Muhua Xu

Identifying Money Laundering Subgraphs on the Blockchain

Oct 10, 2024

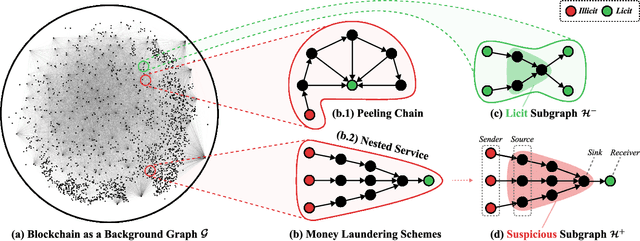

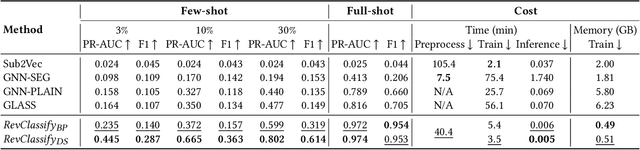

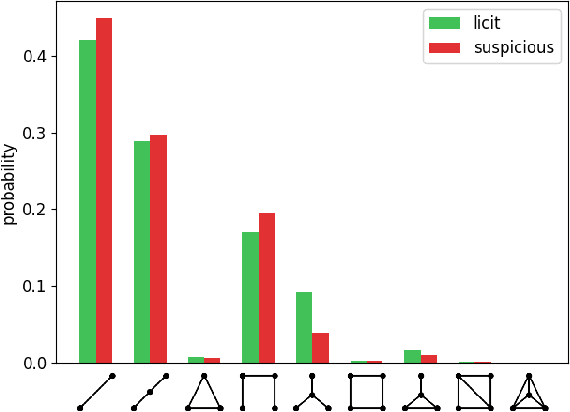

Abstract:Anti-Money Laundering (AML) involves the identification of money laundering crimes in financial activities, such as cryptocurrency transactions. Recent studies advanced AML through the lens of graph-based machine learning, modeling the web of financial transactions as a graph and developing graph methods to identify suspicious activities. For instance, a recent effort on opensourcing datasets and benchmarks, Elliptic2, treats a set of Bitcoin addresses, considered to be controlled by the same entity, as a graph node and transactions among entities as graph edges. This modeling reveals the "shape" of a money laundering scheme - a subgraph on the blockchain. Despite the attractive subgraph classification results benchmarked by the paper, competitive methods remain expensive to apply due to the massive size of the graph; moreover, existing methods require candidate subgraphs as inputs which may not be available in practice. In this work, we introduce RevTrack, a graph-based framework that enables large-scale AML analysis with a lower cost and a higher accuracy. The key idea is to track the initial senders and the final receivers of funds; these entities offer a strong indication of the nature (licit vs. suspicious) of their respective subgraph. Based on this framework, we propose RevClassify, which is a neural network model for subgraph classification. Additionally, we address the practical problem where subgraph candidates are not given, by proposing RevFilter. This method identifies new suspicious subgraphs by iteratively filtering licit transactions, using RevClassify. Benchmarking these methods on Elliptic2, a new standard for AML, we show that RevClassify outperforms state-of-the-art subgraph classification techniques in both cost and accuracy. Furthermore, we demonstrate the effectiveness of RevFilter in discovering new suspicious subgraphs, confirming its utility for practical AML.

The Shape of Money Laundering: Subgraph Representation Learning on the Blockchain with the Elliptic2 Dataset

May 01, 2024

Abstract:Subgraph representation learning is a technique for analyzing local structures (or shapes) within complex networks. Enabled by recent developments in scalable Graph Neural Networks (GNNs), this approach encodes relational information at a subgroup level (multiple connected nodes) rather than at a node level of abstraction. We posit that certain domain applications, such as anti-money laundering (AML), are inherently subgraph problems and mainstream graph techniques have been operating at a suboptimal level of abstraction. This is due in part to the scarcity of annotated datasets of real-world size and complexity, as well as the lack of software tools for managing subgraph GNN workflows at scale. To enable work in fundamental algorithms as well as domain applications in AML and beyond, we introduce Elliptic2, a large graph dataset containing 122K labeled subgraphs of Bitcoin clusters within a background graph consisting of 49M node clusters and 196M edge transactions. The dataset provides subgraphs known to be linked to illicit activity for learning the set of "shapes" that money laundering exhibits in cryptocurrency and accurately classifying new criminal activity. Along with the dataset we share our graph techniques, software tooling, promising early experimental results, and new domain insights already gleaned from this approach. Taken together, we find immediate practical value in this approach and the potential for a new standard in anti-money laundering and forensic analytics in cryptocurrencies and other financial networks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge