Michael Pfarrhofer

Asymmetries in Financial Spillovers

Oct 21, 2024Abstract:This paper analyzes nonlinearities in the international transmission of financial shocks originating in the US. To do so, we develop a flexible nonlinear multi-country model. Our framework is capable of producing asymmetries in the responses to financial shocks for shock size and sign, and over time. We show that international reactions to US-based financial shocks are asymmetric along these dimensions. Particularly, we find that adverse shocks trigger stronger declines in output, inflation, and stock markets than benign shocks. Further, we investigate time variation in the estimated dynamic effects and characterize the responsiveness of three major central banks to financial shocks.

Nowcasting with mixed frequency data using Gaussian processes

Feb 16, 2024Abstract:We propose and discuss Bayesian machine learning methods for mixed data sampling (MIDAS) regressions. This involves handling frequency mismatches with restricted and unrestricted MIDAS variants and specifying functional relationships between many predictors and the dependent variable. We use Gaussian processes (GP) and Bayesian additive regression trees (BART) as flexible extensions to linear penalized estimation. In a nowcasting and forecasting exercise we focus on quarterly US output growth and inflation in the GDP deflator. The new models leverage macroeconomic Big Data in a computationally efficient way and offer gains in predictive accuracy along several dimensions.

Approximate Bayesian inference and forecasting in huge-dimensional multi-country VARs

Mar 08, 2021

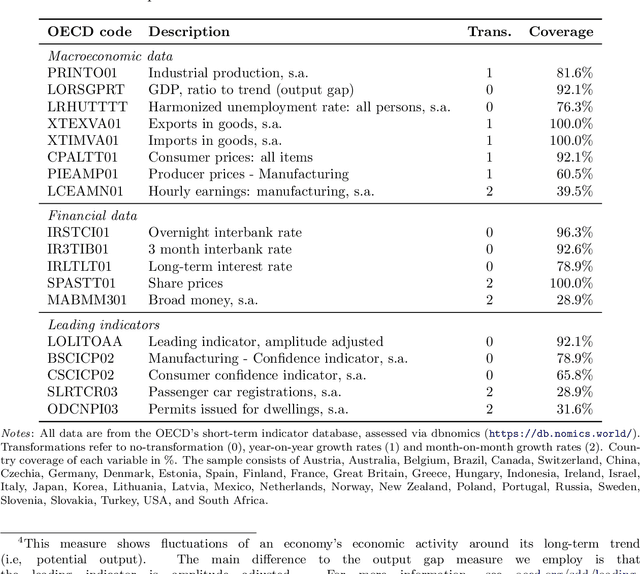

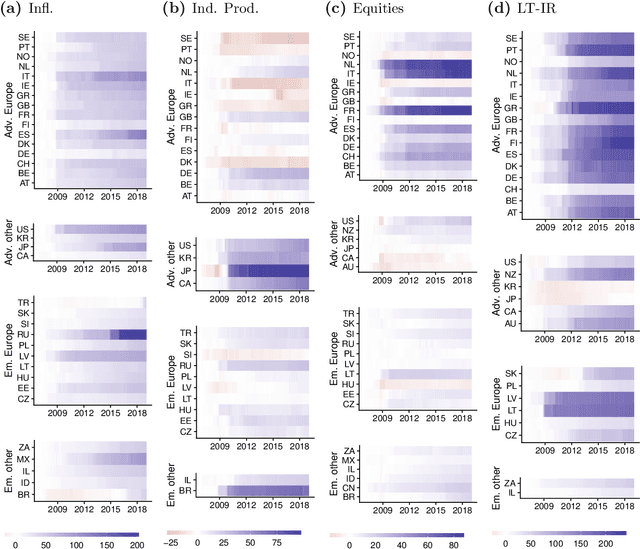

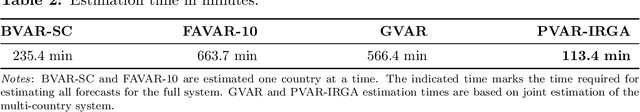

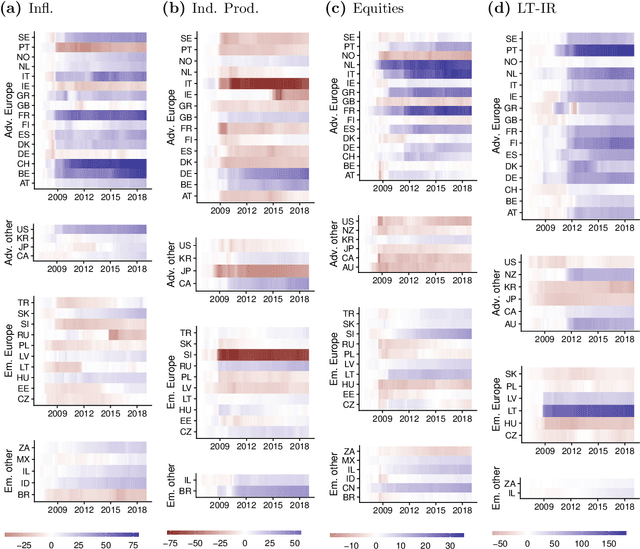

Abstract:The Panel Vector Autoregressive (PVAR) model is a popular tool for macroeconomic forecasting and structural analysis in multi-country applications since it allows for spillovers between countries in a very flexible fashion. However, this flexibility means that the number of parameters to be estimated can be enormous leading to over-parameterization concerns. Bayesian global-local shrinkage priors, such as the Horseshoe prior used in this paper, can overcome these concerns, but they require the use of Markov Chain Monte Carlo (MCMC) methods rendering them computationally infeasible in high dimensions. In this paper, we develop computationally efficient Bayesian methods for estimating PVARs using an integrated rotated Gaussian approximation (IRGA). This exploits the fact that whereas own country information is often important in PVARs, information on other countries is often unimportant. Using an IRGA, we split the the posterior into two parts: one involving own country coefficients, the other involving other country coefficients. Fast methods such as approximate message passing or variational Bayes can be used on the latter and, conditional on these, the former are estimated with precision using MCMC methods. In a forecasting exercise involving PVARs with up to $18$ variables for each of $38$ countries, we demonstrate that our methods produce good forecasts quickly.

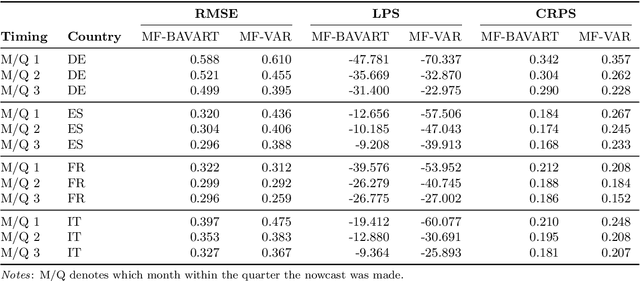

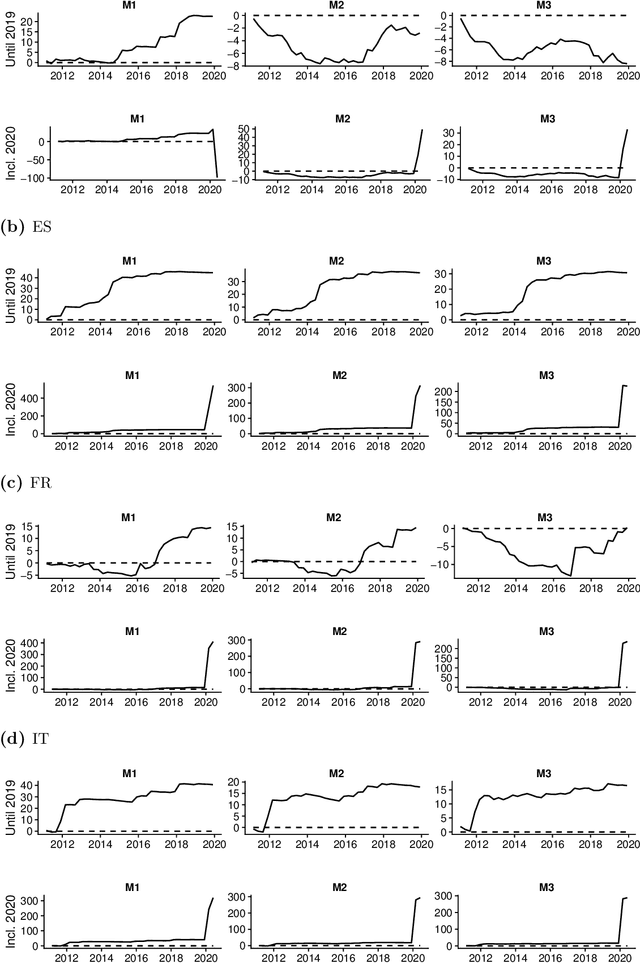

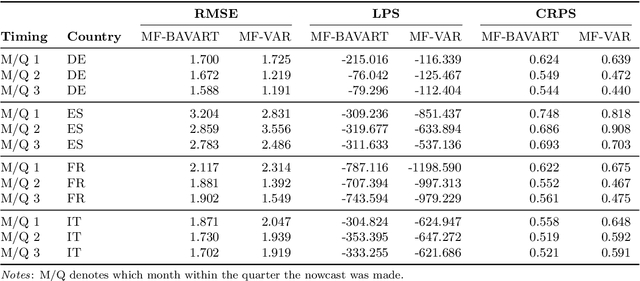

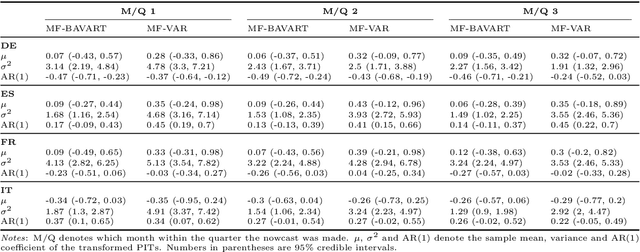

Nowcasting in a Pandemic using Non-Parametric Mixed Frequency VARs

Sep 08, 2020

Abstract:This paper develops Bayesian econometric methods for posterior and predictive inference in a non-parametric mixed frequency VAR using additive regression trees. We argue that regression tree models are ideally suited for macroeconomic nowcasting in the face of the extreme observations produced by the pandemic due to their flexibility and ability to model outliers. In a nowcasting application involving four major countries in the European Union, we find substantial improvements in nowcasting performance relative to a linear mixed frequency VAR. A detailed examination of the predictive densities in the first six months of 2020 shows where these improvements are achieved.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge