Supporting Financial Inclusion with Graph Machine Learning and Super-App Alternative Data

Paper and Code

Feb 19, 2021

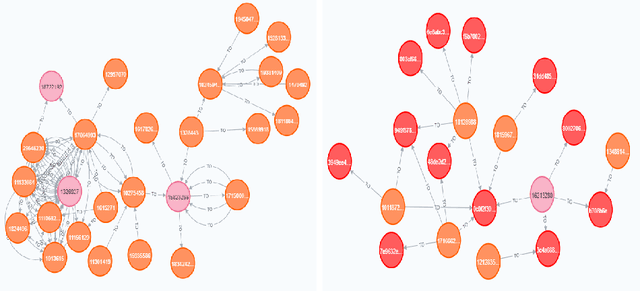

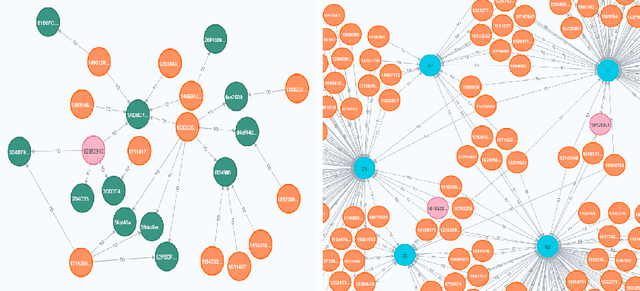

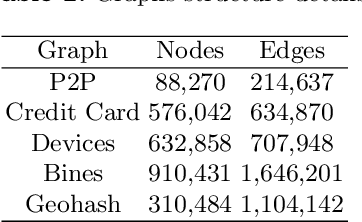

The presence of Super-Apps have changed the way we think about the interactions between users and commerce. It then comes as no surprise that it is also redefining the way banking is done. The paper investigates how different interactions between users within a Super-App provide a new source of information to predict borrower behavior. To this end, two experiments with different graph-based methodologies are proposed, the first uses graph based features as input in a classification model and the second uses graph neural networks. Our results show that variables of centrality, behavior of neighboring users and transactionality of a user constituted new forms of knowledge that enhance statistical and financial performance of credit risk models. Furthermore, opportunities are identified for Super-Apps to redefine the definition of credit risk by contemplating all the environment that their platforms entail, leading to a more inclusive financial system.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge