Cesar Charalla Olazo

Relational Graph Neural Networks for Fraud Detection in a Super-App environment

Jul 30, 2021

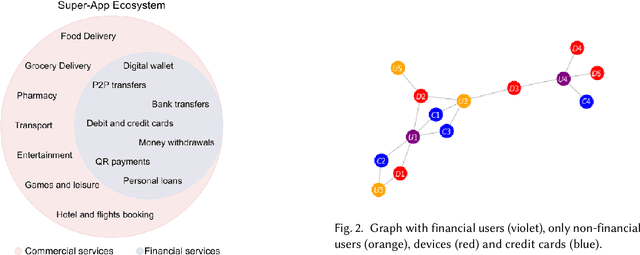

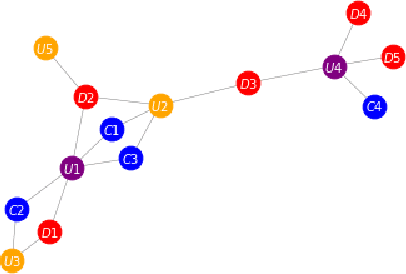

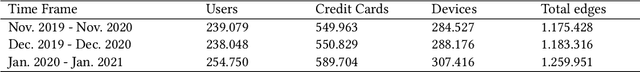

Abstract:Large digital platforms create environments where different types of user interactions are captured, these relationships offer a novel source of information for fraud detection problems. In this paper we propose a framework of relational graph convolutional networks methods for fraudulent behaviour prevention in the financial services of a Super-App. To this end, we apply the framework on different heterogeneous graphs of users, devices, and credit cards; and finally use an interpretability algorithm for graph neural networks to determine the most important relations to the classification task of the users. Our results show that there is an added value when considering models that take advantage of the alternative data of the Super-App and the interactions found in their high connectivity, further proofing how they can leverage that into better decisions and fraud detection strategies.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge