João Torres

Lightweight Automated Feature Monitoring for Data Streams

Jul 19, 2022

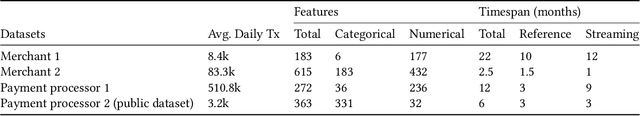

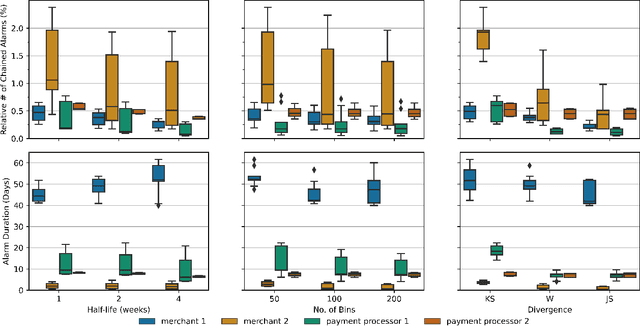

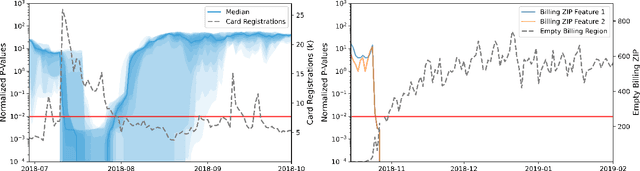

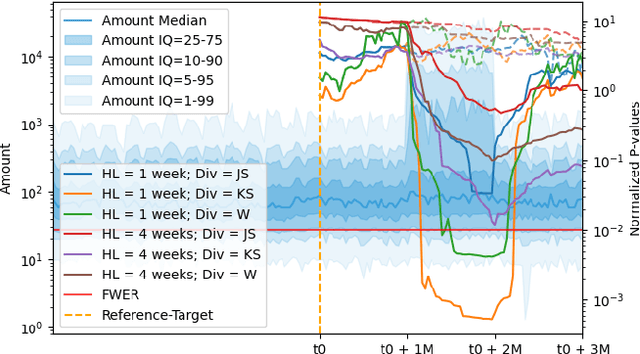

Abstract:Monitoring the behavior of automated real-time stream processing systems has become one of the most relevant problems in real world applications. Such systems have grown in complexity relying heavily on high dimensional input data, and data hungry Machine Learning (ML) algorithms. We propose a flexible system, Feature Monitoring (FM), that detects data drifts in such data sets, with a small and constant memory footprint and a small computational cost in streaming applications. The method is based on a multi-variate statistical test and is data driven by design (full reference distributions are estimated from the data). It monitors all features that are used by the system, while providing an interpretable features ranking whenever an alarm occurs (to aid in root cause analysis). The computational and memory lightness of the system results from the use of Exponential Moving Histograms. In our experimental study, we analyze the system's behavior with its parameters and, more importantly, show examples where it detects problems that are not directly related to a single feature. This illustrates how FM eliminates the need to add custom signals to detect specific types of problems and that monitoring the available space of features is often enough.

GuiltyWalker: Distance to illicit nodes in the Bitcoin network

Feb 10, 2021

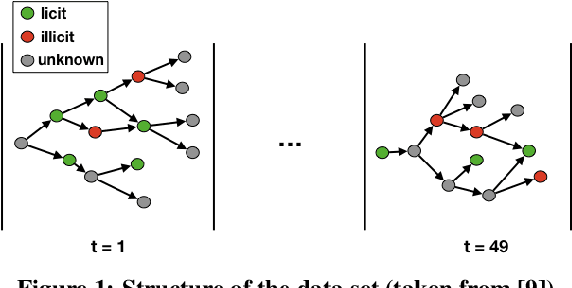

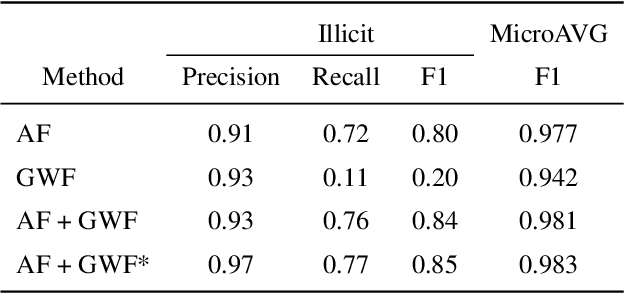

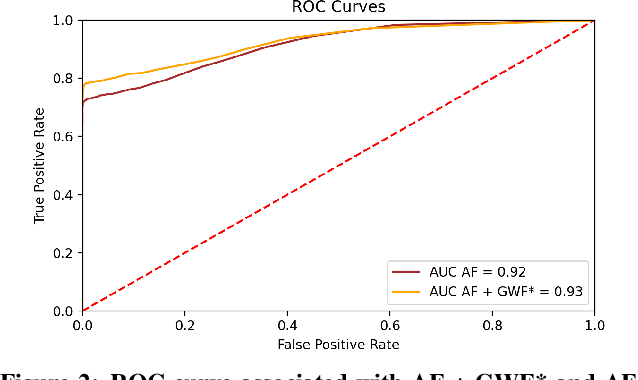

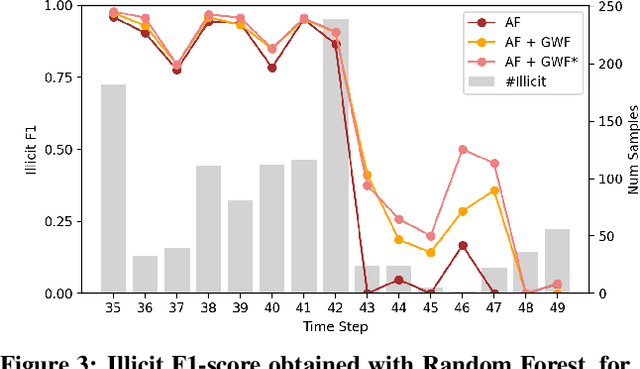

Abstract:Money laundering is a global phenomenon with wide-reaching social and economic consequences. Cryptocurrencies are particularly susceptible due to the lack of control by authorities and their anonymity. Thus, it is important to develop new techniques to detect and prevent illicit cryptocurrency transactions. In our work, we propose new features based on the structure of the graph and past labels to boost the performance of machine learning methods to detect money laundering. Our method, GuiltyWalker, performs random walks on the bitcoin transaction graph and computes features based on the distance to illicit transactions. We combine these new features with features proposed by Weber et al. and observe an improvement of about 5pp regarding illicit classification. Namely, we observe that our proposed features are particularly helpful during a black market shutdown, where the algorithm by Weber et al. was low performing.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge