Minyoung Choe

Temporal Graph Networks for Graph Anomaly Detection in Financial Networks

Mar 27, 2024

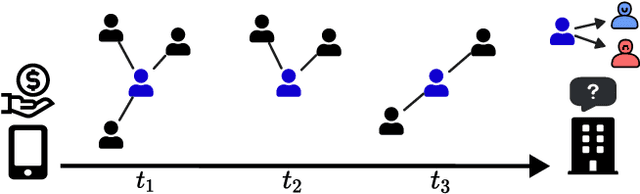

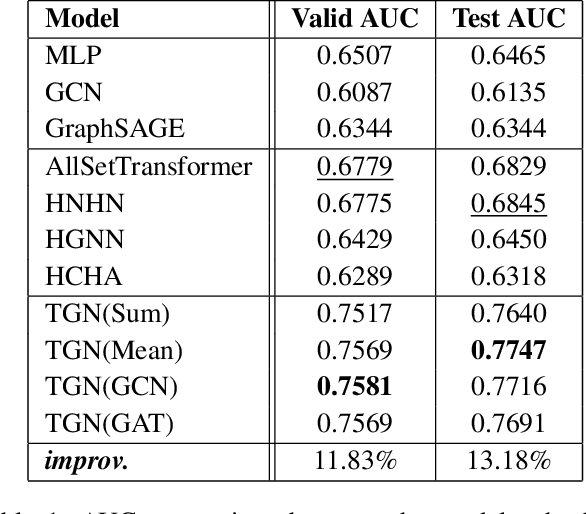

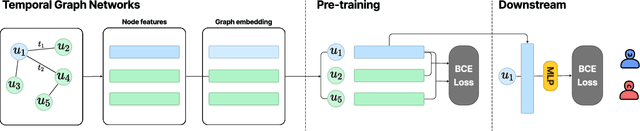

Abstract:This paper explores the utilization of Temporal Graph Networks (TGN) for financial anomaly detection, a pressing need in the era of fintech and digitized financial transactions. We present a comprehensive framework that leverages TGN, capable of capturing dynamic changes in edges within financial networks, for fraud detection. Our study compares TGN's performance against static Graph Neural Network (GNN) baselines, as well as cutting-edge hypergraph neural network baselines using DGraph dataset for a realistic financial context. Our results demonstrate that TGN significantly outperforms other models in terms of AUC metrics. This superior performance underlines TGN's potential as an effective tool for detecting financial fraud, showcasing its ability to adapt to the dynamic and complex nature of modern financial systems. We also experimented with various graph embedding modules within the TGN framework and compared the effectiveness of each module. In conclusion, we demonstrated that, even with variations within TGN, it is possible to achieve good performance in the anomaly detection task.

Classification of Edge-dependent Labels of Nodes in Hypergraphs

Jun 05, 2023

Abstract:A hypergraph is a data structure composed of nodes and hyperedges, where each hyperedge is an any-sized subset of nodes. Due to the flexibility in hyperedge size, hypergraphs represent group interactions (e.g., co-authorship by more than two authors) more naturally and accurately than ordinary graphs. Interestingly, many real-world systems modeled as hypergraphs contain edge-dependent node labels, i.e., node labels that vary depending on hyperedges. For example, on co-authorship datasets, the same author (i.e., a node) can be the primary author in a paper (i.e., a hyperedge) but the corresponding author in another paper (i.e., another hyperedge). In this work, we introduce a classification of edge-dependent node labels as a new problem. This problem can be used as a benchmark task for hypergraph neural networks, which recently have attracted great attention, and also the usefulness of edge-dependent node labels has been verified in various applications. To tackle this problem, we propose WHATsNet, a novel hypergraph neural network that represents the same node differently depending on the hyperedges it participates in by reflecting its varying importance in the hyperedges. To this end, WHATsNet models the relations between nodes within each hyperedge, using their relative centrality as positional encodings. In our experiments, we demonstrate that WHATsNet significantly and consistently outperforms ten competitors on six real-world hypergraphs, and we also show successful applications of WHATsNet to (a) ranking aggregation, (b) node clustering, and (c) product return prediction.

Pretraining Neural Architecture Search Controllers with Locality-based Self-Supervised Learning

Mar 15, 2021

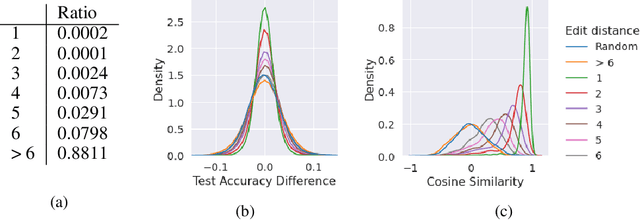

Abstract:Neural architecture search (NAS) has fostered various fields of machine learning. Despite its prominent dedications, many have criticized the intrinsic limitations of high computational cost. We aim to ameliorate this by proposing a pretraining scheme that can be generally applied to controller-based NAS. Our method, locality-based self-supervised classification task, leverages the structural similarity of network architectures to obtain good architecture representations. We incorporate our method into neural architecture optimization (NAO) to analyze the pretrained embeddings and its effectiveness and highlight that adding metric learning loss brings a favorable impact on NAS. Our code is available at \url{https://github.com/Multi-Objective-NAS/self-supervised-nas}.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge