Miao Tian

AI-Driven Anonymization: Protecting Personal Data Privacy While Leveraging Machine Learning

Feb 27, 2024Abstract:The development of artificial intelligence has significantly transformed people's lives. However, it has also posed a significant threat to privacy and security, with numerous instances of personal information being exposed online and reports of criminal attacks and theft. Consequently, the need to achieve intelligent protection of personal information through machine learning algorithms has become a paramount concern. Artificial intelligence leverages advanced algorithms and technologies to effectively encrypt and anonymize personal data, enabling valuable data analysis and utilization while safeguarding privacy. This paper focuses on personal data privacy protection and the promotion of anonymity as its core research objectives. It achieves personal data privacy protection and detection through the use of machine learning's differential privacy protection algorithm. The paper also addresses existing challenges in machine learning related to privacy and personal data protection, offers improvement suggestions, and analyzes factors impacting datasets to enable timely personal data privacy detection and protection.

Optimizing Portfolio Management and Risk Assessment in Digital Assets Using Deep Learning for Predictive Analysis

Feb 25, 2024Abstract:Portfolio management issues have been extensively studied in the field of artificial intelligence in recent years, but existing deep learning-based quantitative trading methods have some areas where they could be improved. First of all, the prediction mode of stocks is singular; often, only one trading expert is trained by a model, and the trading decision is solely based on the prediction results of the model. Secondly, the data source used by the model is relatively simple, and only considers the data of the stock itself, ignoring the impact of the whole market risk on the stock. In this paper, the DQN algorithm is introduced into asset management portfolios in a novel and straightforward way, and the performance greatly exceeds the benchmark, which fully proves the effectiveness of the DRL algorithm in portfolio management. This also inspires us to consider the complexity of financial problems, and the use of algorithms should be fully combined with the problems to adapt. Finally, in this paper, the strategy is implemented by selecting the assets and actions with the largest Q value. Since different assets are trained separately as environments, there may be a phenomenon of Q value drift among different assets (different assets have different Q value distribution areas), which may easily lead to incorrect asset selection. Consider adding constraints so that the Q values of different assets share a Q value distribution to improve results.

Improving auto-encoder novelty detection using channel attention and entropy minimization

Jul 03, 2020

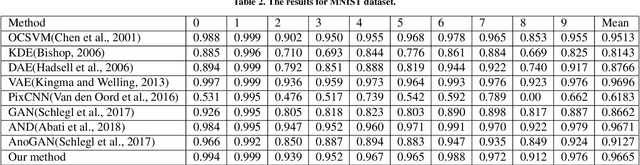

Abstract:Novelty detection is a important research area which mainly solves the classification problem of inliers which usually consists of normal samples and outliers composed of abnormal samples. We focus on the role of auto-encoder in novelty detection and further improved the performance of such methods based on auto-encoder through two main contributions. Firstly, we introduce attention mechanism into novelty detection. Under the action of attention mechanism, auto-encoder can pay more attention to the representation of inlier samples through adversarial training. Secondly, we try to constrain the expression of the latent space by information entropy. Experimental results on three public datasets show that the proposed method has potential performance for novelty detection.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge