Linking Bank Clients using Graph Neural Networks Powered by Rich Transactional Data

Paper and Code

Jan 23, 2020

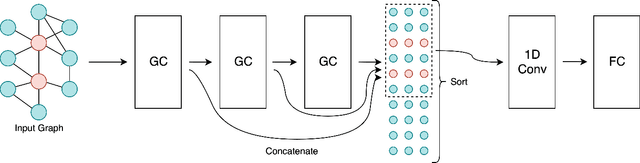

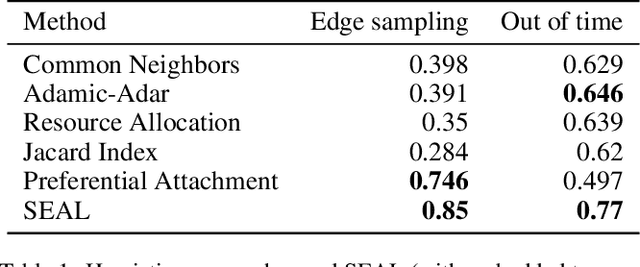

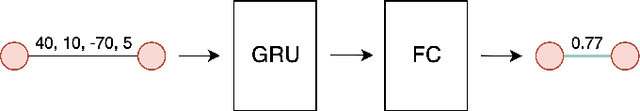

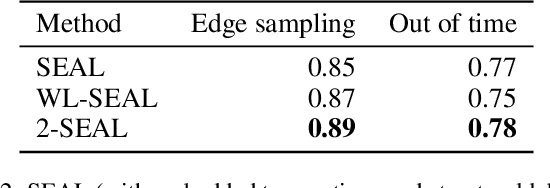

Financial institutions obtain enormous amounts of data about user transactions and money transfers, which can be considered as a large graph dynamically changing in time. In this work, we focus on the task of predicting new interactions in the network of bank clients and treat it as a link prediction problem. We propose a new graph neural network model, which uses not only the topological structure of the network but rich time-series data available for the graph nodes and edges. We evaluate the developed method using the data provided by a large European bank for several years. The proposed model outperforms the existing approaches, including other neural network models, with a significant gap in ROC AUC score on link prediction problem and also allows to improve the quality of credit scoring.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge