Charles Twardy

Replication Markets: Results, Lessons, Challenges and Opportunities in AI Replication

May 10, 2020

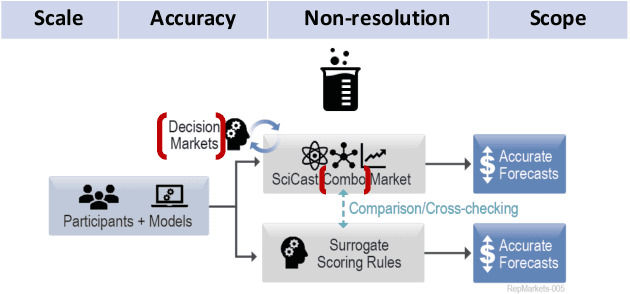

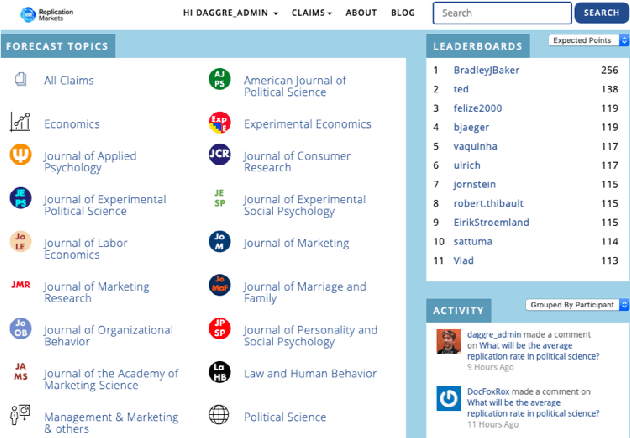

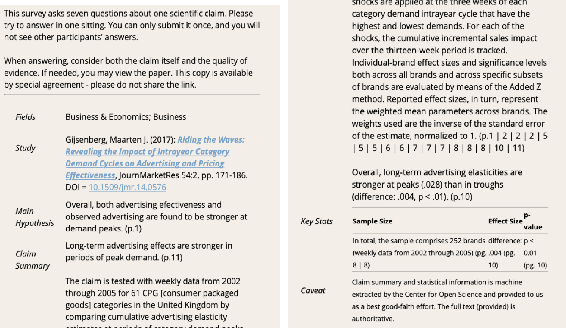

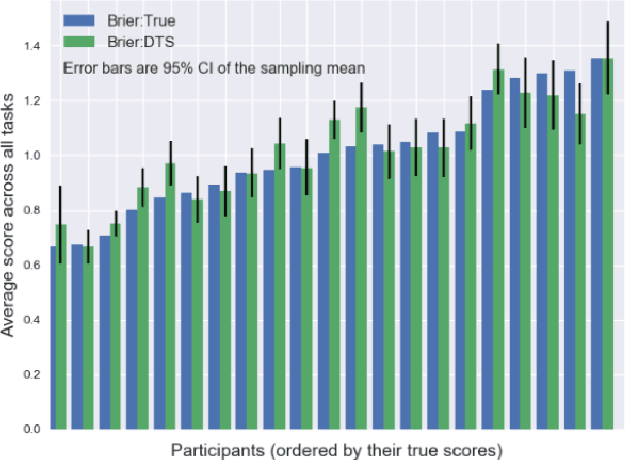

Abstract:The last decade saw the emergence of systematic large-scale replication projects in the social and behavioral sciences, (Camerer et al., 2016, 2018; Ebersole et al., 2016; Klein et al., 2014, 2018; Collaboration, 2015). These projects were driven by theoretical and conceptual concerns about a high fraction of "false positives" in the scientific publications (Ioannidis, 2005) (and a high prevalence of "questionable research practices" (Simmons, Nelson, and Simonsohn, 2011). Concerns about the credibility of research findings are not unique to the behavioral and social sciences; within Computer Science, Artificial Intelligence (AI) and Machine Learning (ML) are areas of particular concern (Lucic et al., 2018; Freire, Bonnet, and Shasha, 2012; Gundersen and Kjensmo, 2018; Henderson et al., 2018). Given the pioneering role of the behavioral and social sciences in the promotion of novel methodologies to improve the credibility of research, it is a promising approach to analyze the lessons learned from this field and adjust strategies for Computer Science, AI and ML In this paper, we review approaches used in the behavioral and social sciences and in the DARPA SCORE project. We particularly focus on the role of human forecasting of replication outcomes, and how forecasting can leverage the information gained from relatively labor and resource-intensive replications. We will discuss opportunities and challenges of using these approaches to monitor and improve the credibility of research areas in Computer Science, AI, and ML.

Probability and Asset Updating using Bayesian Networks for Combinatorial Prediction Markets

Oct 16, 2012

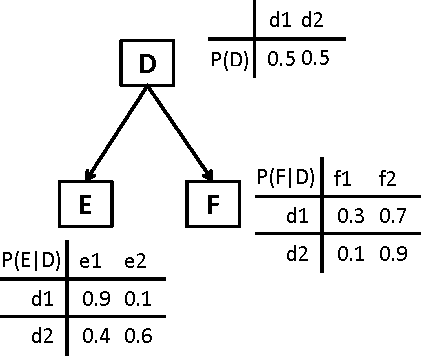

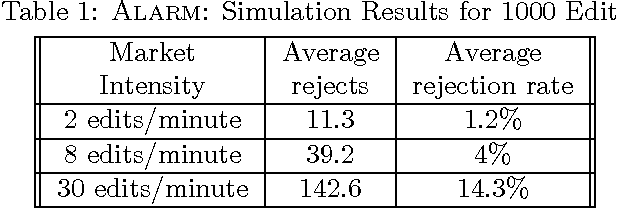

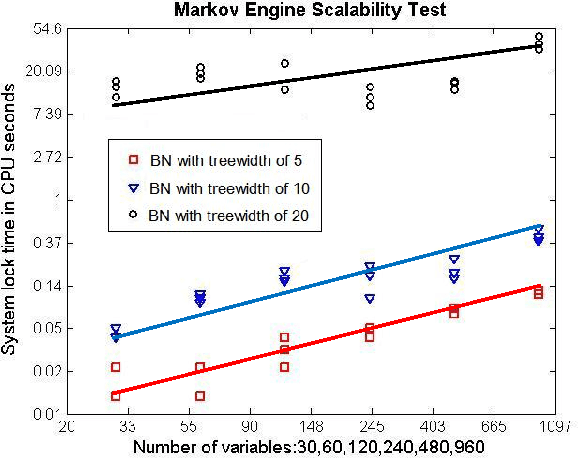

Abstract:A market-maker-based prediction market lets forecasters aggregate information by editing a consensus probability distribution either directly or by trading securities that pay off contingent on an event of interest. Combinatorial prediction markets allow trading on any event that can be specified as a combination of a base set of events. However, explicitly representing the full joint distribution is infeasible for markets with more than a few base events. A factored representation such as a Bayesian network (BN) can achieve tractable computation for problems with many related variables. Standard BN inference algorithms, such as the junction tree algorithm, can be used to update a representation of the entire joint distribution given a change to any local conditional probability. However, in order to let traders reuse assets from prior trades while never allowing assets to become negative, a BN based prediction market also needs to update a representation of each user's assets and find the conditional state in which a user has minimum assets. Users also find it useful to see their expected assets given an edit outcome. We show how to generalize the junction tree algorithm to perform all these computations.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge