Practical Forecasting of Cryptocoins Timeseries using Correlation Patterns

Paper and Code

Sep 05, 2024

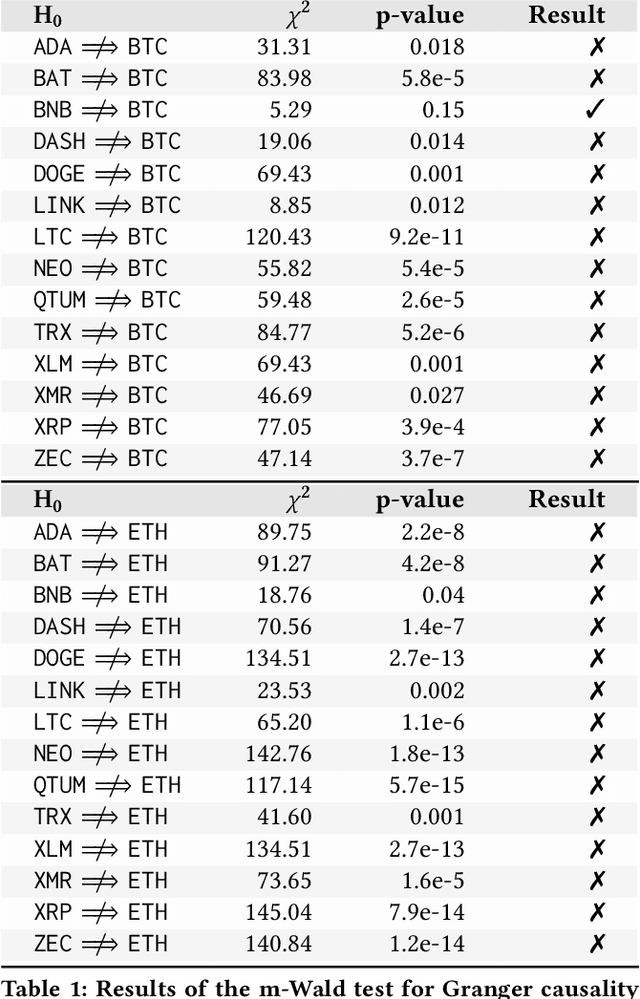

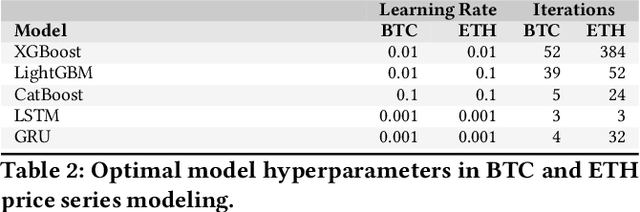

Cryptocoins (i.e., Bitcoin, Ether, Litecoin) are tradable digital assets. Ownerships of cryptocoins are registered on distributed ledgers (i.e., blockchains). Secure encryption techniques guarantee the security of the transactions (transfers of coins among owners), registered into the ledger. Cryptocoins are exchanged for specific trading prices. The extreme volatility of such trading prices across all different sets of crypto-assets remains undisputed. However, the relations between the trading prices across different cryptocoins remains largely unexplored. Major coin exchanges indicate trend correlation to advise for sells or buys. However, price correlations remain largely unexplored. We shed some light on the trend correlations across a large variety of cryptocoins, by investigating their coin/price correlation trends over the past two years. We study the causality between the trends, and exploit the derived correlations to understand the accuracy of state-of-the-art forecasting techniques for time series modeling (e.g., GBMs, LSTM and GRU) of correlated cryptocoins. Our evaluation shows (i) strong correlation patterns between the most traded coins (e.g., Bitcoin and Ether) and other types of cryptocurrencies, and (ii) state-of-the-art time series forecasting algorithms can be used to forecast cryptocoins price trends. We released datasets and code to reproduce our analysis to the research community.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge