Pasquale De Rosa

On the Cost of Model-Serving Frameworks: An Experimental Evaluation

Nov 15, 2024

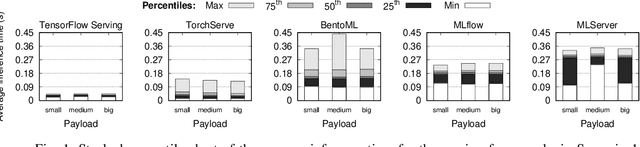

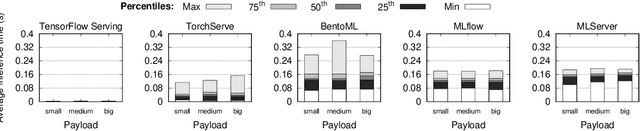

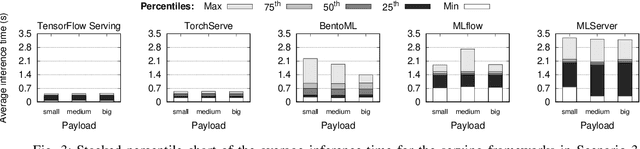

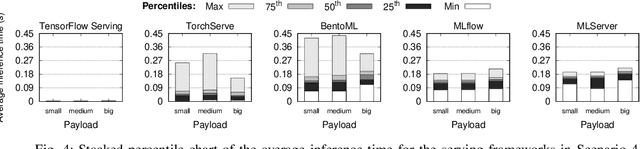

Abstract:In machine learning (ML), the inference phase is the process of applying pre-trained models to new, unseen data with the objective of making predictions. During the inference phase, end-users interact with ML services to gain insights, recommendations, or actions based on the input data. For this reason, serving strategies are nowadays crucial for deploying and managing models in production environments effectively. These strategies ensure that models are available, scalable, reliable, and performant for real-world applications, such as time series forecasting, image classification, natural language processing, and so on. In this paper, we evaluate the performances of five widely-used model serving frameworks (TensorFlow Serving, TorchServe, MLServer, MLflow, and BentoML) under four different scenarios (malware detection, cryptocoin prices forecasting, image classification, and sentiment analysis). We demonstrate that TensorFlow Serving is able to outperform all the other frameworks in serving deep learning (DL) models. Moreover, we show that DL-specific frameworks (TensorFlow Serving and TorchServe) display significantly lower latencies than the three general-purpose ML frameworks (BentoML, MLFlow, and MLServer).

Practical Forecasting of Cryptocoins Timeseries using Correlation Patterns

Sep 05, 2024

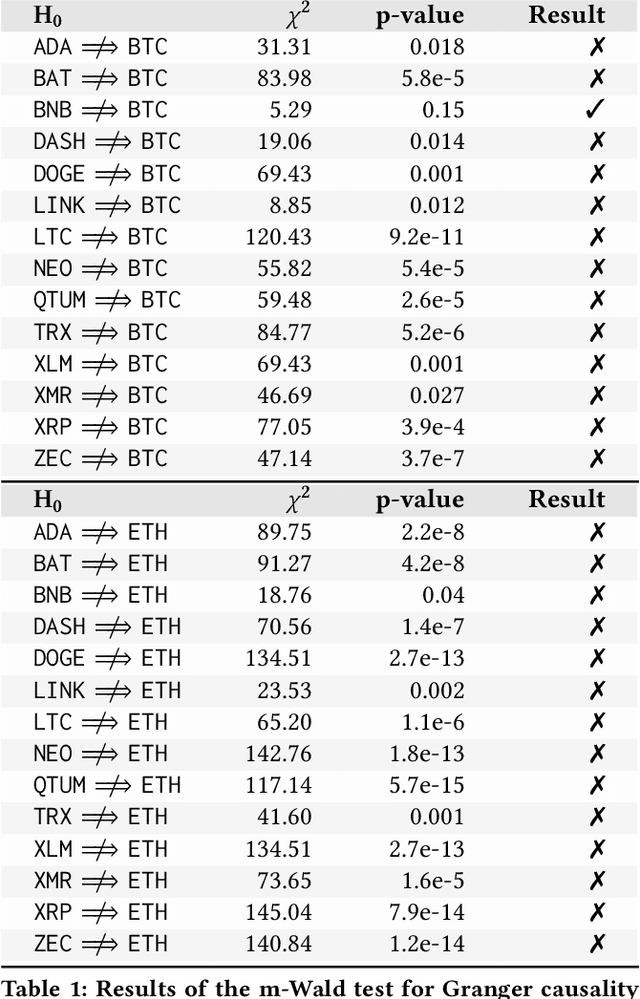

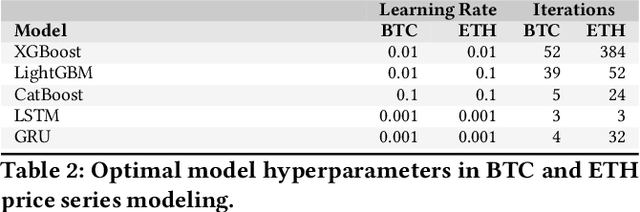

Abstract:Cryptocoins (i.e., Bitcoin, Ether, Litecoin) are tradable digital assets. Ownerships of cryptocoins are registered on distributed ledgers (i.e., blockchains). Secure encryption techniques guarantee the security of the transactions (transfers of coins among owners), registered into the ledger. Cryptocoins are exchanged for specific trading prices. The extreme volatility of such trading prices across all different sets of crypto-assets remains undisputed. However, the relations between the trading prices across different cryptocoins remains largely unexplored. Major coin exchanges indicate trend correlation to advise for sells or buys. However, price correlations remain largely unexplored. We shed some light on the trend correlations across a large variety of cryptocoins, by investigating their coin/price correlation trends over the past two years. We study the causality between the trends, and exploit the derived correlations to understand the accuracy of state-of-the-art forecasting techniques for time series modeling (e.g., GBMs, LSTM and GRU) of correlated cryptocoins. Our evaluation shows (i) strong correlation patterns between the most traded coins (e.g., Bitcoin and Ether) and other types of cryptocurrencies, and (ii) state-of-the-art time series forecasting algorithms can be used to forecast cryptocoins price trends. We released datasets and code to reproduce our analysis to the research community.

Understanding Cryptocoins Trends Correlations

Nov 30, 2022Abstract:Crypto-coins (also known as cryptocurrencies) are tradable digital assets. Notable examples include Bitcoin, Ether and Litecoin. Ownerships of cryptocoins are registered on distributed ledgers (i.e., blockchains). Secure encryption techniques guarantee the security of the transactions (transfers of coins across owners), registered into the ledger. Cryptocoins are exchanged for specific trading prices. While history has shown the extreme volatility of such trading prices across all different sets of crypto-assets, it remains unclear what and if there are tight relations between the trading prices of different cryptocoins. Major coin exchanges (i.e., Coinbase) provide trend correlation indicators to coin owners, suggesting possible acquisitions or sells. However, these correlations remain largely unvalidated. In this paper, we shed lights on the trend correlations across a large variety of cryptocoins, by investigating their coin-price correlation trends over a period of two years. Our experimental results suggest strong correlation patterns between main coins (Ethereum, Bitcoin) and alt-coins. We believe our study can support forecasting techniques for time-series modeling in the context of crypto-coins. We release our dataset and code to reproduce our analysis to the research community.

* 8 pages, 4 figures

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge