Ayoub El Qadi

A Practical Tutorial on Explainable AI Techniques

Nov 13, 2021

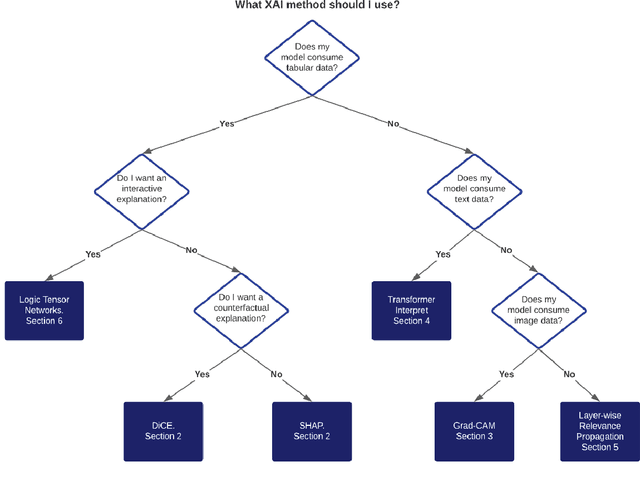

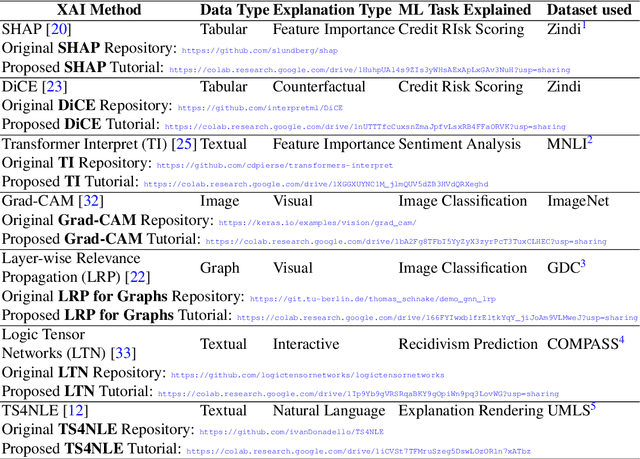

Abstract:Last years have been characterized by an upsurge of opaque automatic decision support systems, such as Deep Neural Networks (DNNs). Although they have great generalization and prediction skills, their functioning does not allow obtaining detailed explanations of their behaviour. As opaque machine learning models are increasingly being employed to make important predictions in critical environments, the danger is to create and use decisions that are not justifiable or legitimate. Therefore, there is a general agreement on the importance of endowing machine learning models with explainability. The reason is that EXplainable Artificial Intelligence (XAI) techniques can serve to verify and certify model outputs and enhance them with desirable notions such as trustworthiness, accountability, transparency and fairness. This tutorial is meant to be the go-to handbook for any audience with a computer science background aiming at getting intuitive insights of machine learning models, accompanied with straight, fast, and intuitive explanations out of the box. We believe that these methods provide a valuable contribution for applying XAI techniques in their particular day-to-day models, datasets and use-cases. Figure \ref{fig:Flowchart} acts as a flowchart/map for the reader and should help him to find the ideal method to use according to his type of data. The reader will find a description of the proposed method as well as an example of use and a Python notebook that he can easily modify as he pleases in order to apply it to his own case of application.

Explaining Credit Risk Scoring through Feature Contribution Alignment with Expert Risk Analysts

Mar 15, 2021

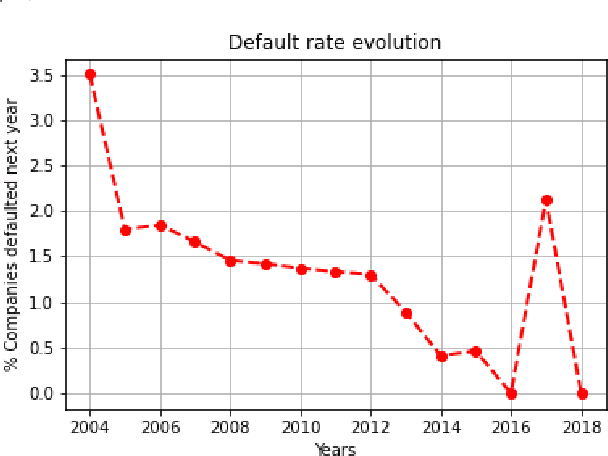

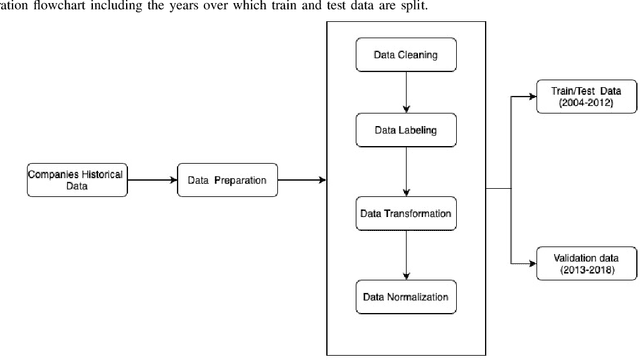

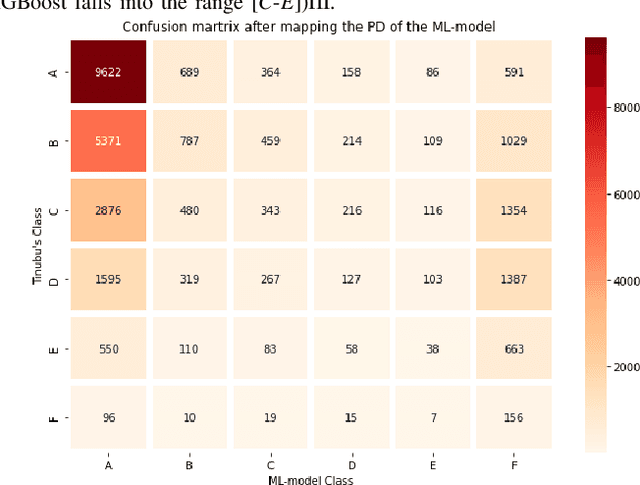

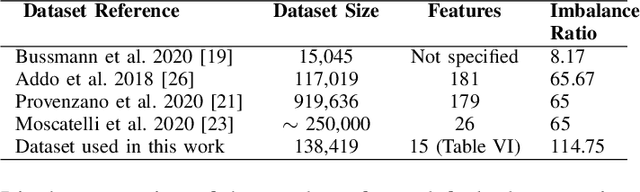

Abstract:Credit assessments activities are essential for financial institutions and allow the global economy to grow. Building robust, solid and accurate models that estimate the probability of a default of a company is mandatory for credit insurance companies, moreover when it comes to bridging the trade finance gap. Automating the risk assessment process will allow credit risk experts to reduce their workload and focus on the critical and complex cases, as well as to improve the loan approval process by reducing the time to process the application. The recent developments in Artificial Intelligence are offering new powerful opportunities. However, most AI techniques are labelled as blackbox models due to their lack of explainability. For both users and regulators, in order to deploy such technologies at scale, being able to understand the model logic is a must to grant accurate and ethical decision making. In this study, we focus on companies credit scoring and we benchmark different machine learning models. The aim is to build a model to predict whether a company will experience financial problems in a given time horizon. We address the black box problem using eXplainable Artificial Techniques in particular, post-hoc explanations using SHapley Additive exPlanations. We bring light by providing an expert-aligned feature relevance score highlighting the disagreement between a credit risk expert and a model feature attribution explanation in order to better quantify the convergence towards a better human-aligned decision making.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge