John Soldatos

Towards Conversational AI for Human-Machine Collaborative MLOps

Apr 16, 2025Abstract:This paper presents a Large Language Model (LLM) based conversational agent system designed to enhance human-machine collaboration in Machine Learning Operations (MLOps). We introduce the Swarm Agent, an extensible architecture that integrates specialized agents to create and manage ML workflows through natural language interactions. The system leverages a hierarchical, modular design incorporating a KubeFlow Pipelines (KFP) Agent for ML pipeline orchestration, a MinIO Agent for data management, and a Retrieval-Augmented Generation (RAG) Agent for domain-specific knowledge integration. Through iterative reasoning loops and context-aware processing, the system enables users with varying technical backgrounds to discover, execute, and monitor ML pipelines; manage datasets and artifacts; and access relevant documentation, all via intuitive conversational interfaces. Our approach addresses the accessibility gap in complex MLOps platforms like Kubeflow, making advanced ML tools broadly accessible while maintaining the flexibility to extend to other platforms. The paper describes the architecture, implementation details, and demonstrates how this conversational MLOps assistant reduces complexity and lowers barriers to entry for users across diverse technical skill levels.

Bridging Industrial Expertise and XR with LLM-Powered Conversational Agents

Apr 07, 2025Abstract:This paper introduces a novel integration of Retrieval-Augmented Generation (RAG) enhanced Large Language Models (LLMs) with Extended Reality (XR) technologies to address knowledge transfer challenges in industrial environments. The proposed system embeds domain-specific industrial knowledge into XR environments through a natural language interface, enabling hands-free, context-aware expert guidance for workers. We present the architecture of the proposed system consisting of an LLM Chat Engine with dynamic tool orchestration and an XR application featuring voice-driven interaction. Performance evaluation of various chunking strategies, embedding models, and vector databases reveals that semantic chunking, balanced embedding models, and efficient vector stores deliver optimal performance for industrial knowledge retrieval. The system's potential is demonstrated through early implementation in multiple industrial use cases, including robotic assembly, smart infrastructure maintenance, and aerospace component servicing. Results indicate potential for enhancing training efficiency, remote assistance capabilities, and operational guidance in alignment with Industry 5.0's human-centric and resilient approach to industrial development.

Can Large Language Models Beat Wall Street? Unveiling the Potential of AI in Stock Selection

Jan 08, 2024Abstract:In the dynamic and data-driven landscape of financial markets, this paper introduces MarketSenseAI, a novel AI-driven framework leveraging the advanced reasoning capabilities of GPT-4 for scalable stock selection. MarketSenseAI incorporates Chain of Thought and In-Context Learning methodologies to analyze a wide array of data sources, including market price dynamics, financial news, company fundamentals, and macroeconomic reports emulating the decision making process of prominent financial investment teams. The development, implementation, and empirical validation of MarketSenseAI are detailed, with a focus on its ability to provide actionable investment signals (buy, hold, sell) backed by cogent explanations. A notable aspect of this study is the use of GPT-4 not only as a predictive tool but also as an evaluator, revealing the significant impact of the AI-generated explanations on the reliability and acceptance of the suggested investment signals. In an extensive empirical evaluation with S&P 100 stocks, MarketSenseAI outperformed the benchmark index by 13%, achieving returns up to 40%, while maintaining a risk profile comparable to the market. These results demonstrate the efficacy of Large Language Models in complex financial decision-making and mark a significant advancement in the integration of AI into financial analysis and investment strategies. This research contributes to the financial AI field, presenting an innovative approach and underscoring the transformative potential of AI in revolutionizing traditional financial analysis investment methodologies.

Transforming Sentiment Analysis in the Financial Domain with ChatGPT

Aug 13, 2023

Abstract:Financial sentiment analysis plays a crucial role in decoding market trends and guiding strategic trading decisions. Despite the deployment of advanced deep learning techniques and language models to refine sentiment analysis in finance, this study breaks new ground by investigating the potential of large language models, particularly ChatGPT 3.5, in financial sentiment analysis, with a strong emphasis on the foreign exchange market (forex). Employing a zero-shot prompting approach, we examine multiple ChatGPT prompts on a meticulously curated dataset of forex-related news headlines, measuring performance using metrics such as precision, recall, f1-score, and Mean Absolute Error (MAE) of the sentiment class. Additionally, we probe the correlation between predicted sentiment and market returns as an additional evaluation approach. ChatGPT, compared to FinBERT, a well-established sentiment analysis model for financial texts, exhibited approximately 35\% enhanced performance in sentiment classification and a 36\% higher correlation with market returns. By underlining the significance of prompt engineering, particularly in zero-shot contexts, this study spotlights ChatGPT's potential to substantially boost sentiment analysis in financial applications. By sharing the utilized dataset, our intention is to stimulate further research and advancements in the field of financial services.

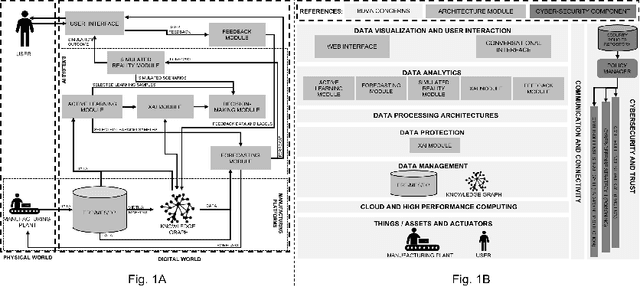

Human-Centric Artificial Intelligence Architecture for Industry 5.0 Applications

Mar 21, 2022

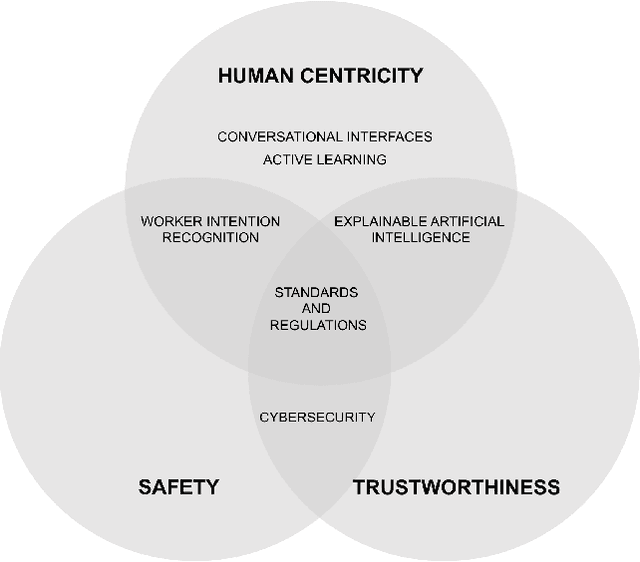

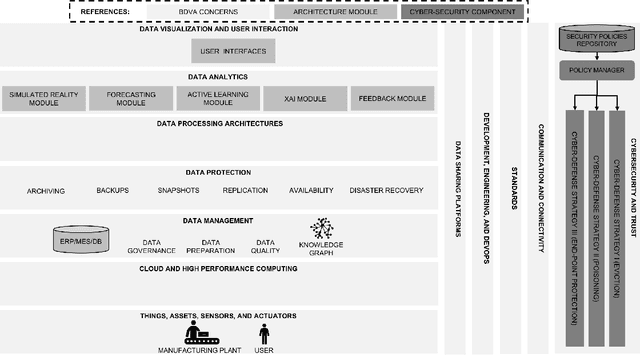

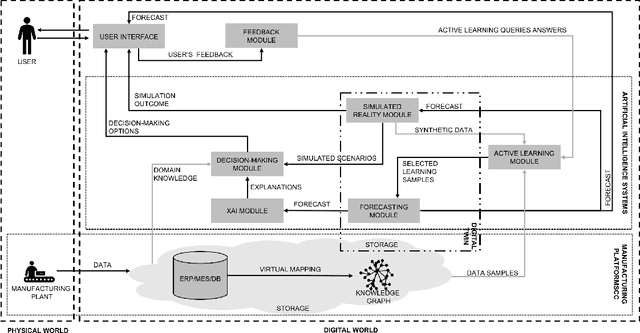

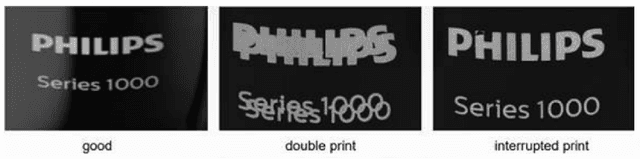

Abstract:Human-centricity is the core value behind the evolution of manufacturing towards Industry 5.0. Nevertheless, there is a lack of architecture that considers safety, trustworthiness, and human-centricity at its core. Therefore, we propose an architecture that integrates Artificial Intelligence (Active Learning, Forecasting, Explainable Artificial Intelligence), simulated reality, decision-making, and users' feedback, focusing on synergies between humans and machines. Furthermore, we align the proposed architecture with the Big Data Value Association Reference Architecture Model. Finally, we validate it on two use cases from real-world case studies.

STARdom: an architecture for trusted and secure human-centered manufacturing systems

Apr 02, 2021

Abstract:There is a lack of a single architecture specification that addresses the needs of trusted and secure Artificial Intelligence systems with humans in the loop, such as human-centered manufacturing systems at the core of the evolution towards Industry 5.0. To realize this, we propose an architecture that integrates forecasts, Explainable Artificial Intelligence, supports collecting users' feedback, and uses Active Learning and Simulated Reality to enhance forecasts and provide decision-making recommendations. The architecture security is addressed as a general concern. We align the proposed architecture with the Big Data Value Association Reference Architecture Model. We tailor it for the domain of demand forecasting and validate it on a real-world case study.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge