U-CNNpred: A Universal CNN-based Predictor for Stock Markets

Paper and Code

Nov 28, 2019

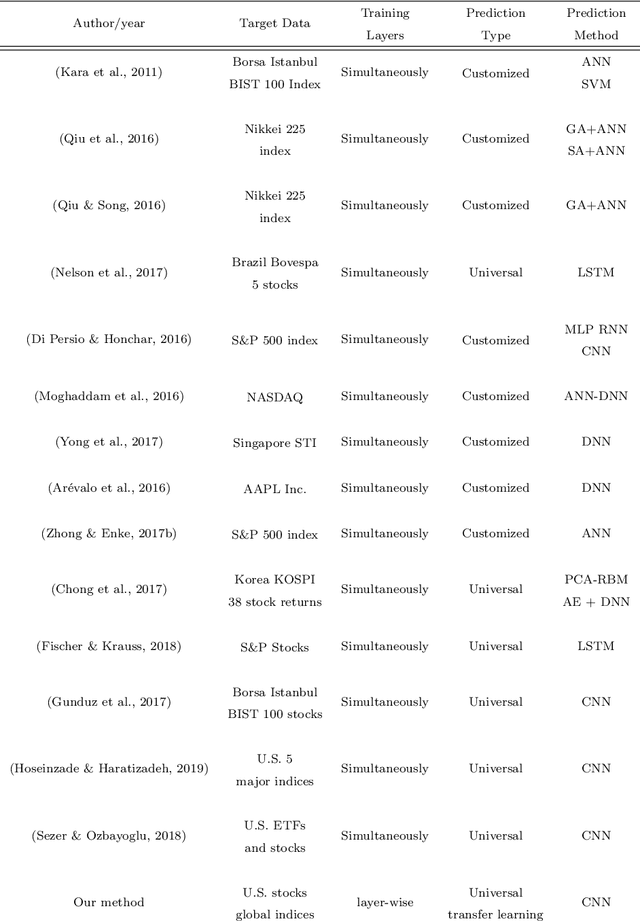

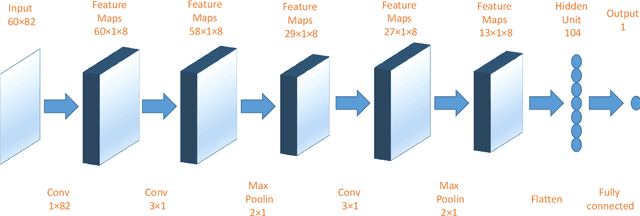

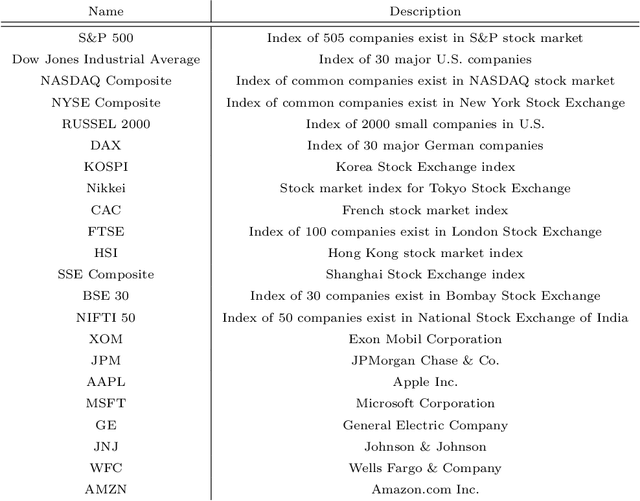

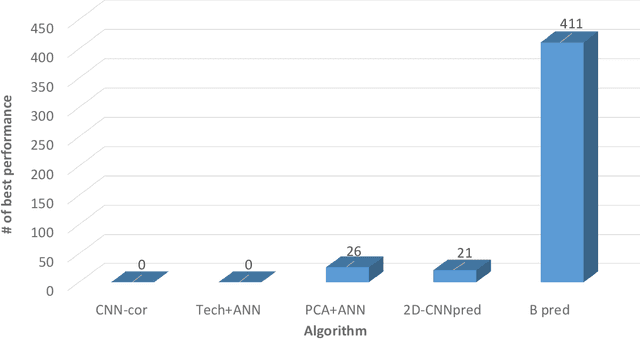

The performance of financial market prediction systems depends heavily on the quality of features it is using. While researchers have used various techniques for enhancing the stock specific features, less attention has been paid to extracting features that represent general mechanism of financial markets. In this paper, we investigate the importance of extracting such general features in stock market prediction domain and show how it can improve the performance of financial market prediction. We present a framework called U-CNNpred, that uses a CNN-based structure. A base model is trained in a specially designed layer-wise training procedure over a pool of historical data from many financial markets, in order to extract the common patterns from different markets. Our experiments, in which we have used hundreds of stocks in S\&P 500 as well as 14 famous indices around the world, show that this model can outperform baseline algorithms when predicting the directional movement of the markets for which it has been trained for. We also show that the base model can be fine-tuned for predicting new markets and achieve a better performance compared to the state of the art baseline algorithms that focus on constructing market-specific models from scratch.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge