Lidia Mangu

Model-based Reinforcement Learning for Predictions and Control for Limit Order Books

Oct 09, 2019

Abstract:We build a profitable electronic trading agent with Reinforcement Learning that places buy and sell orders in the stock market. An environment model is built only with historical observational data, and the RL agent learns the trading policy by interacting with the environment model instead of with the real-market to minimize the risk and potential monetary loss. Trained in unsupervised and self-supervised fashion, our environment model learned a temporal and causal representation of the market in latent space through deep neural networks. We demonstrate that the trading policy trained entirely within the environment model can be transferred back into the real market and maintain its profitability. We believe that this environment model can serve as a robust simulator that predicts market movement as well as trade impact for further studies.

Sensitivity based Neural Networks Explanations

Dec 03, 2018

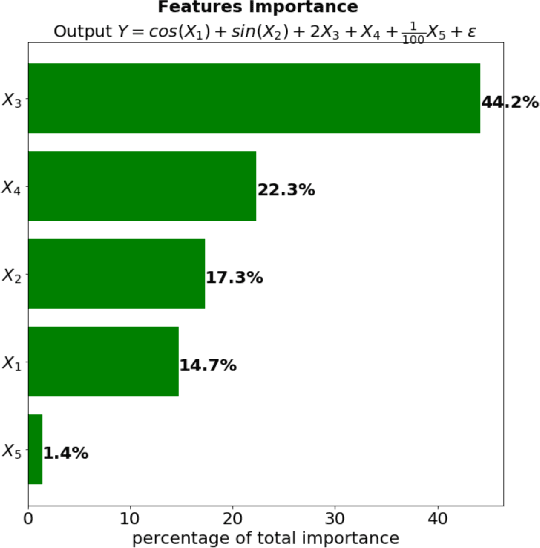

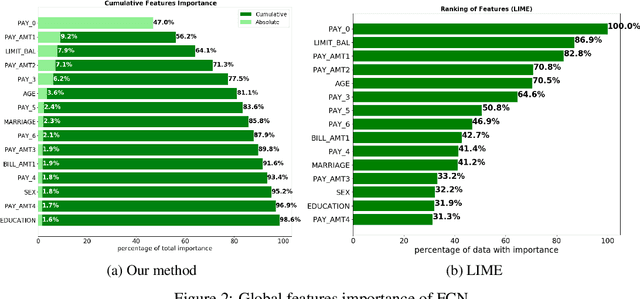

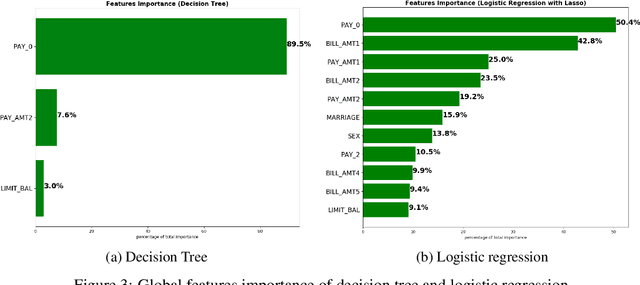

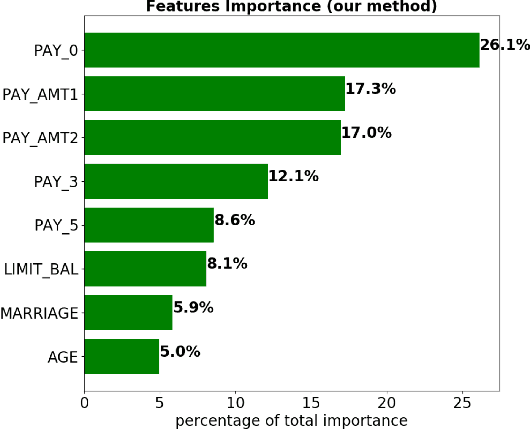

Abstract:Although neural networks can achieve very high predictive performance on various different tasks such as image recognition or natural language processing, they are often considered as opaque "black boxes". The difficulty of interpreting the predictions of a neural network often prevents its use in fields where explainability is important, such as the financial industry where regulators and auditors often insist on this aspect. In this paper, we present a way to assess the relative input features importance of a neural network based on the sensitivity of the model output with respect to its input. This method has the advantage of being fast to compute, it can provide both global and local levels of explanations and is applicable for many types of neural network architectures. We illustrate the performance of this method on both synthetic and real data and compare it with other interpretation techniques. This method is implemented into an open-source Python package that allows its users to easily generate and visualize explanations for their neural networks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge