Ori Plonsky

Predicting Human Choice Between Textually Described Lotteries

Mar 18, 2025Abstract:Predicting human decision-making under risk and uncertainty is a long-standing challenge in cognitive science, economics, and AI. While prior research has focused on numerically described lotteries, real-world decisions often rely on textual descriptions. This study conducts the first large-scale exploration of human decision-making in such tasks using a large dataset of one-shot binary choices between textually described lotteries. We evaluate multiple computational approaches, including fine-tuning Large Language Models (LLMs), leveraging embeddings, and integrating behavioral theories of choice under risk. Our results show that fine-tuned LLMs, specifically RoBERTa and GPT-4o outperform hybrid models that incorporate behavioral theory, challenging established methods in numerical settings. These findings highlight fundamental differences in how textual and numerical information influence decision-making and underscore the need for new modeling strategies to bridge this gap.

LLM Agents Display Human Biases but Exhibit Distinct Learning Patterns

Mar 13, 2025Abstract:We investigate the choice patterns of Large Language Models (LLMs) in the context of Decisions from Experience tasks that involve repeated choice and learning from feedback, and compare their behavior to human participants. We find that on the aggregate, LLMs appear to display behavioral biases similar to humans: both exhibit underweighting rare events and correlation effects. However, more nuanced analyses of the choice patterns reveal that this happens for very different reasons. LLMs exhibit strong recency biases, unlike humans, who appear to respond in more sophisticated ways. While these different processes may lead to similar behavior on average, choice patterns contingent on recent events differ vastly between the two groups. Specifically, phenomena such as ``surprise triggers change" and the ``wavy recency effect of rare events" are robustly observed in humans, but entirely absent in LLMs. Our findings provide insights into the limitations of using LLMs to simulate and predict humans in learning environments and highlight the need for refined analyses of their behavior when investigating whether they replicate human decision making tendencies.

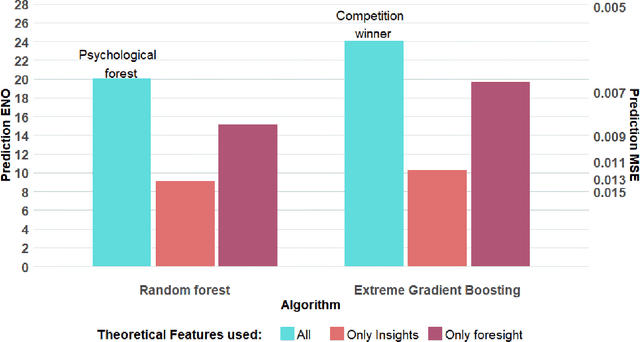

Predicting human decisions with behavioral theories and machine learning

Apr 15, 2019

Abstract:Behavioral decision theories aim to explain human behavior. Can they help predict it? An open tournament for prediction of human choices in fundamental economic decision tasks is presented. The results suggest that integration of certain behavioral theories as features in machine learning systems provides the best predictions. Surprisingly, the most useful theories for prediction build on basic properties of human and animal learning and are very different from mainstream decision theories that focus on deviations from rational choice. Moreover, we find that theoretical features should be based not only on qualitative behavioral insights (e.g. loss aversion), but also on quantitative behavioral foresights generated by functional descriptive models (e.g. Prospect Theory). Our analysis prescribes a recipe for derivation of explainable, useful predictions of human decisions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge