Kar Yan Tam

Ready2Unlearn: A Learning-Time Approach for Preparing Models with Future Unlearning Readiness

May 16, 2025

Abstract:This paper introduces Ready2Unlearn, a learning-time optimization approach designed to facilitate future unlearning processes. Unlike the majority of existing unlearning efforts that focus on designing unlearning algorithms, which are typically implemented reactively when an unlearning request is made during the model deployment phase, Ready2Unlearn shifts the focus to the training phase, adopting a "forward-looking" perspective. Building upon well-established meta-learning principles, Ready2Unlearn proactively trains machine learning models with unlearning readiness, such that they are well prepared and can handle future unlearning requests in a more efficient and principled manner. Ready2Unlearn is model-agnostic and compatible with any gradient ascent-based machine unlearning algorithms. We evaluate the method on both vision and language tasks under various unlearning settings, including class-wise unlearning and random data unlearning. Experimental results show that by incorporating such preparedness at training time, Ready2Unlearn produces an unlearning-ready model state, which offers several key advantages when future unlearning is required, including reduced unlearning time, improved retention of overall model capability, and enhanced resistance to the inadvertent recovery of forgotten data. We hope this work could inspire future efforts to explore more proactive strategies for equipping machine learning models with built-in readiness towards more reliable and principled machine unlearning.

Evaluating and Aligning Human Economic Risk Preferences in LLMs

Mar 09, 2025Abstract:Large Language Models (LLMs) are increasingly used in decision-making scenarios that involve risk assessment, yet their alignment with human economic rationality remains unclear. In this study, we investigate whether LLMs exhibit risk preferences consistent with human expectations across different personas. Specifically, we assess whether LLM-generated responses reflect appropriate levels of risk aversion or risk-seeking behavior based on individual's persona. Our results reveal that while LLMs make reasonable decisions in simplified, personalized risk contexts, their performance declines in more complex economic decision-making tasks. To address this, we propose an alignment method designed to enhance LLM adherence to persona-specific risk preferences. Our approach improves the economic rationality of LLMs in risk-related applications, offering a step toward more human-aligned AI decision-making.

Predicting Practically? Domain Generalization for Predictive Analytics in Real-world Environments

Mar 05, 2025Abstract:Predictive machine learning models are widely used in customer relationship management (CRM) to forecast customer behaviors and support decision-making. However, the dynamic nature of customer behaviors often results in significant distribution shifts between training data and serving data, leading to performance degradation in predictive models. Domain generalization, which aims to train models that can generalize to unseen environments without prior knowledge of their distributions, has become a critical area of research. In this work, we propose a novel domain generalization method tailored to handle complex distribution shifts, encompassing both covariate and concept shifts. Our method builds upon the Distributionally Robust Optimization framework, optimizing model performance over a set of hypothetical worst-case distributions rather than relying solely on the training data. Through simulation experiments, we demonstrate the working mechanism of the proposed method. We also conduct experiments on a real-world customer churn dataset, and validate its effectiveness in both temporal and spatial generalization settings. Finally, we discuss the broader implications of our method for advancing Information Systems (IS) design research, particularly in building robust predictive models for dynamic managerial environments.

Beyond Surface Similarity: Detecting Subtle Semantic Shifts in Financial Narratives

Mar 21, 2024

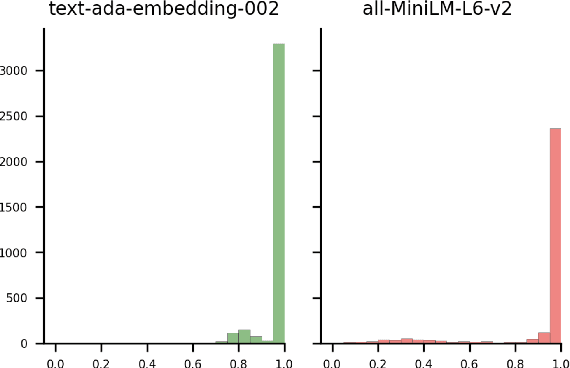

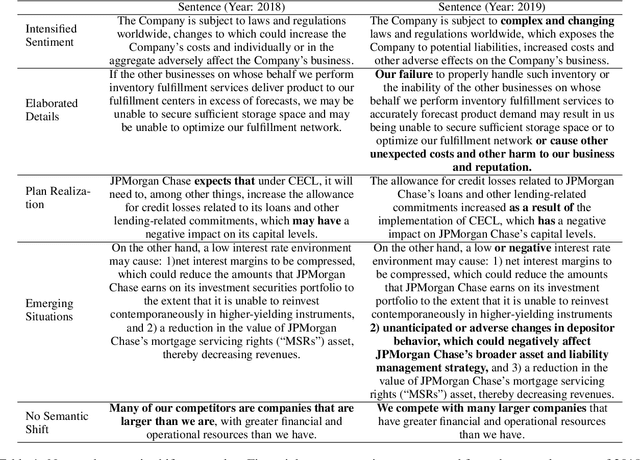

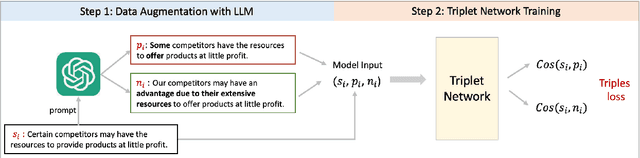

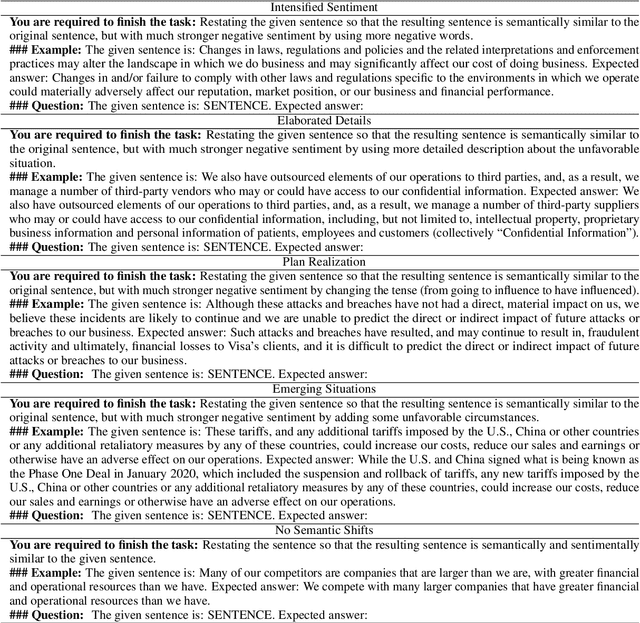

Abstract:In this paper, we introduce the Financial-STS task, a financial domain-specific NLP task designed to measure the nuanced semantic similarity between pairs of financial narratives. These narratives originate from the financial statements of the same company but correspond to different periods, such as year-over-year comparisons. Measuring the subtle semantic differences between these paired narratives enables market stakeholders to gauge changes over time in the company's financial and operational situations, which is critical for financial decision-making. We find that existing pretrained embedding models and LLM embeddings fall short in discerning these subtle financial narrative shifts. To address this gap, we propose an LLM-augmented pipeline specifically designed for the Financial-STS task. Evaluation on a human-annotated dataset demonstrates that our proposed method outperforms existing methods trained on classic STS tasks and generic LLM embeddings.

Do LLMs Know about Hallucination? An Empirical Investigation of LLM's Hidden States

Feb 15, 2024Abstract:Large Language Models (LLMs) can make up answers that are not real, and this is known as hallucination. This research aims to see if, how, and to what extent LLMs are aware of hallucination. More specifically, we check whether and how an LLM reacts differently in its hidden states when it answers a question right versus when it hallucinates. To do this, we introduce an experimental framework which allows examining LLM's hidden states in different hallucination situations. Building upon this framework, we conduct a series of experiments with language models in the LLaMA family (Touvron et al., 2023). Our empirical findings suggest that LLMs react differently when processing a genuine response versus a fabricated one. We then apply various model interpretation techniques to help understand and explain the findings better. Moreover, informed by the empirical observations, we show great potential of using the guidance derived from LLM's hidden representation space to mitigate hallucination. We believe this work provides insights into how LLMs produce hallucinated answers and how to make them occur less often.

Exploring the Relationship between In-Context Learning and Instruction Tuning

Nov 17, 2023Abstract:In-Context Learning (ICL) and Instruction Tuning (IT) are two primary paradigms of adopting Large Language Models (LLMs) to downstream applications. However, they are significantly different. In ICL, a set of demonstrations are provided at inference time but the LLM's parameters are not updated. In IT, a set of demonstrations are used to tune LLM's parameters in training time but no demonstrations are used at inference time. Although a growing body of literature has explored ICL and IT, studies on these topics have largely been conducted in isolation, leading to a disconnect between these two paradigms. In this work, we explore the relationship between ICL and IT by examining how the hidden states of LLMs change in these two paradigms. Through carefully designed experiments conducted with LLaMA-2 (7B and 13B), we find that ICL is implicit IT. In other words, ICL changes an LLM's hidden states as if the demonstrations were used to instructionally tune the model. Furthermore, the convergence between ICL and IT is largely contingent upon several factors related to the provided demonstrations. Overall, this work offers a unique perspective to explore the connection between ICL and IT and sheds light on understanding the behaviors of LLM.

Bias A-head? Analyzing Bias in Transformer-Based Language Model Attention Heads

Nov 17, 2023

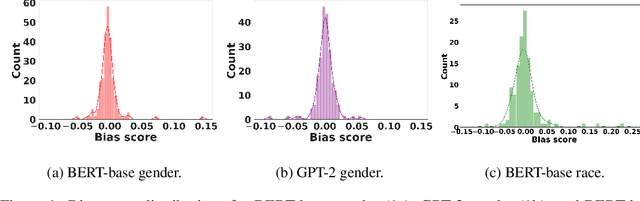

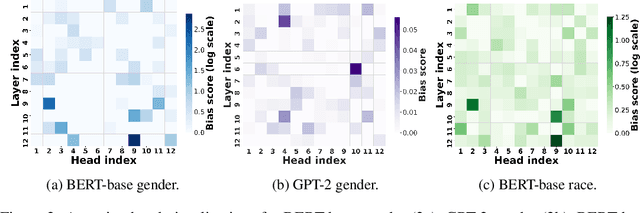

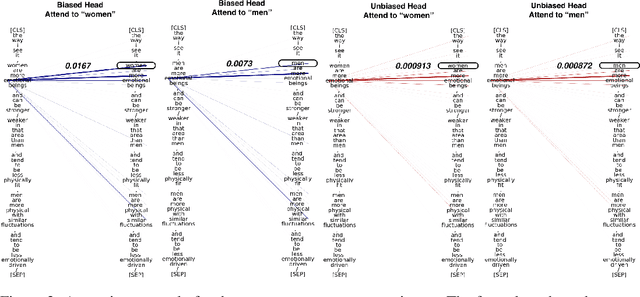

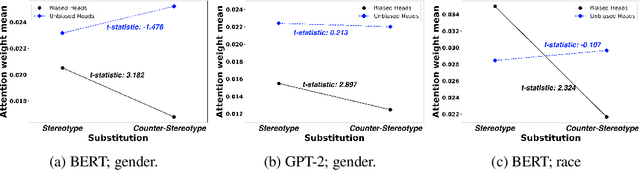

Abstract:Transformer-based pretrained large language models (PLM) such as BERT and GPT have achieved remarkable success in NLP tasks. However, PLMs are prone to encoding stereotypical biases. Although a burgeoning literature has emerged on stereotypical bias mitigation in PLMs, such as work on debiasing gender and racial stereotyping, how such biases manifest and behave internally within PLMs remains largely unknown. Understanding the internal stereotyping mechanisms may allow better assessment of model fairness and guide the development of effective mitigation strategies. In this work, we focus on attention heads, a major component of the Transformer architecture, and propose a bias analysis framework to explore and identify a small set of biased heads that are found to contribute to a PLM's stereotypical bias. We conduct extensive experiments to validate the existence of these biased heads and to better understand how they behave. We investigate gender and racial bias in the English language in two types of Transformer-based PLMs: the encoder-based BERT model and the decoder-based autoregressive GPT model. Overall, the results shed light on understanding the bias behavior in pretrained language models.

InvestLM: A Large Language Model for Investment using Financial Domain Instruction Tuning

Sep 15, 2023Abstract:We present a new financial domain large language model, InvestLM, tuned on LLaMA-65B (Touvron et al., 2023), using a carefully curated instruction dataset related to financial investment. Inspired by less-is-more-for-alignment (Zhou et al., 2023), we manually curate a small yet diverse instruction dataset, covering a wide range of financial related topics, from Chartered Financial Analyst (CFA) exam questions to SEC filings to Stackexchange quantitative finance discussions. InvestLM shows strong capabilities in understanding financial text and provides helpful responses to investment related questions. Financial experts, including hedge fund managers and research analysts, rate InvestLM's response as comparable to those of state-of-the-art commercial models (GPT-3.5, GPT-4 and Claude-2). Zero-shot evaluation on a set of financial NLP benchmarks demonstrates strong generalizability. From a research perspective, this work suggests that a high-quality domain specific LLM can be tuned using a small set of carefully curated instructions on a well-trained foundation model, which is consistent with the Superficial Alignment Hypothesis (Zhou et al., 2023). From a practical perspective, this work develops a state-of-the-art financial domain LLM with superior capability in understanding financial texts and providing helpful investment advice, potentially enhancing the work efficiency of financial professionals. We release the model parameters to the research community.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge