Massimiliano Marcellino

Asymmetries in Financial Spillovers

Oct 21, 2024Abstract:This paper analyzes nonlinearities in the international transmission of financial shocks originating in the US. To do so, we develop a flexible nonlinear multi-country model. Our framework is capable of producing asymmetries in the responses to financial shocks for shock size and sign, and over time. We show that international reactions to US-based financial shocks are asymmetric along these dimensions. Particularly, we find that adverse shocks trigger stronger declines in output, inflation, and stock markets than benign shocks. Further, we investigate time variation in the estimated dynamic effects and characterize the responsiveness of three major central banks to financial shocks.

Nowcasting with mixed frequency data using Gaussian processes

Feb 16, 2024Abstract:We propose and discuss Bayesian machine learning methods for mixed data sampling (MIDAS) regressions. This involves handling frequency mismatches with restricted and unrestricted MIDAS variants and specifying functional relationships between many predictors and the dependent variable. We use Gaussian processes (GP) and Bayesian additive regression trees (BART) as flexible extensions to linear penalized estimation. In a nowcasting and forecasting exercise we focus on quarterly US output growth and inflation in the GDP deflator. The new models leverage macroeconomic Big Data in a computationally efficient way and offer gains in predictive accuracy along several dimensions.

Enhanced Bayesian Neural Networks for Macroeconomics and Finance

Nov 10, 2022Abstract:We develop Bayesian neural networks (BNNs) that permit to model generic nonlinearities and time variation for (possibly large sets of) macroeconomic and financial variables. From a methodological point of view, we allow for a general specification of networks that can be applied to either dense or sparse datasets, and combines various activation functions, a possibly very large number of neurons, and stochastic volatility (SV) for the error term. From a computational point of view, we develop fast and efficient estimation algorithms for the general BNNs we introduce. From an empirical point of view, we show both with simulated data and with a set of common macro and financial applications that our BNNs can be of practical use, particularly so for observations in the tails of the cross-sectional or time series distributions of the target variables.

Can Machine Learning Catch the COVID-19 Recession?

Mar 01, 2021

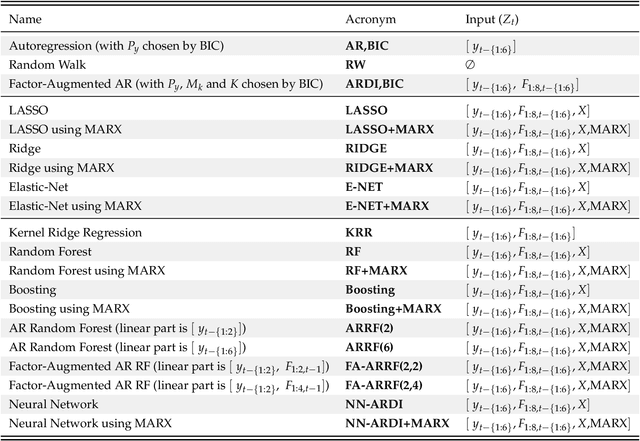

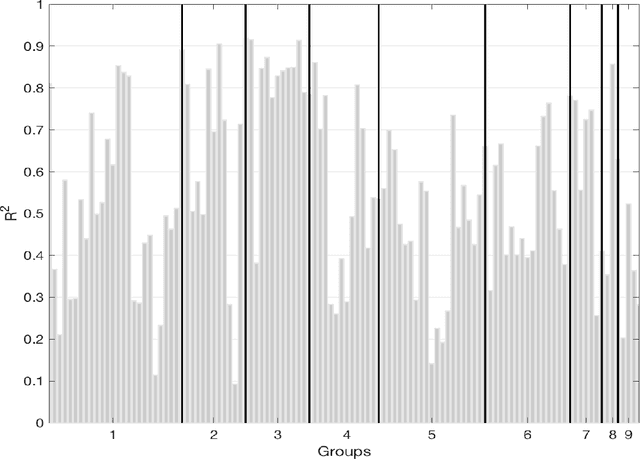

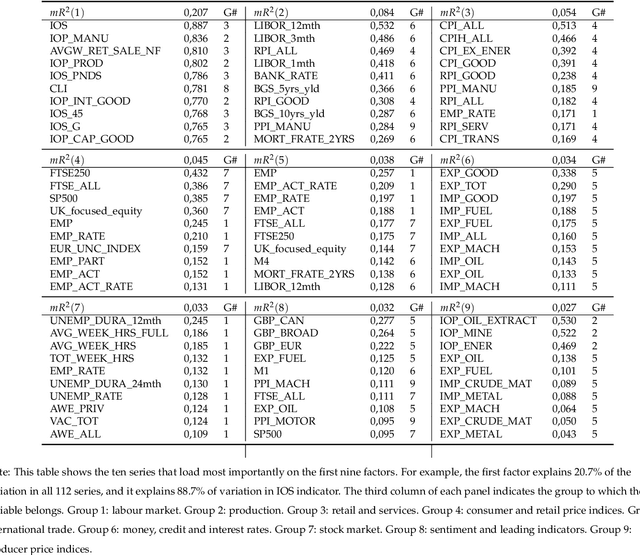

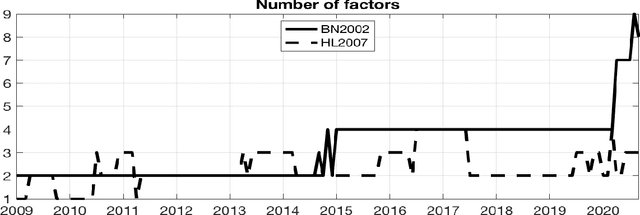

Abstract:Based on evidence gathered from a newly built large macroeconomic data set for the UK, labeled UK-MD and comparable to similar datasets for the US and Canada, it seems the most promising avenue for forecasting during the pandemic is to allow for general forms of nonlinearity by using machine learning (ML) methods. But not all nonlinear ML methods are alike. For instance, some do not allow to extrapolate (like regular trees and forests) and some do (when complemented with linear dynamic components). This and other crucial aspects of ML-based forecasting in unprecedented times are studied in an extensive pseudo-out-of-sample exercise.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge