Temporal Graph Networks for Graph Anomaly Detection in Financial Networks

Paper and Code

Mar 27, 2024

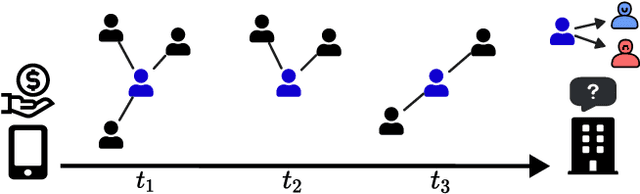

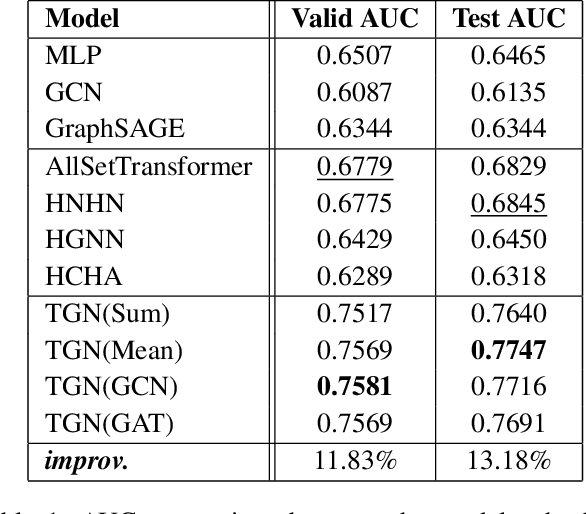

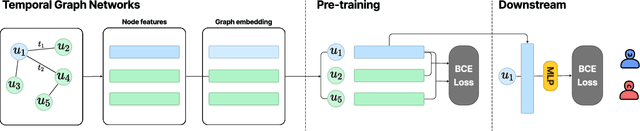

This paper explores the utilization of Temporal Graph Networks (TGN) for financial anomaly detection, a pressing need in the era of fintech and digitized financial transactions. We present a comprehensive framework that leverages TGN, capable of capturing dynamic changes in edges within financial networks, for fraud detection. Our study compares TGN's performance against static Graph Neural Network (GNN) baselines, as well as cutting-edge hypergraph neural network baselines using DGraph dataset for a realistic financial context. Our results demonstrate that TGN significantly outperforms other models in terms of AUC metrics. This superior performance underlines TGN's potential as an effective tool for detecting financial fraud, showcasing its ability to adapt to the dynamic and complex nature of modern financial systems. We also experimented with various graph embedding modules within the TGN framework and compared the effectiveness of each module. In conclusion, we demonstrated that, even with variations within TGN, it is possible to achieve good performance in the anomaly detection task.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge