Ivan Sukharev

SeqNAS: Neural Architecture Search for Event Sequence Classification

Jan 06, 2024Abstract:Neural Architecture Search (NAS) methods are widely used in various industries to obtain high quality taskspecific solutions with minimal human intervention. Event Sequences find widespread use in various industrial applications including churn prediction customer segmentation fraud detection and fault diagnosis among others. Such data consist of categorical and real-valued components with irregular timestamps. Despite the usefulness of NAS methods previous approaches only have been applied to other domains images texts or time series. Our work addresses this limitation by introducing a novel NAS algorithm SeqNAS specifically designed for event sequence classification. We develop a simple yet expressive search space that leverages commonly used building blocks for event sequence classification including multihead self attention convolutions and recurrent cells. To perform the search we adopt sequential Bayesian Optimization and utilize previously trained models as an ensemble of teachers to augment knowledge distillation. As a result of our work we demonstrate that our method surpasses state of the art NAS methods and popular architectures suitable for sequence classification and holds great potential for various industrial applications.

EWS-GCN: Edge Weight-Shared Graph Convolutional Network for Transactional Banking Data

Sep 30, 2020

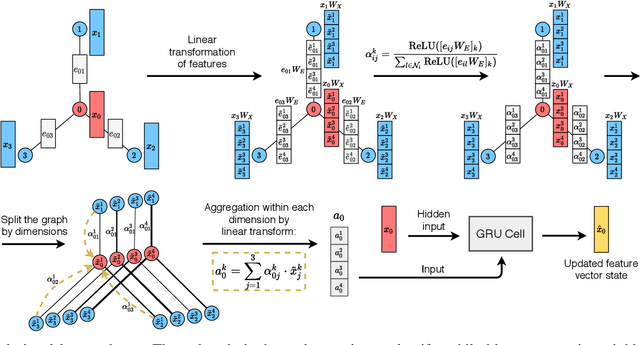

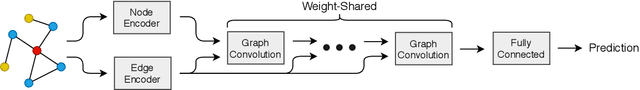

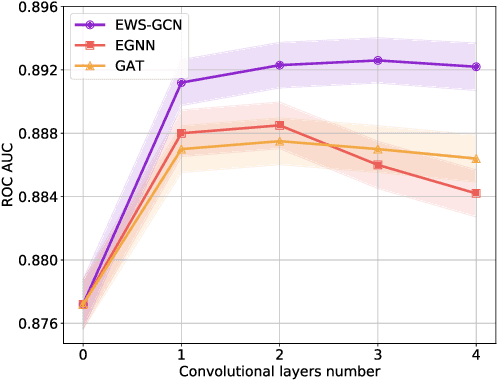

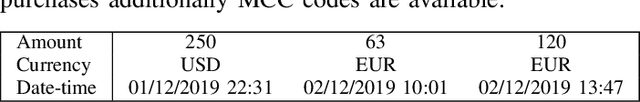

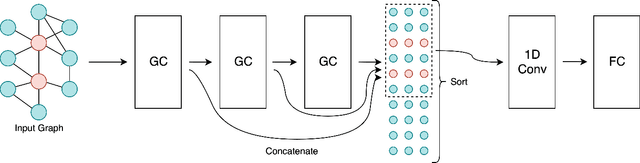

Abstract:In this paper, we discuss how modern deep learning approaches can be applied to the credit scoring of bank clients. We show that information about connections between clients based on money transfers between them allows us to significantly improve the quality of credit scoring compared to the approaches using information about the target client solely. As a final solution, we develop a new graph neural network model EWS-GCN that combines ideas of graph convolutional and recurrent neural networks via attention mechanism. The resulting model allows for robust training and efficient processing of large-scale data. We also demonstrate that our model outperforms the state-of-the-art graph neural networks achieving excellent results

Linking Bank Clients using Graph Neural Networks Powered by Rich Transactional Data

Jan 23, 2020

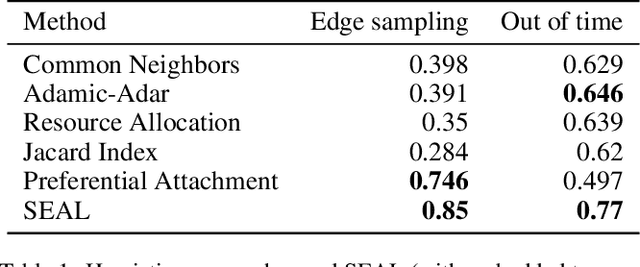

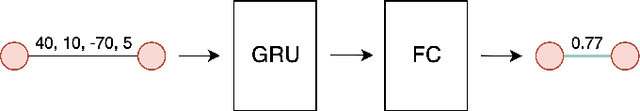

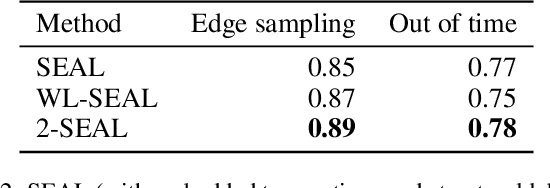

Abstract:Financial institutions obtain enormous amounts of data about user transactions and money transfers, which can be considered as a large graph dynamically changing in time. In this work, we focus on the task of predicting new interactions in the network of bank clients and treat it as a link prediction problem. We propose a new graph neural network model, which uses not only the topological structure of the network but rich time-series data available for the graph nodes and edges. We evaluate the developed method using the data provided by a large European bank for several years. The proposed model outperforms the existing approaches, including other neural network models, with a significant gap in ROC AUC score on link prediction problem and also allows to improve the quality of credit scoring.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge