Yvan Lucas

Credit card fraud detection using machine learning: A survey

Oct 13, 2020

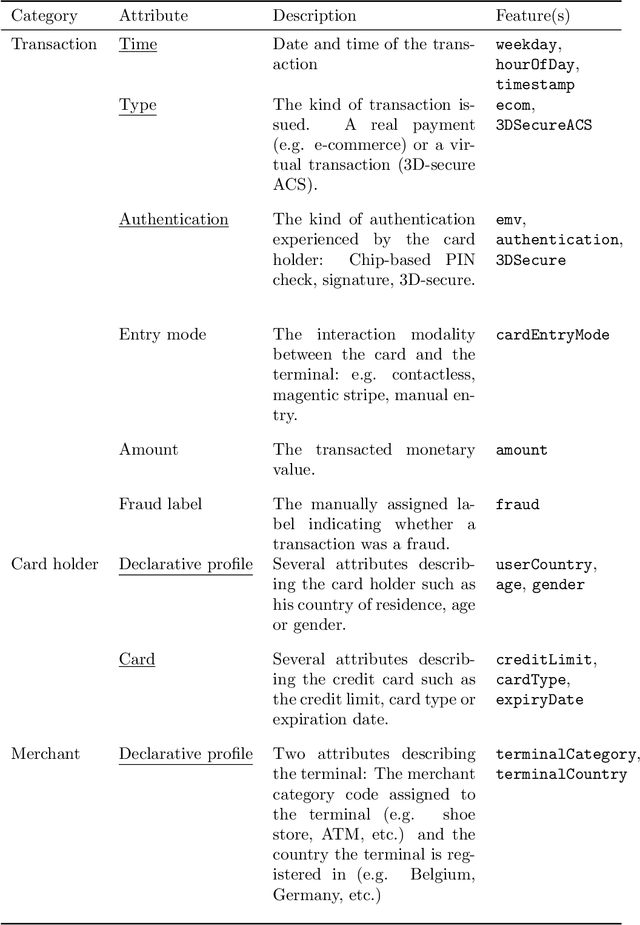

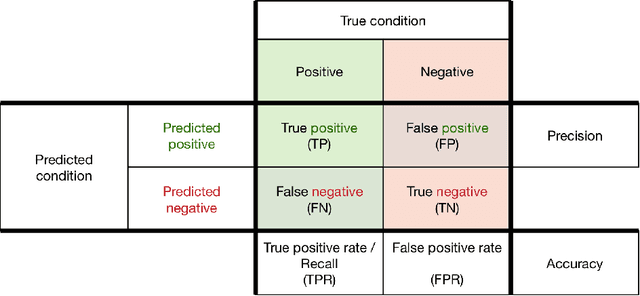

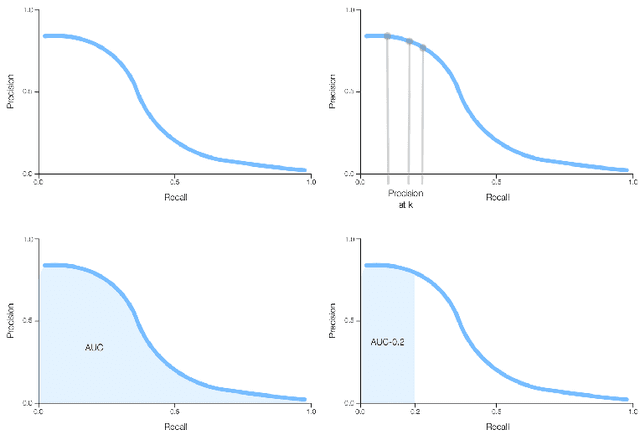

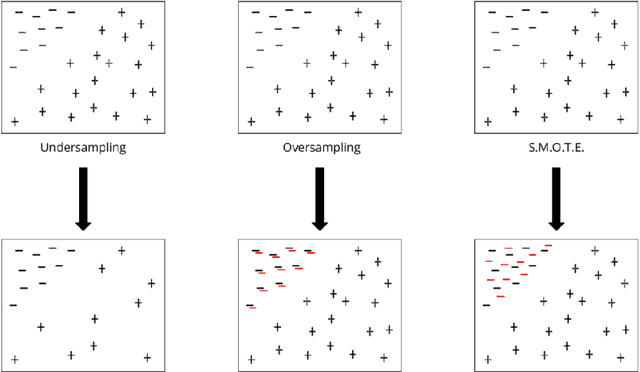

Abstract:Credit card fraud has emerged as major problem in the electronic payment sector. In this survey, we study data-driven credit card fraud detection particularities and several machine learning methods to address each of its intricate challenges with the goal to identify fraudulent transactions that have been issued illegitimately on behalf of the rightful card owner. In particular, we first characterize a typical credit card detection task: the dataset and its attributes, the metric choice along with some methods to handle such unbalanced datasets. These questions are the entry point of every credit card fraud detection problem. Then we focus on dataset shift (sometimes called concept drift), which refers to the fact that the underlying distribution generating the dataset evolves over times: For example, card holders may change their buying habits over seasons and fraudsters may adapt their strategies. This phenomenon may hinder the usage of machine learning methods for real world datasets such as credit card transactions datasets. Afterwards we highlights different approaches used in order to capture the sequential properties of credit card transactions. These approaches range from feature engineering techniques (transactions aggregations for example) to proper sequence modeling methods such as recurrent neural networks (LSTM) or graphical models (hidden markov models).

Towards automated feature engineering for credit card fraud detection using multi-perspective HMMs

Sep 03, 2019

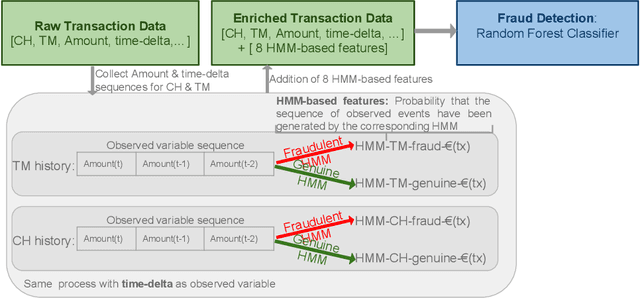

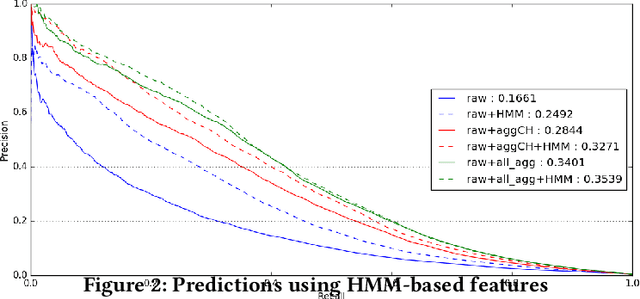

Abstract:Machine learning and data mining techniques have been used extensively in order to detect credit card frauds. However, most studies consider credit card transactions as isolated events and not as a sequence of transactions. In this framework, we model a sequence of credit card transactions from three different perspectives, namely (i) The sequence contains or doesn't contain a fraud (ii) The sequence is obtained by fixing the card-holder or the payment terminal (iii) It is a sequence of spent amount or of elapsed time between the current and previous transactions. Combinations of the three binary perspectives give eight sets of sequences from the (training) set of transactions. Each one of these sequences is modelled with a Hidden Markov Model (HMM). Each HMM associates a likelihood to a transaction given its sequence of previous transactions. These likelihoods are used as additional features in a Random Forest classifier for fraud detection. Our multiple perspectives HMM-based approach offers automated feature engineering to model temporal correlations so as to improve the effectiveness of the classification task and allows for an increase in the detection of fraudulent transactions when combined with the state of the art expert based feature engineering strategy for credit card fraud detection. In extension to previous works, we show that this approach goes beyond ecommerce transactions and provides a robust feature engineering over different datasets, hyperparameters and classifiers. Moreover, we compare strategies to deal with structural missing values.

Dataset shift quantification for credit card fraud detection

Jun 17, 2019

Abstract:Machine learning and data mining techniques have been used extensively in order to detect credit card frauds. However purchase behaviour and fraudster strategies may change over time. This phenomenon is named dataset shift or concept drift in the domain of fraud detection. In this paper, we present a method to quantify day-by-day the dataset shift in our face-to-face credit card transactions dataset (card holder located in the shop) . In practice, we classify the days against each other and measure the efficiency of the classification. The more efficient the classification, the more different the buying behaviour between two days, and vice versa. Therefore, we obtain a distance matrix characterizing the dataset shift. After an agglomerative clustering of the distance matrix, we observe that the dataset shift pattern matches the calendar events for this time period (holidays, week-ends, etc). We then incorporate this dataset shift knowledge in the credit card fraud detection task as a new feature. This leads to a small improvement of the detection.

Multiple perspectives HMM-based feature engineering for credit card fraud detection

May 15, 2019

Abstract:Machine learning and data mining techniques have been used extensively in order to detect credit card frauds. However, most studies consider credit card transactions as isolated events and not as a sequence of transactions. In this article, we model a sequence of credit card transactions from three different perspectives, namely (i) does the sequence contain a Fraud? (ii) Is the sequence obtained by fixing the card-holder or the payment terminal? (iii) Is it a sequence of spent amount or of elapsed time between the current and previous transactions? Combinations of the three binary perspectives give eight sets of sequences from the (training) set of transactions. Each one of these sets is modelled with a Hidden Markov Model (HMM). Each HMM associates a likelihood to a transaction given its sequence of previous transactions. These likelihoods are used as additional features in a Random Forest classifier for fraud detection. This multiple perspectives HMM-based approach enables an automatic feature engineering in order to model the sequential properties of the dataset with respect to the classification task. This strategy allows for a 15% increase in the precision-recall AUC compared to the state of the art feature engineering strategy for credit card fraud detection.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge