Changlong Wang

Temporal-Aware Deep Reinforcement Learning for Energy Storage Bidding in Energy and Contingency Reserve Markets

Feb 29, 2024

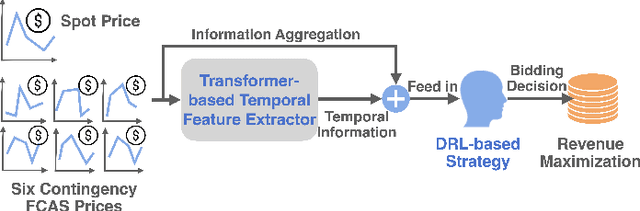

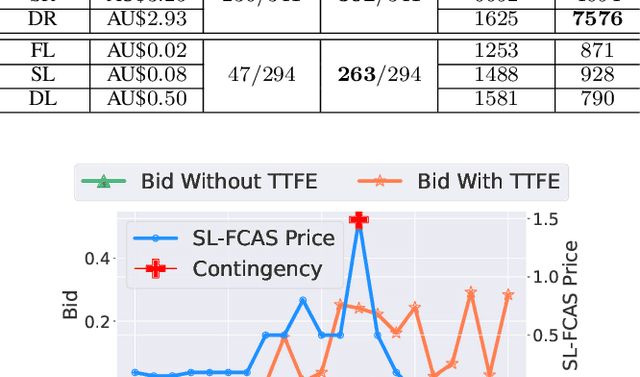

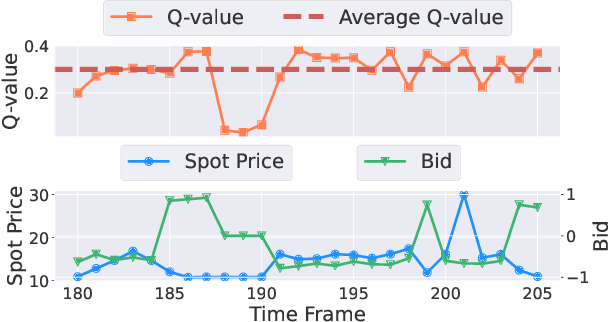

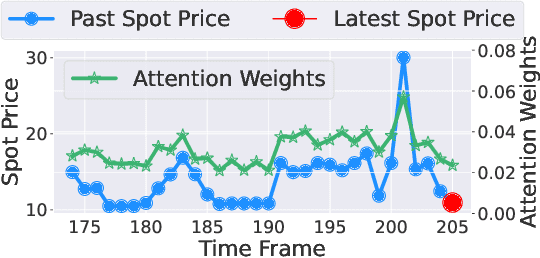

Abstract:The battery energy storage system (BESS) has immense potential for enhancing grid reliability and security through its participation in the electricity market. BESS often seeks various revenue streams by taking part in multiple markets to unlock its full potential, but effective algorithms for joint-market participation under price uncertainties are insufficiently explored in the existing research. To bridge this gap, we develop a novel BESS joint bidding strategy that utilizes deep reinforcement learning (DRL) to bid in the spot and contingency frequency control ancillary services (FCAS) markets. Our approach leverages a transformer-based temporal feature extractor to effectively respond to price fluctuations in seven markets simultaneously and helps DRL learn the best BESS bidding strategy in joint-market participation. Additionally, unlike conventional "black-box" DRL model, our approach is more interpretable and provides valuable insights into the temporal bidding behavior of BESS in the dynamic electricity market. We validate our method using realistic market prices from the Australian National Electricity Market. The results show that our strategy outperforms benchmarks, including both optimization-based and other DRL-based strategies, by substantial margins. Our findings further suggest that effective temporal-aware bidding can significantly increase profits in the spot and contingency FCAS markets compared to individual market participation.

* 15 pages

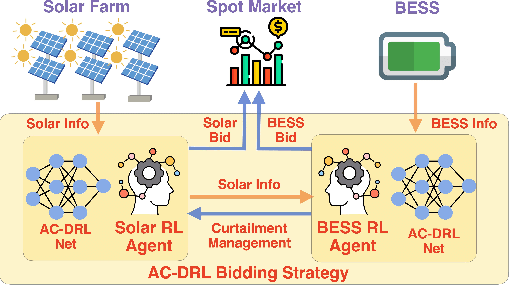

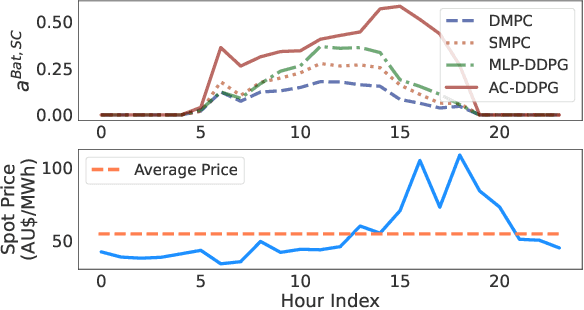

Attentive Convolutional Deep Reinforcement Learning for Optimizing Solar-Storage Systems in Real-Time Electricity Markets

Jan 29, 2024

Abstract:This paper studies the synergy of solar-battery energy storage system (BESS) and develops a viable strategy for the BESS to unlock its economic potential by serving as a backup to reduce solar curtailments while also participating in the electricity market. We model the real-time bidding of the solar-battery system as two Markov decision processes for the solar farm and the BESS, respectively. We develop a novel deep reinforcement learning (DRL) algorithm to solve the problem by leveraging attention mechanism (AC) and multi-grained feature convolution to process DRL input for better bidding decisions. Simulation results demonstrate that our AC-DRL outperforms two optimization-based and one DRL-based benchmarks by generating 23%, 20%, and 11% higher revenue, as well as improving curtailment responses. The excess solar generation can effectively charge the BESS to bid in the market, significantly reducing solar curtailments by 76% and creating synergy for the solar-battery system to be more viable.

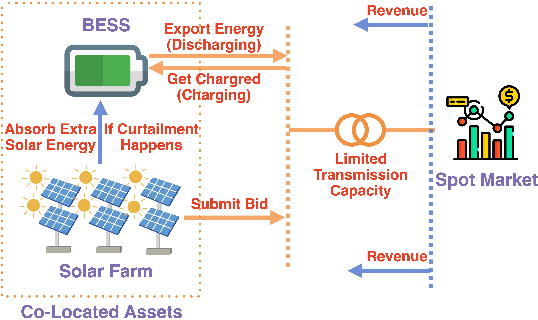

Optimal Energy Storage Scheduling for Wind Curtailment Reduction and Energy Arbitrage: A Deep Reinforcement Learning Approach

Apr 05, 2023Abstract:Wind energy has been rapidly gaining popularity as a means for combating climate change. However, the variable nature of wind generation can undermine system reliability and lead to wind curtailment, causing substantial economic losses to wind power producers. Battery energy storage systems (BESS) that serve as onsite backup sources are among the solutions to mitigate wind curtailment. However, such an auxiliary role of the BESS might severely weaken its economic viability. This paper addresses the issue by proposing joint wind curtailment reduction and energy arbitrage for the BESS. We decouple the market participation of the co-located wind-battery system and develop a joint-bidding framework for the wind farm and BESS. It is challenging to optimize the joint-bidding because of the stochasticity of energy prices and wind generation. Therefore, we leverage deep reinforcement learning to maximize the overall revenue from the spot market while unlocking the BESS's potential in concurrently reducing wind curtailment and conducting energy arbitrage. We validate the proposed strategy using realistic wind farm data and demonstrate that our joint-bidding strategy responds better to wind curtailment and generates higher revenues than the optimization-based benchmark. Our simulations also reveal that the extra wind generation used to be curtailed can be an effective power source to charge the BESS, resulting in additional financial returns.

Deep Reinforcement Learning for Wind and Energy Storage Coordination in Wholesale Energy and Ancillary Service Markets

Dec 27, 2022Abstract:Global power systems are increasingly reliant on wind energy as a mitigation strategy for climate change. However, the variability of wind energy causes system reliability to erode, resulting in the wind being curtailed and, ultimately, leading to substantial economic losses for wind farm owners. Wind curtailment can be reduced using battery energy storage systems (BESS) that serve as onsite backup sources. Yet, this auxiliary role may significantly hamper the BESS's capacity to generate revenues from the electricity market, particularly in conducting energy arbitrage in the Spot market and providing frequency control ancillary services (FCAS) in the FCAS markets. Ideal BESS scheduling should effectively balance the BESS's role in absorbing onsite wind curtailment and trading in the electricity market, but it is difficult in practice because of the underlying coordination complexity and the stochastic nature of energy prices and wind generation. In this study, we investigate the bidding strategy of a wind-battery system co-located and participating simultaneously in both the Spot and Regulation FCAS markets. We propose a deep reinforcement learning (DRL)-based approach that decouples the market participation of the wind-battery system into two related Markov decision processes for each facility, enabling the BESS to absorb onsite wind curtailment while simultaneously bidding in the wholesale Spot and FCAS markets to maximize overall operational revenues. Using realistic wind farm data, we validated the coordinated bidding strategy for the wind-battery system and find that our strategy generates significantly higher revenue and responds better to wind curtailment compared to an optimization-based benchmark. Our results show that joint-market bidding can significantly improve the financial performance of wind-battery systems compared to individual market participation.

Proximal Policy Optimization Based Reinforcement Learning for Joint Bidding in Energy and Frequency Regulation Markets

Dec 13, 2022

Abstract:Driven by the global decarbonization effort, the rapid integration of renewable energy into the conventional electricity grid presents new challenges and opportunities for the battery energy storage system (BESS) participating in the energy market. Energy arbitrage can be a significant source of revenue for the BESS due to the increasing price volatility in the spot market caused by the mismatch between renewable generation and electricity demand. In addition, the Frequency Control Ancillary Services (FCAS) markets established to stabilize the grid can offer higher returns for the BESS due to their capability to respond within milliseconds. Therefore, it is crucial for the BESS to carefully decide how much capacity to assign to each market to maximize the total profit under uncertain market conditions. This paper formulates the bidding problem of the BESS as a Markov Decision Process, which enables the BESS to participate in both the spot market and the FCAS market to maximize profit. Then, Proximal Policy Optimization, a model-free deep reinforcement learning algorithm, is employed to learn the optimal bidding strategy from the dynamic environment of the energy market under a continuous bidding scale. The proposed model is trained and validated using real-world historical data of the Australian National Electricity Market. The results demonstrate that our developed joint bidding strategy in both markets is significantly profitable compared to individual markets.

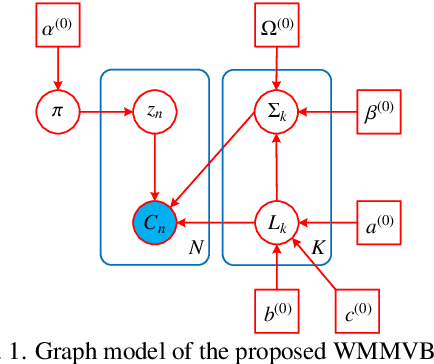

Unsupervised Classification for Polarimetric SAR Data Using Variational Bayesian Wishart Mixture Model with Inverse Gamma-Gamma Prior

Apr 04, 2021

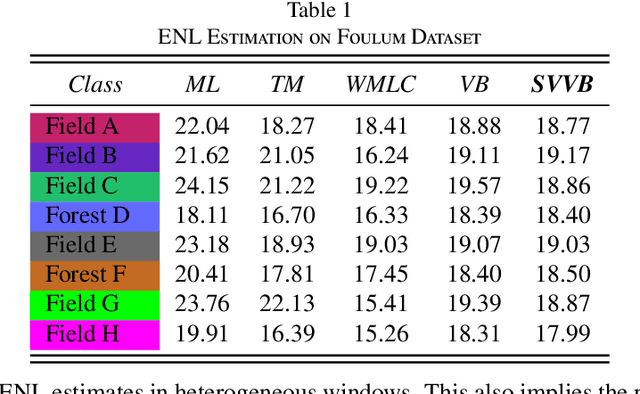

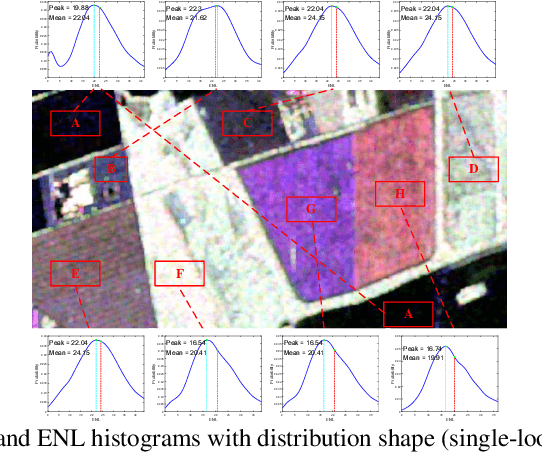

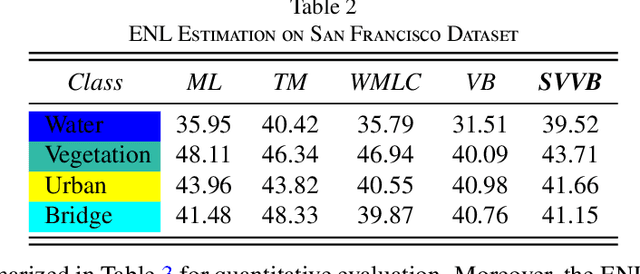

Abstract:Although various clustering methods have been successfully applied to polarimetric synthetic aperture radar (PolSAR) image clustering tasks, most of the available approaches fail to realize automatic determination of cluster number, nor have they derived an exact distribution for the number of looks. To overcome these limitations and achieve robust unsupervised classification of PolSAR images, this paper proposes the variational Bayesian Wishart mixture model (VBWMM), where variational Bayesian expectation maximization (VBEM) technique is applied to estimate the variational posterior distribution of model parameters iteratively. Besides, covariance matrix similarity and geometric similarity are combined to incorporate spatial information of PolSAR images. Furthermore, we derive a new distribution named inverse gamma-gamma (IGG) prior that originates from the log-likelihood function of proposed model to enable efficient handling of number of looks. As a result, we obtain a closed-form variational lower bound, which can be used to evaluate the convergence of proposed model. We validate the superiority of proposed method in clustering performance on four real-measured datasets and demonstrate significant improvements towards conventional methods. As a by-product, the experiments show that our proposed IGG prior is effective in estimating the number of looks.

A nonconvex approach to low-rank and sparse matrix decomposition with application to video surveillance

Jul 02, 2018

Abstract:In this paper, we develop a new nonconvex approach to the problem of low-rank and sparse matrix decomposition. In our nonconvex method, we replace the rank function and the $\ell_{0}$-norm of a given matrix with a non-convex fraction function on the singular values and the elements of the matrix respectively. An alternative direction method of multipliers algorithm is utilized to solve our nonconvex problem with the non-convex fraction function penalty. Numerical experiments on video surveillance show that our method performs very well in separating the moving objects from the static background.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge