Luisa Roa

Relational Graph Neural Networks for Fraud Detection in a Super-App environment

Jul 30, 2021

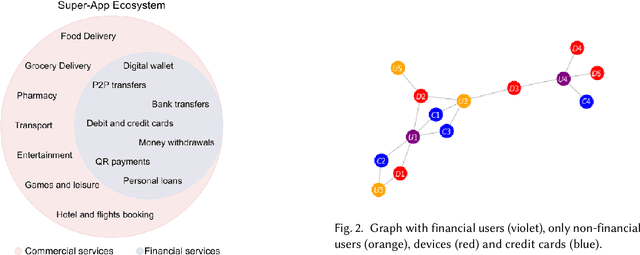

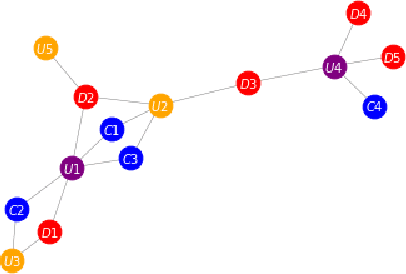

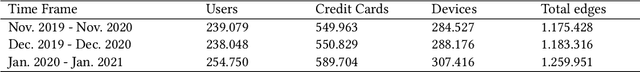

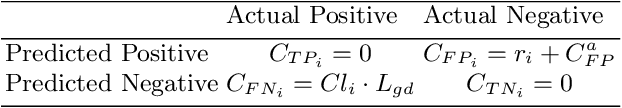

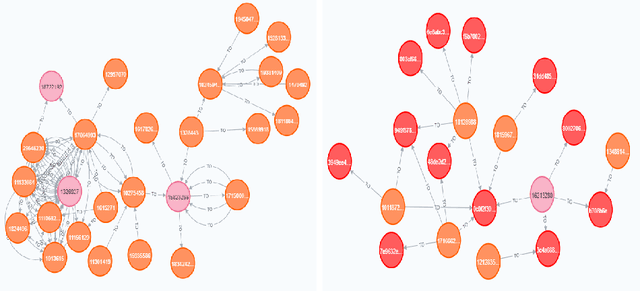

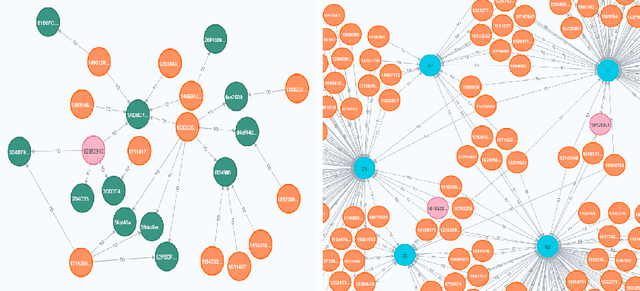

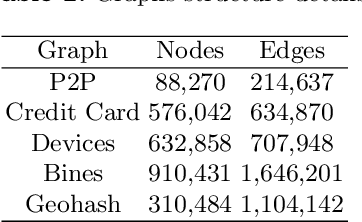

Abstract:Large digital platforms create environments where different types of user interactions are captured, these relationships offer a novel source of information for fraud detection problems. In this paper we propose a framework of relational graph convolutional networks methods for fraudulent behaviour prevention in the financial services of a Super-App. To this end, we apply the framework on different heterogeneous graphs of users, devices, and credit cards; and finally use an interpretability algorithm for graph neural networks to determine the most important relations to the classification task of the users. Our results show that there is an added value when considering models that take advantage of the alternative data of the Super-App and the interactions found in their high connectivity, further proofing how they can leverage that into better decisions and fraud detection strategies.

Supporting Financial Inclusion with Graph Machine Learning and Super-App Alternative Data

Feb 19, 2021

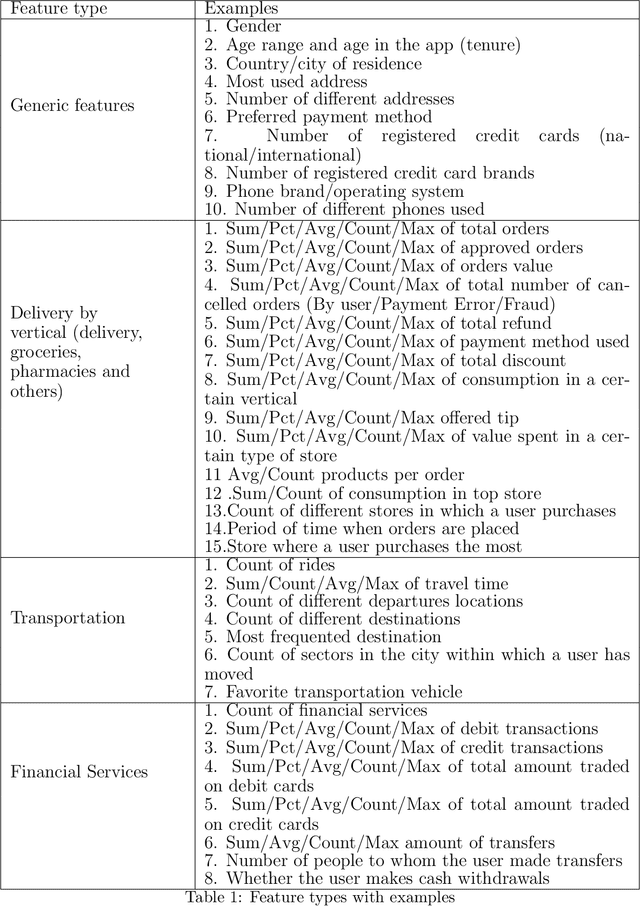

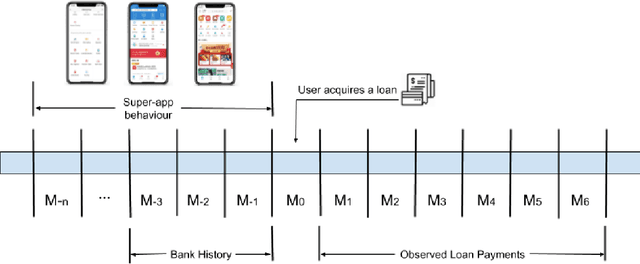

Abstract:The presence of Super-Apps have changed the way we think about the interactions between users and commerce. It then comes as no surprise that it is also redefining the way banking is done. The paper investigates how different interactions between users within a Super-App provide a new source of information to predict borrower behavior. To this end, two experiments with different graph-based methodologies are proposed, the first uses graph based features as input in a classification model and the second uses graph neural networks. Our results show that variables of centrality, behavior of neighboring users and transactionality of a user constituted new forms of knowledge that enhance statistical and financial performance of credit risk models. Furthermore, opportunities are identified for Super-Apps to redefine the definition of credit risk by contemplating all the environment that their platforms entail, leading to a more inclusive financial system.

Super-App Behavioral Patterns in Credit Risk Models: Financial, Statistical and Regulatory Implications

May 09, 2020

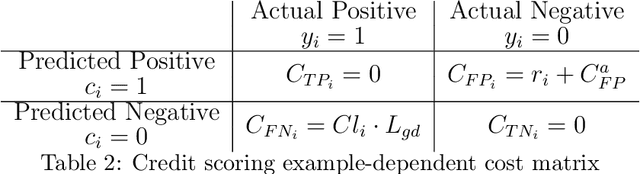

Abstract:In this paper we present the impact of alternative data that originates from an app-based marketplace, in contrast to traditional bureau data, upon credit scoring models. These alternative data sources have shown themselves to be immensely powerful in predicting borrower behavior in segments traditionally underserved by banks and financial institutions. Our results, validated across two countries, show that these new sources of data are particularly useful for predicting financial behavior in low-wealth and young individuals, who are also the most likely to engage with alternative lenders. Furthermore, using the TreeSHAP method for Stochastic Gradient Boosting interpretation, our results also revealed interesting non-linear trends in the variables originating from the app, which would not normally be available to traditional banks. Our results represent an opportunity for technology companies to disrupt traditional banking by correctly identifying alternative data sources and handling this new information properly. At the same time alternative data must be carefully validated to overcome regulatory hurdles across diverse jurisdictions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge