Shiqing Long

Advanced Financial Fraud Detection Using GNN-CL Model

Jul 09, 2024

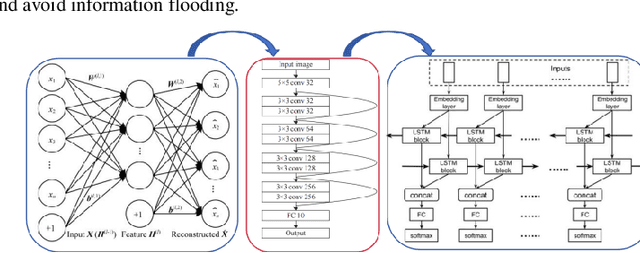

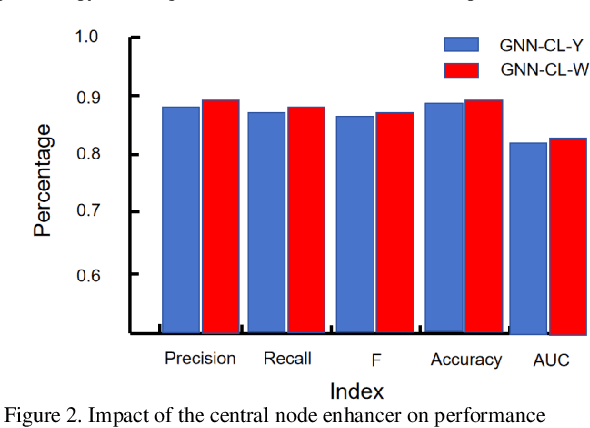

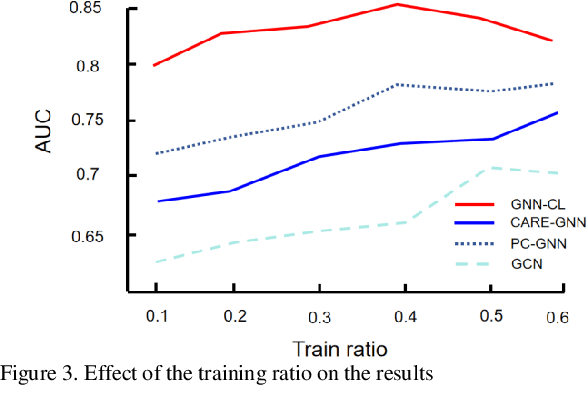

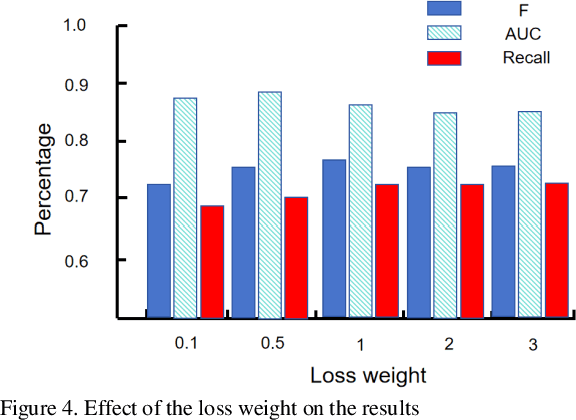

Abstract:The innovative GNN-CL model proposed in this paper marks a breakthrough in the field of financial fraud detection by synergistically combining the advantages of graph neural networks (gnn), convolutional neural networks (cnn) and long short-term memory (LSTM) networks. This convergence enables multifaceted analysis of complex transaction patterns, improving detection accuracy and resilience against complex fraudulent activities. A key novelty of this paper is the use of multilayer perceptrons (MLPS) to estimate node similarity, effectively filtering out neighborhood noise that can lead to false positives. This intelligent purification mechanism ensures that only the most relevant information is considered, thereby improving the model's understanding of the network structure. Feature weakening often plagues graph-based models due to the dilution of key signals. In order to further address the challenge of feature weakening, GNN-CL adopts reinforcement learning strategies. By dynamically adjusting the weights assigned to central nodes, it reinforces the importance of these influential entities to retain important clues of fraud even in less informative data. Experimental evaluations on Yelp datasets show that the results highlight the superior performance of GNN-CL compared to existing methods.

Advancing Financial Risk Prediction Through Optimized LSTM Model Performance and Comparative Analysis

May 31, 2024Abstract:This paper focuses on the application and optimization of LSTM model in financial risk prediction. The study starts with an overview of the architecture and algorithm foundation of LSTM, and then details the model training process and hyperparameter tuning strategy, and adjusts network parameters through experiments to improve performance. Comparative experiments show that the optimized LSTM model shows significant advantages in AUC index compared with random forest, BP neural network and XGBoost, which verifies its efficiency and practicability in the field of financial risk prediction, especially its ability to deal with complex time series data, which lays a solid foundation for the application of the model in the actual production environment.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge