Transferable Energy Storage Bidder

Paper and Code

Jan 02, 2023

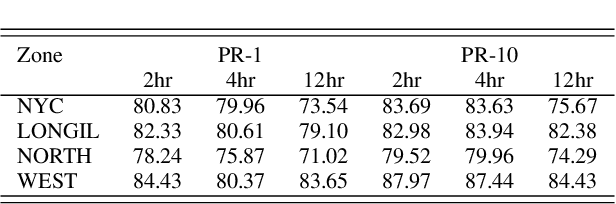

Energy storage resources must consider both price uncertainties and their physical operating characteristics when participating in wholesale electricity markets. This is a challenging problem as electricity prices are highly volatile, and energy storage has efficiency losses, power, and energy constraints. This paper presents a novel, versatile, and transferable approach combining model-based optimization with a convolutional long short-term memory network for energy storage to respond to or bid into wholesale electricity markets. We apply transfer learning to the ConvLSTM network to quickly adapt the trained bidding model to new market environments. We test our proposed approach using historical prices from New York State, showing it achieves state-of-the-art results, achieving between 70% to near 90% profit ratio compared to perfect foresight cases, in both price response and wholesale market bidding setting with various energy storage durations. We also test a transfer learning approach by pre-training the bidding model using New York data and applying it to arbitrage in Queensland, Australia. The result shows transfer learning achieves exceptional arbitrage profitability with as little as three days of local training data, demonstrating its significant advantage over training from scratch in scenarios with very limited data availability.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge