Ali Babar

Enhancing Financial Sentiment Analysis via Retrieval Augmented Large Language Models

Oct 06, 2023

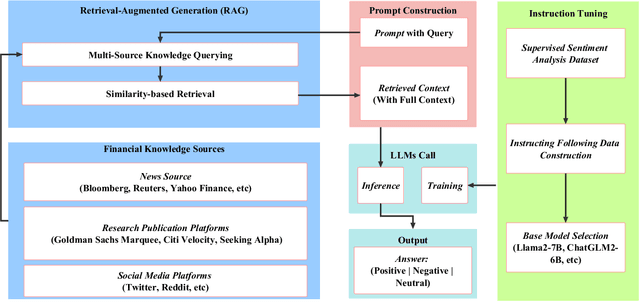

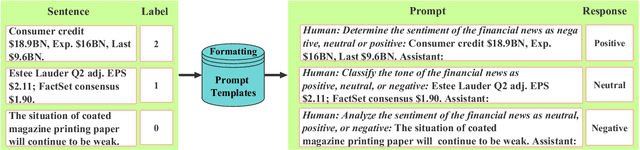

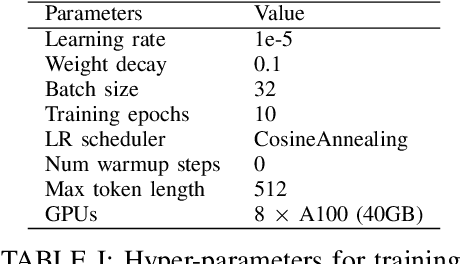

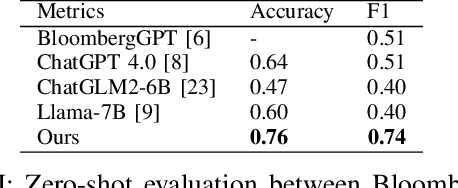

Abstract:Financial sentiment analysis is critical for valuation and investment decision-making. Traditional NLP models, however, are limited by their parameter size and the scope of their training datasets, which hampers their generalization capabilities and effectiveness in this field. Recently, Large Language Models (LLMs) pre-trained on extensive corpora have demonstrated superior performance across various NLP tasks due to their commendable zero-shot abilities. Yet, directly applying LLMs to financial sentiment analysis presents challenges: The discrepancy between the pre-training objective of LLMs and predicting the sentiment label can compromise their predictive performance. Furthermore, the succinct nature of financial news, often devoid of sufficient context, can significantly diminish the reliability of LLMs' sentiment analysis. To address these challenges, we introduce a retrieval-augmented LLMs framework for financial sentiment analysis. This framework includes an instruction-tuned LLMs module, which ensures LLMs behave as predictors of sentiment labels, and a retrieval-augmentation module which retrieves additional context from reliable external sources. Benchmarked against traditional models and LLMs like ChatGPT and LLaMA, our approach achieves 15\% to 48\% performance gain in accuracy and F1 score.

Deep Learning Methods for Credit Card Fraud Detection

Dec 07, 2020

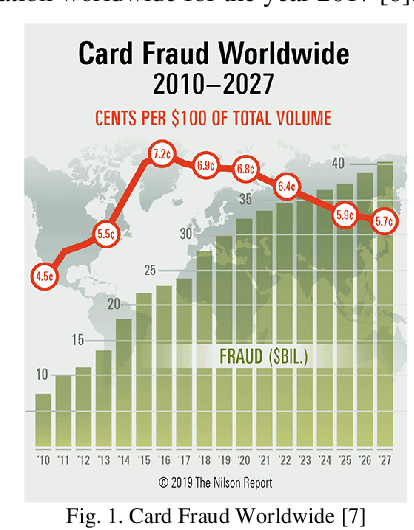

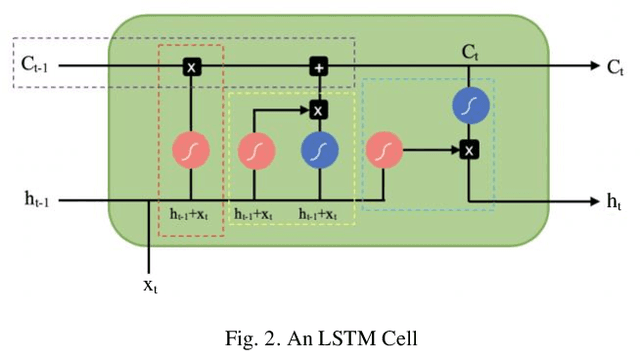

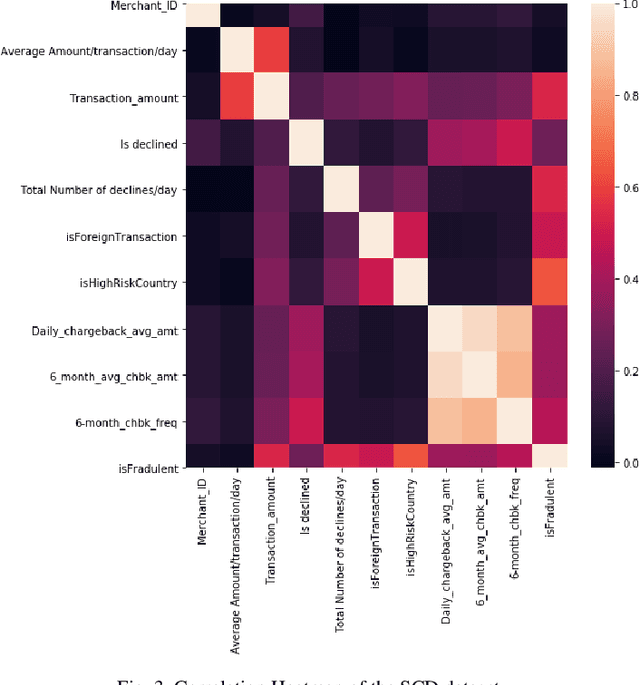

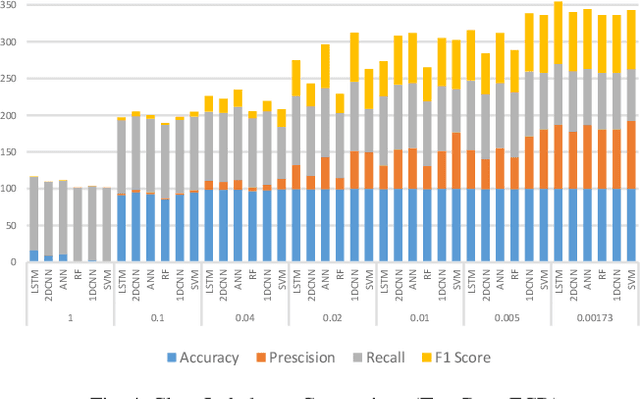

Abstract:Credit card frauds are at an ever-increasing rate and have become a major problem in the financial sector. Because of these frauds, card users are hesitant in making purchases and both the merchants and financial institutions bear heavy losses. Some major challenges in credit card frauds involve the availability of public data, high class imbalance in data, changing nature of frauds and the high number of false alarms. Machine learning techniques have been used to detect credit card frauds but no fraud detection systems have been able to offer great efficiency to date. Recent development of deep learning has been applied to solve complex problems in various areas. This paper presents a thorough study of deep learning methods for the credit card fraud detection problem and compare their performance with various machine learning algorithms on three different financial datasets. Experimental results show great performance of the proposed deep learning methods against traditional machine learning models and imply that the proposed approaches can be implemented effectively for real-world credit card fraud detection systems.

Gathering Cyber Threat Intelligence from Twitter Using Novelty Classification

Jul 03, 2019

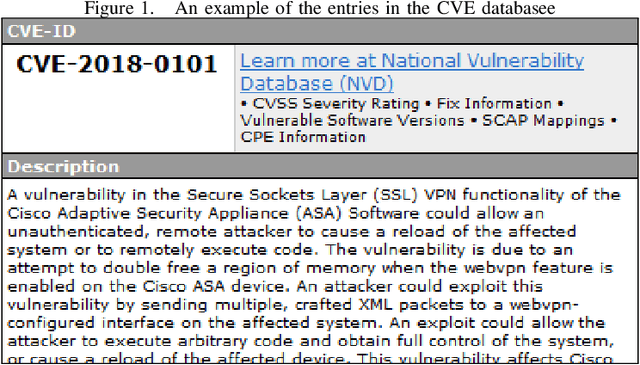

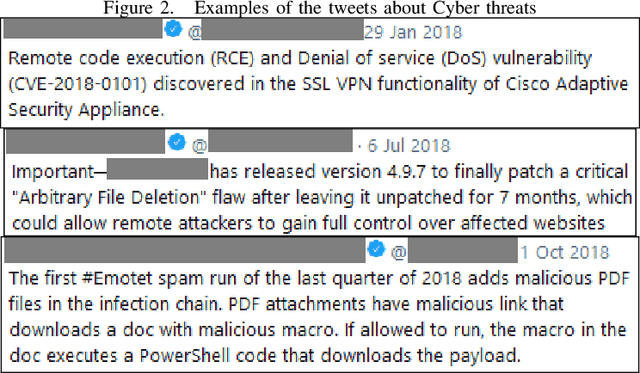

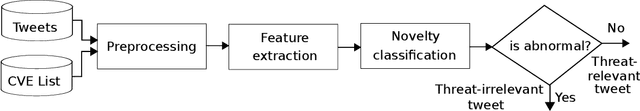

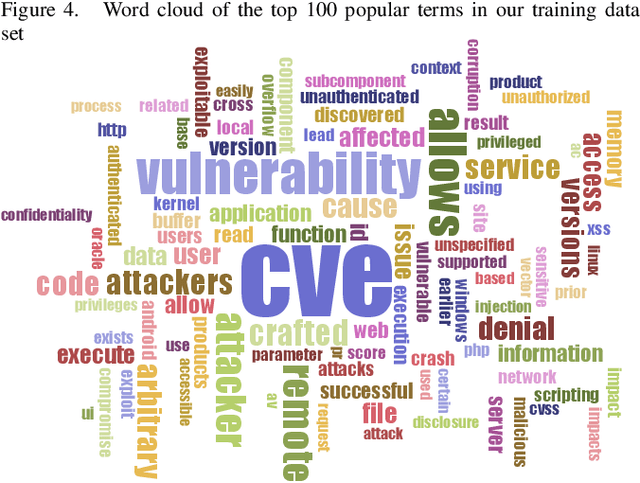

Abstract:Preventing organizations from Cyber exploits needs timely intelligence about Cyber vulnerabilities and attacks, referred as threats. Cyber threat intelligence can be extracted from various sources including social media platforms where users publish the threat information in real time. Gathering Cyber threat intelligence from social media sites is a time consuming task for security analysts that can delay timely response to emerging Cyber threats. We propose a framework for automatically gathering Cyber threat intelligence from Twitter by using a novelty detection model. Our model learns the features of Cyber threat intelligence from the threat descriptions published in public repositories such as Common Vulnerabilities and Exposures (CVE) and classifies a new unseen tweet as either normal or anomalous to Cyber threat intelligence. We evaluate our framework using a purpose-built data set of tweets from 50 influential Cyber security related accounts over twelve months (in 2018). Our classifier achieves the F1-score of 0.643 for classifying Cyber threat tweets and outperforms several baselines including binary classification models. Our analysis of the classification results suggests that Cyber threat relevant tweets on Twitter do not often include the CVE identifier of the related threats. Hence, it would be valuable to collect these tweets and associate them with the related CVE identifier for cyber security applications.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge