Dmitry Berestnev

Designing an attack-defense game: how to increase robustness of financial transaction models via a competition

Aug 23, 2023Abstract:Given the escalating risks of malicious attacks in the finance sector and the consequential severe damage, a thorough understanding of adversarial strategies and robust defense mechanisms for machine learning models is critical. The threat becomes even more severe with the increased adoption in banks more accurate, but potentially fragile neural networks. We aim to investigate the current state and dynamics of adversarial attacks and defenses for neural network models that use sequential financial data as the input. To achieve this goal, we have designed a competition that allows realistic and detailed investigation of problems in modern financial transaction data. The participants compete directly against each other, so possible attacks and defenses are examined in close-to-real-life conditions. Our main contributions are the analysis of the competition dynamics that answers the questions on how important it is to conceal a model from malicious users, how long does it take to break it, and what techniques one should use to make it more robust, and introduction additional way to attack models or increase their robustness. Our analysis continues with a meta-study on the used approaches with their power, numerical experiments, and accompanied ablations studies. We show that the developed attacks and defenses outperform existing alternatives from the literature while being practical in terms of execution, proving the validity of the competition as a tool for uncovering vulnerabilities of machine learning models and mitigating them in various domains.

Hiding Backdoors within Event Sequence Data via Poisoning Attacks

Aug 20, 2023Abstract:The financial industry relies on deep learning models for making important decisions. This adoption brings new danger, as deep black-box models are known to be vulnerable to adversarial attacks. In computer vision, one can shape the output during inference by performing an adversarial attack called poisoning via introducing a backdoor into the model during training. For sequences of financial transactions of a customer, insertion of a backdoor is harder to perform, as models operate over a more complex discrete space of sequences, and systematic checks for insecurities occur. We provide a method to introduce concealed backdoors, creating vulnerabilities without altering their functionality for uncontaminated data. To achieve this, we replace a clean model with a poisoned one that is aware of the availability of a backdoor and utilize this knowledge. Our most difficult for uncovering attacks include either additional supervised detection step of poisoned data activated during the test or well-hidden model weight modifications. The experimental study provides insights into how these effects vary across different datasets, architectures, and model components. Alternative methods and baselines, such as distillation-type regularization, are also explored but found to be less efficient. Conducted on three open transaction datasets and architectures, including LSTM, CNN, and Transformer, our findings not only illuminate the vulnerabilities in contemporary models but also can drive the construction of more robust systems.

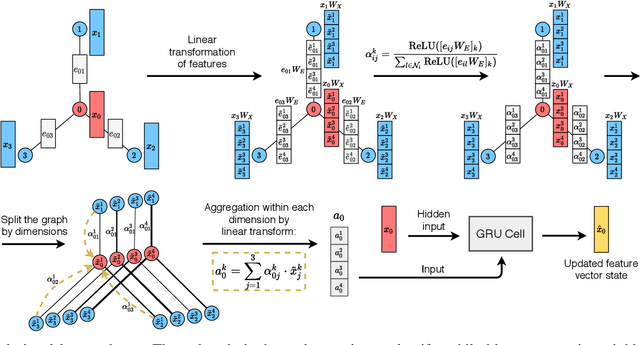

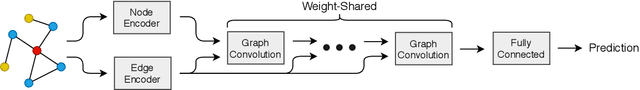

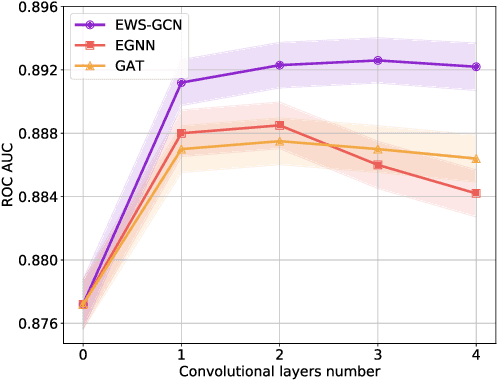

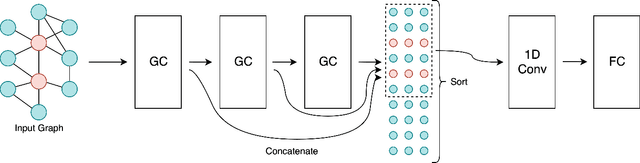

EWS-GCN: Edge Weight-Shared Graph Convolutional Network for Transactional Banking Data

Sep 30, 2020

Abstract:In this paper, we discuss how modern deep learning approaches can be applied to the credit scoring of bank clients. We show that information about connections between clients based on money transfers between them allows us to significantly improve the quality of credit scoring compared to the approaches using information about the target client solely. As a final solution, we develop a new graph neural network model EWS-GCN that combines ideas of graph convolutional and recurrent neural networks via attention mechanism. The resulting model allows for robust training and efficient processing of large-scale data. We also demonstrate that our model outperforms the state-of-the-art graph neural networks achieving excellent results

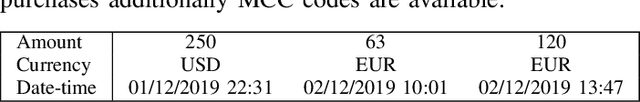

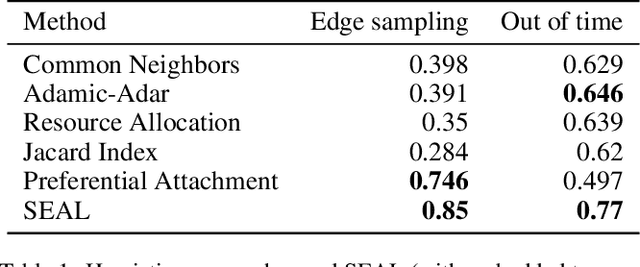

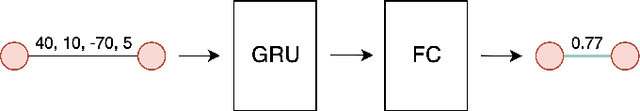

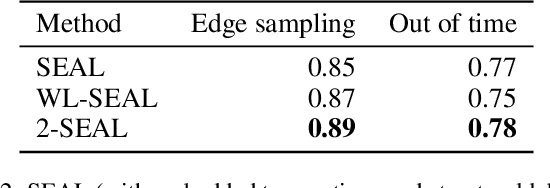

Linking Bank Clients using Graph Neural Networks Powered by Rich Transactional Data

Jan 23, 2020

Abstract:Financial institutions obtain enormous amounts of data about user transactions and money transfers, which can be considered as a large graph dynamically changing in time. In this work, we focus on the task of predicting new interactions in the network of bank clients and treat it as a link prediction problem. We propose a new graph neural network model, which uses not only the topological structure of the network but rich time-series data available for the graph nodes and edges. We evaluate the developed method using the data provided by a large European bank for several years. The proposed model outperforms the existing approaches, including other neural network models, with a significant gap in ROC AUC score on link prediction problem and also allows to improve the quality of credit scoring.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge