction. We present a framework called U-CNNpred, that uses a CNN-based structure. A base model is trained in a specially designed layer-wise training procedure over a pool of historical data from many financial markets, in order to extract the common patterns from different markets. Our experiments, in which we have used hundreds of stocks in S\&P 500 as well as 14 famous indices around the world, show that this model can outperform baseline algorithms when predicting the directional movement of the markets for which it has been trained for. We also show that the base model can be fine-tuned for predicting new markets and achieve a better performance compared to the state of the art baseline algorithms that focus on constructing market-specific models from scratch.

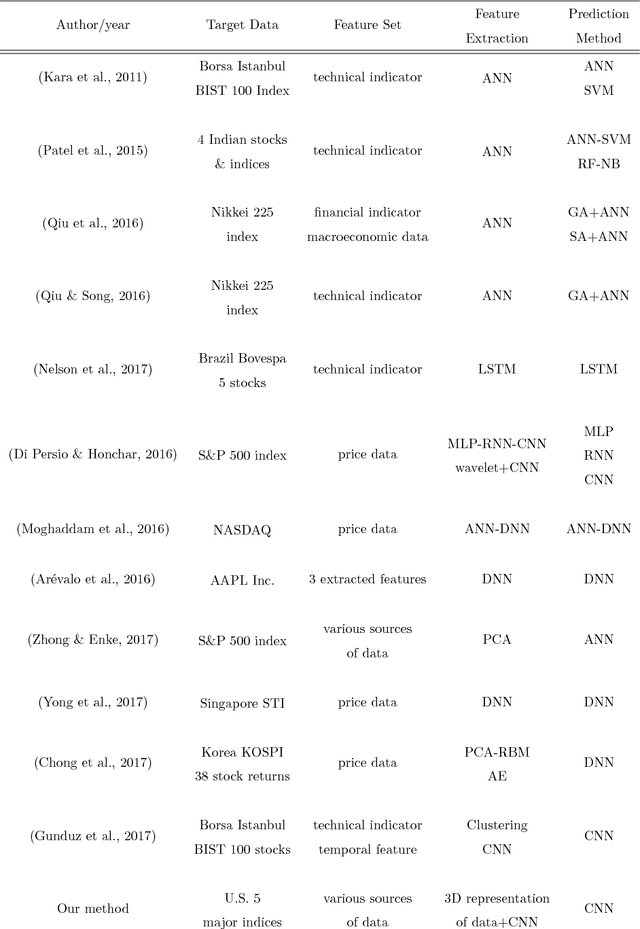

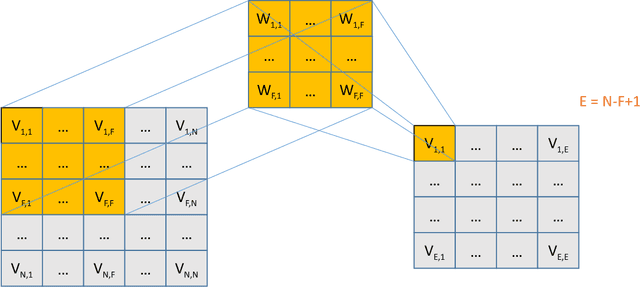

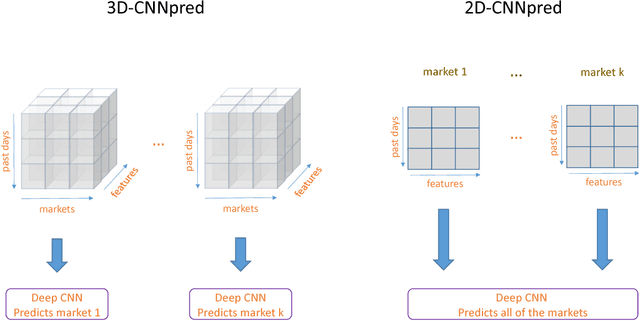

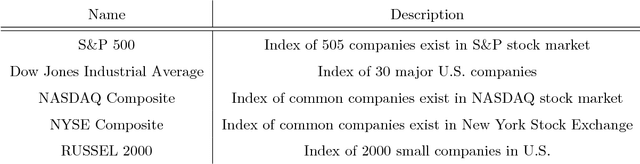

CNNPred: CNN-based stock market prediction using several data sources

Oct 21, 2018

Abstract:Feature extraction from financial data is one of the most important problems in market prediction domain for which many approaches have been suggested. Among other modern tools, convolutional neural networks (CNN) have recently been applied for automatic feature selection and market prediction. However, in experiments reported so far, less attention has been paid to the correlation among different markets as a possible source of information for extracting features. In this paper, we suggest a CNN-based framework with specially designed CNNs, that can be applied on a collection of data from a variety of sources, including different markets, in order to extract features for predicting the future of those markets. The suggested framework has been applied for predicting the next day's direction of movement for the indices of S&P 500, NASDAQ, DJI, NYSE, and RUSSELL markets based on various sets of initial features. The evaluations show a significant improvement in prediction's performance compared to the state of the art baseline algorithms.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge