Johannes Stephan

Causal Forecasting for Pricing

Dec 23, 2023Abstract:This paper proposes a novel method for demand forecasting in a pricing context. Here, modeling the causal relationship between price as an input variable to demand is crucial because retailers aim to set prices in a (profit) optimal manner in a downstream decision making problem. Our methods bring together the Double Machine Learning methodology for causal inference and state-of-the-art transformer-based forecasting models. In extensive empirical experiments, we show on the one hand that our method estimates the causal effect better in a fully controlled setting via synthetic, yet realistic data. On the other hand, we demonstrate on real-world data that our method outperforms forecasting methods in off-policy settings (i.e., when there's a change in the pricing policy) while only slightly trailing in the on-policy setting.

Deep Learning based Forecasting: a case study from the online fashion industry

May 23, 2023Abstract:Demand forecasting in the online fashion industry is particularly amendable to global, data-driven forecasting models because of the industry's set of particular challenges. These include the volume of data, the irregularity, the high amount of turn-over in the catalog and the fixed inventory assumption. While standard deep learning forecasting approaches cater for many of these, the fixed inventory assumption requires a special treatment via controlling the relationship between price and demand closely. In this case study, we describe the data and our modelling approach for this forecasting problem in detail and present empirical results that highlight the effectiveness of our approach.

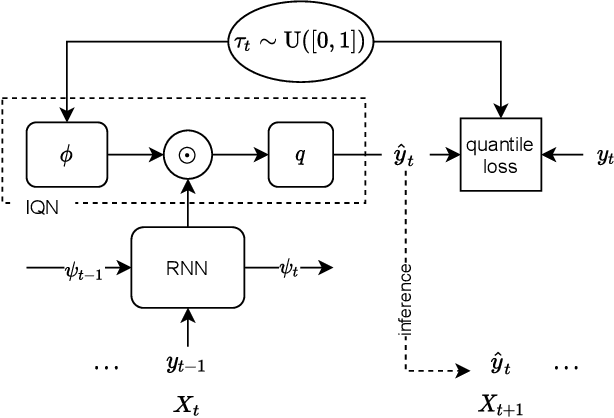

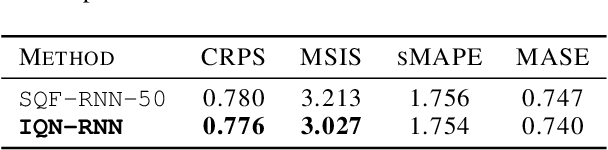

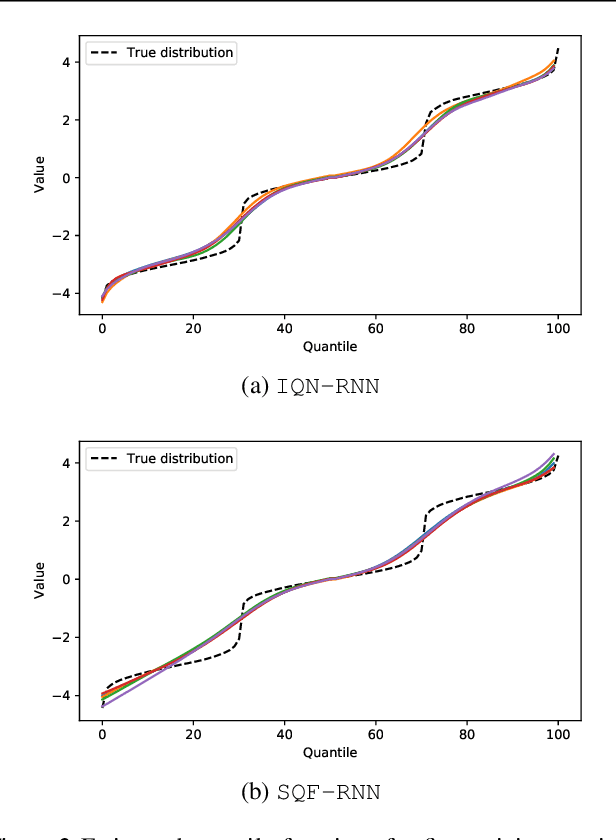

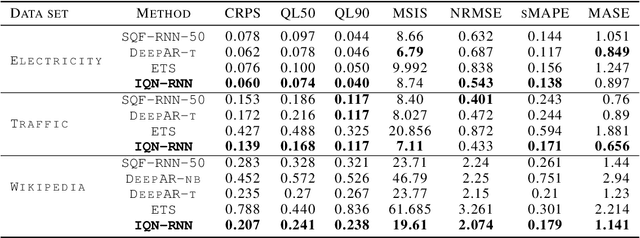

Probabilistic Time Series Forecasting with Implicit Quantile Networks

Jul 08, 2021

Abstract:Here, we propose a general method for probabilistic time series forecasting. We combine an autoregressive recurrent neural network to model temporal dynamics with Implicit Quantile Networks to learn a large class of distributions over a time-series target. When compared to other probabilistic neural forecasting models on real- and simulated data, our approach is favorable in terms of point-wise prediction accuracy as well as on estimating the underlying temporal distribution.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge