Luca Candelori

Shallow-circuit Supervised Learning on a Quantum Processor

Jan 06, 2026Abstract:Quantum computing has long promised transformative advances in data analysis, yet practical quantum machine learning has remained elusive due to fundamental obstacles such as a steep quantum cost for the loading of classical data and poor trainability of many quantum machine learning algorithms designed for near-term quantum hardware. In this work, we show that one can overcome these obstacles by using a linear Hamiltonian-based machine learning method which provides a compact quantum representation of classical data via ground state problems for k-local Hamiltonians. We use the recent sample-based Krylov quantum diagonalization method to compute low-energy states of the data Hamiltonians, whose parameters are trained to express classical datasets through local gradients. We demonstrate the efficacy and scalability of the methods by performing experiments on benchmark datasets using up to 50 qubits of an IBM Heron quantum processor.

Supervised Similarity for High-Yield Corporate Bonds with Quantum Cognition Machine Learning

Feb 03, 2025

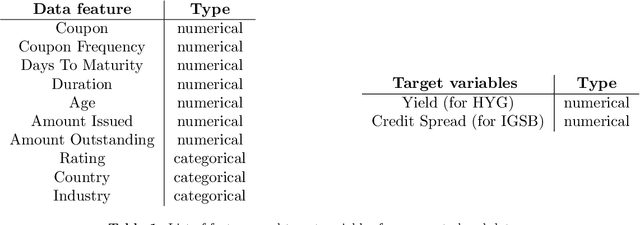

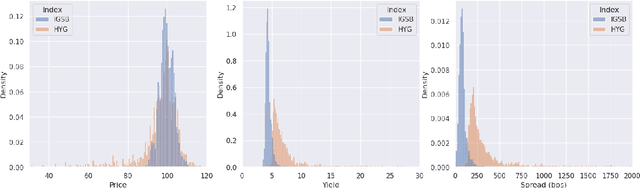

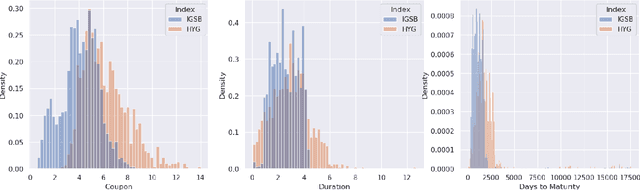

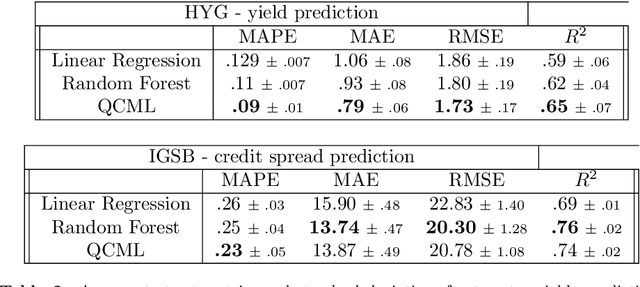

Abstract:We investigate the application of quantum cognition machine learning (QCML), a novel paradigm for both supervised and unsupervised learning tasks rooted in the mathematical formalism of quantum theory, to distance metric learning in corporate bond markets. Compared to equities, corporate bonds are relatively illiquid and both trade and quote data in these securities are relatively sparse. Thus, a measure of distance/similarity among corporate bonds is particularly useful for a variety of practical applications in the trading of illiquid bonds, including the identification of similar tradable alternatives, pricing securities with relatively few recent quotes or trades, and explaining the predictions and performance of ML models based on their training data. Previous research has explored supervised similarity learning based on classical tree-based models in this context; here, we explore the application of the QCML paradigm for supervised distance metric learning in the same context, showing that it outperforms classical tree-based models in high-yield (HY) markets, while giving comparable or better performance (depending on the evaluation metric) in investment grade (IG) markets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge