Ningkun Zheng

Energy Storage Arbitrage in Two-settlement Markets: A Transformer-Based Approach

Apr 26, 2024Abstract:This paper presents an integrated model for bidding energy storage in day-ahead and real-time markets to maximize profits. We show that in integrated two-stage bidding, the real-time bids are independent of day-ahead settlements, while the day-ahead bids should be based on predicted real-time prices. We utilize a transformer-based model for real-time price prediction, which captures complex dynamical patterns of real-time prices, and use the result for day-ahead bidding design. For real-time bidding, we utilize a long short-term memory-dynamic programming hybrid real-time bidding model. We train and test our model with historical data from New York State, and our results showed that the integrated system achieved promising results of almost a 20\% increase in profit compared to only bidding in real-time markets, and at the same time reducing the risk in terms of the number of days with negative profits.

Transferable Energy Storage Bidder

Jan 02, 2023

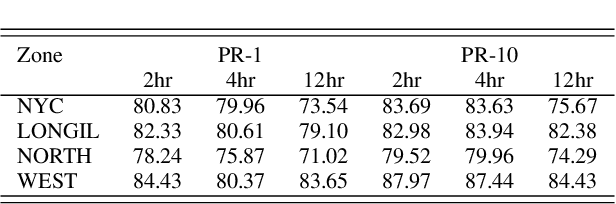

Abstract:Energy storage resources must consider both price uncertainties and their physical operating characteristics when participating in wholesale electricity markets. This is a challenging problem as electricity prices are highly volatile, and energy storage has efficiency losses, power, and energy constraints. This paper presents a novel, versatile, and transferable approach combining model-based optimization with a convolutional long short-term memory network for energy storage to respond to or bid into wholesale electricity markets. We apply transfer learning to the ConvLSTM network to quickly adapt the trained bidding model to new market environments. We test our proposed approach using historical prices from New York State, showing it achieves state-of-the-art results, achieving between 70% to near 90% profit ratio compared to perfect foresight cases, in both price response and wholesale market bidding setting with various energy storage durations. We also test a transfer learning approach by pre-training the bidding model using New York data and applying it to arbitrage in Queensland, Australia. The result shows transfer learning achieves exceptional arbitrage profitability with as little as three days of local training data, demonstrating its significant advantage over training from scratch in scenarios with very limited data availability.

Energy Storage Price Arbitrage via Opportunity Value Function Prediction

Nov 20, 2022

Abstract:This paper proposes a novel energy storage price arbitrage algorithm combining supervised learning with dynamic programming. The proposed approach uses a neural network to directly predicts the opportunity cost at different energy storage state-of-charge levels, and then input the predicted opportunity cost into a model-based arbitrage control algorithm for optimal decisions. We generate the historical optimal opportunity value function using price data and a dynamic programming algorithm, then use it as the ground truth and historical price as predictors to train the opportunity value function prediction model. Our method achieves 65% to 90% profit compared to perfect foresight in case studies using different energy storage models and price data from New York State, which significantly outperforms existing model-based and learning-based methods. While guaranteeing high profitability, the algorithm is also light-weighted and can be trained and implemented with minimal computational cost. Our results also show that the learned prediction model has excellent transferability. The prediction model trained using price data from one region also provides good arbitrage results when tested over other regions.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge