Jan Vanthienen

Extracting Process-Aware Decision Models from Object-Centric Process Data

Jan 26, 2024Abstract:Organizations execute decisions within business processes on a daily basis whilst having to take into account multiple stakeholders who might require multiple point of views of the same process. Moreover, the complexity of the information systems running these business processes is generally high as they are linked to databases storing all the relevant data and aspects of the processes. Given the presence of multiple objects within an information system which support the processes in their enactment, decisions are naturally influenced by both these perspectives, logged in object-centric process logs. However, the discovery of such decisions from object-centric process logs is not straightforward as it requires to correctly link the involved objects whilst considering the sequential constraints that business processes impose as well as correctly discovering what a decision actually does. This paper proposes the first object-centric decision-mining algorithm called Integrated Object-centric Decision Discovery Algorithm (IODDA). IODDA is able to discover how a decision is structured as well as how a decision is made. Moreover, IODDA is able to discover which activities and object types are involved in the decision-making process. Next, IODDA is demonstrated with the first artificial knowledge-intensive process logs whose log generators are provided to the research community.

The Value of Big Data for Credit Scoring: Enhancing Financial Inclusion using Mobile Phone Data and Social Network Analytics

Feb 23, 2020

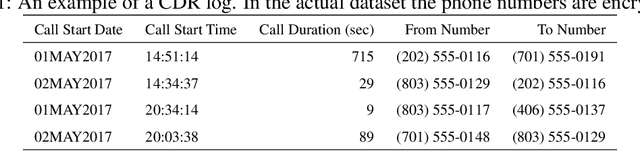

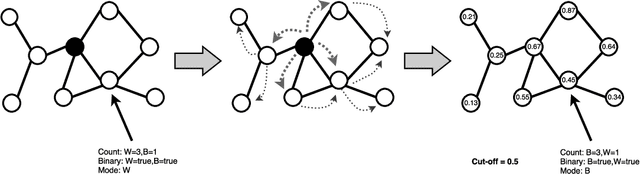

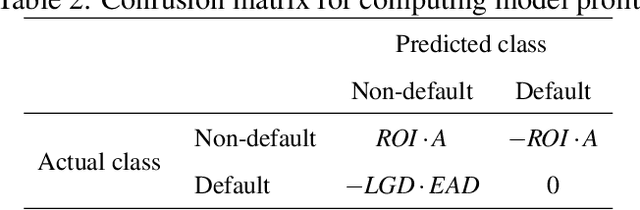

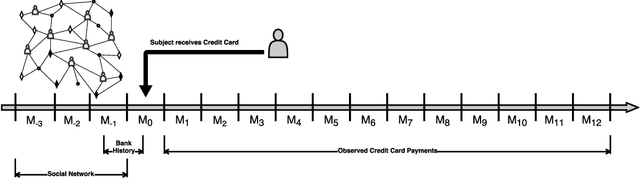

Abstract:Credit scoring is without a doubt one of the oldest applications of analytics. In recent years, a multitude of sophisticated classification techniques have been developed to improve the statistical performance of credit scoring models. Instead of focusing on the techniques themselves, this paper leverages alternative data sources to enhance both statistical and economic model performance. The study demonstrates how including call networks, in the context of positive credit information, as a new Big Data source has added value in terms of profit by applying a profit measure and profit-based feature selection. A unique combination of datasets, including call-detail records, credit and debit account information of customers is used to create scorecards for credit card applicants. Call-detail records are used to build call networks and advanced social network analytics techniques are applied to propagate influence from prior defaulters throughout the network to produce influence scores. The results show that combining call-detail records with traditional data in credit scoring models significantly increases their performance when measured in AUC. In terms of profit, the best model is the one built with only calling behavior features. In addition, the calling behavior features are the most predictive in other models, both in terms of statistical and economic performance. The results have an impact in terms of ethical use of call-detail records, regulatory implications, financial inclusion, as well as data sharing and privacy.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge