Alireza Jafari

How Much Temporal Modeling is Enough? A Systematic Study of Hybrid CNN-RNN Architectures for Multi-Label ECG Classification

Jan 25, 2026Abstract:Accurate multi-label classification of electrocardiogram (ECG) signals remains challenging due to the coexistence of multiple cardiac conditions, pronounced class imbalance, and long-range temporal dependencies in multi-lead recordings. Although recent studies increasingly rely on deep and stacked recurrent architectures, the necessity and clinical justification of such architectural complexity have not been rigorously examined. In this work, we perform a systematic comparative evaluation of convolutional neural networks (CNNs) combined with multiple recurrent configurations, including LSTM, GRU, Bidirectional LSTM (BiLSTM), and their stacked variants, for multi-label ECG classification on the PTB-XL dataset comprising 23 diagnostic categories. The CNN component serves as a morphology-driven baseline, while recurrent layers are progressively integrated to assess their contribution to temporal modeling and generalization performance. Experimental results indicate that a CNN integrated with a single BiLSTM layer achieves the most favorable trade-off between predictive performance and model complexity. This configuration attains superior Hamming loss (0.0338), macro-AUPRC (0.4715), micro-F1 score (0.6979), and subset accuracy (0.5723) compared with deeper recurrent combinations. Although stacked recurrent models occasionally improve recall for specific rare classes, our results provide empirical evidence that increasing recurrent depth yields diminishing returns and may degrade generalization due to reduced precision and overfitting. These findings suggest that architectural alignment with the intrinsic temporal structure of ECG signals, rather than increased recurrent depth, is a key determinant of robust performance and clinically relevant deployment.

Leveraging Exogenous Signals for Hydrology Time Series Forecasting

Nov 14, 2025Abstract:Recent advances in time series research facilitate the development of foundation models. While many state-of-the-art time series foundation models have been introduced, few studies examine their effectiveness in specific downstream applications in physical science. This work investigates the role of integrating domain knowledge into time series models for hydrological rainfall-runoff modeling. Using the CAMELS-US dataset, which includes rainfall and runoff data from 671 locations with six time series streams and 30 static features, we compare baseline and foundation models. Results demonstrate that models incorporating comprehensive known exogenous inputs outperform more limited approaches, including foundation models. Notably, incorporating natural annual periodic time series contribute the most significant improvements.

DeepBoost-AF: A Novel Unsupervised Feature Learning and Gradient Boosting Fusion for Robust Atrial Fibrillation Detection in Raw ECG Signals

May 30, 2025Abstract:Atrial fibrillation (AF) is a prevalent cardiac arrhythmia associated with elevated health risks, where timely detection is pivotal for mitigating stroke-related morbidity. This study introduces an innovative hybrid methodology integrating unsupervised deep learning and gradient boosting models to improve AF detection. A 19-layer deep convolutional autoencoder (DCAE) is coupled with three boosting classifiers-AdaBoost, XGBoost, and LightGBM (LGBM)-to harness their complementary advantages while addressing individual limitations. The proposed framework uniquely combines DCAE with gradient boosting, enabling end-to-end AF identification devoid of manual feature extraction. The DCAE-LGBM model attains an F1-score of 95.20%, sensitivity of 99.99%, and inference latency of four seconds, outperforming existing methods and aligning with clinical deployment requirements. The DCAE integration significantly enhances boosting models, positioning this hybrid system as a reliable tool for automated AF detection in clinical settings.

Time Series Foundation Models and Deep Learning Architectures for Earthquake Temporal and Spatial Nowcasting

Aug 21, 2024

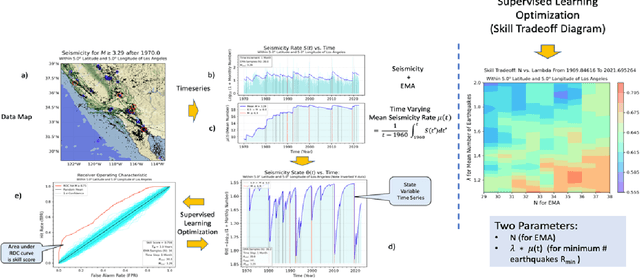

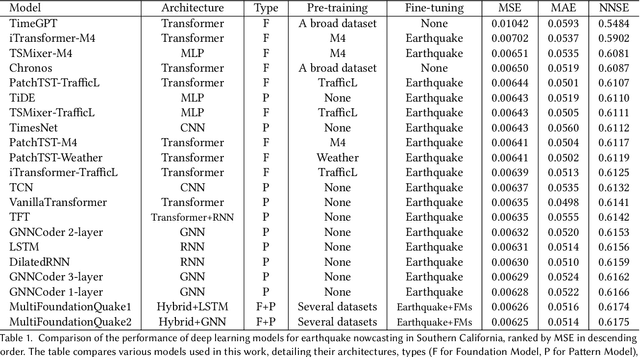

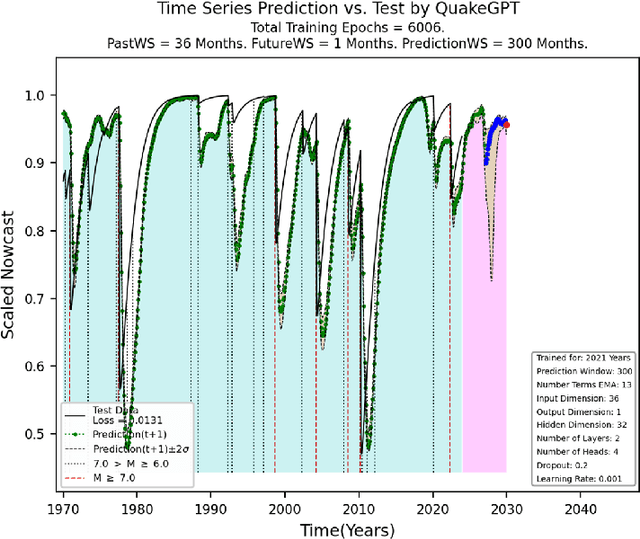

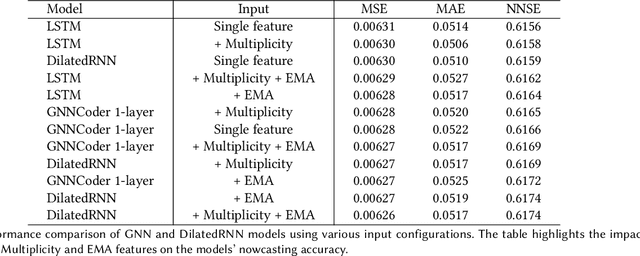

Abstract:Advancing the capabilities of earthquake nowcasting, the real-time forecasting of seismic activities remains a crucial and enduring objective aimed at reducing casualties. This multifaceted challenge has recently gained attention within the deep learning domain, facilitated by the availability of extensive, long-term earthquake datasets. Despite significant advancements, existing literature on earthquake nowcasting lacks comprehensive evaluations of pre-trained foundation models and modern deep learning architectures. These architectures, such as transformers or graph neural networks, uniquely focus on different aspects of data, including spatial relationships, temporal patterns, and multi-scale dependencies. This paper addresses the mentioned gap by analyzing different architectures and introducing two innovation approaches called MultiFoundationQuake and GNNCoder. We formulate earthquake nowcasting as a time series forecasting problem for the next 14 days within 0.1-degree spatial bins in Southern California, spanning from 1986 to 2024. Earthquake time series is forecasted as a function of logarithm energy released by quakes. Our comprehensive evaluation employs several key performance metrics, notably Nash-Sutcliffe Efficiency and Mean Squared Error, over time in each spatial region. The results demonstrate that our introduced models outperform other custom architectures by effectively capturing temporal-spatial relationships inherent in seismic data. The performance of existing foundation models varies significantly based on the pre-training datasets, emphasizing the need for careful dataset selection. However, we introduce a new general approach termed MultiFoundationPattern that combines a bespoke pattern with foundation model results handled as auxiliary streams. In the earthquake case, the resultant MultiFoundationQuake model achieves the best overall performance.

NETpred: Network-based modeling and prediction of multiple connected market indices

Dec 02, 2022

Abstract:Market prediction plays a major role in supporting financial decisions. An emerging approach in this domain is to use graphical modeling and analysis to for prediction of next market index fluctuations. One important question in this domain is how to construct an appropriate graphical model of the data that can be effectively used by a semi-supervised GNN to predict index fluctuations. In this paper, we introduce a framework called NETpred that generates a novel heterogeneous graph representing multiple related indices and their stocks by using several stock-stock and stock-index relation measures. It then thoroughly selects a diverse set of representative nodes that cover different parts of the state space and whose price movements are accurately predictable. By assigning initial predicted labels to such a set of nodes, NETpred makes sure that the subsequent GCN model can be successfully trained using a semi-supervised learning process. The resulting model is then used to predict the stock labels which are finally aggregated to infer the labels for all the index nodes in the graph. Our comprehensive set of experiments shows that NETpred improves the performance of the state-of-the-art baselines by 3%-5% in terms of F-score measure on different well-known data sets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge