Jiarui Song

A Parameter Adaptive Trajectory Tracking and Motion Control Framework for Autonomous Vehicle

Nov 25, 2024Abstract:This paper studies the trajectory tracking and motion control problems for autonomous vehicles (AVs). A parameter adaptive control framework for AVs is proposed to enhance tracking accuracy and yaw stability. While establishing linear quadratic regulator (LQR) and three robust controllers, the control framework addresses trajectory tracking and motion control in a modular fashion, without introducing complexity into each controller. The robust performance has been guaranteed in three robust controllers by considering the parameter uncertainties, mismatch of unmodeled subsystem as well as external disturbance, comprehensively. Also, the dynamic characteristics of uncertain parameters are identified by Recursive Least Squares (RLS) algorithm, while the boundaries of three robust factors are determined through combining Gaussian Process Regression (GPR) and Bayesian optimization machine learning methods, reducing the conservatism of the controller. Sufficient conditions for closed-loop stability under the diverse robust factors are provided by the Lyapunov method analytically. The simulation results on MATLAB/Simulink and Carsim joint platform demonstrate that the proposed methodology considerably improves tracking accuracy, driving stability, and robust performance, guaranteeing the feasibility and capability of driving in extreme scenarios.

Learning Non-Stationary Time-Series with Dynamic Pattern Extractions

Nov 20, 2021

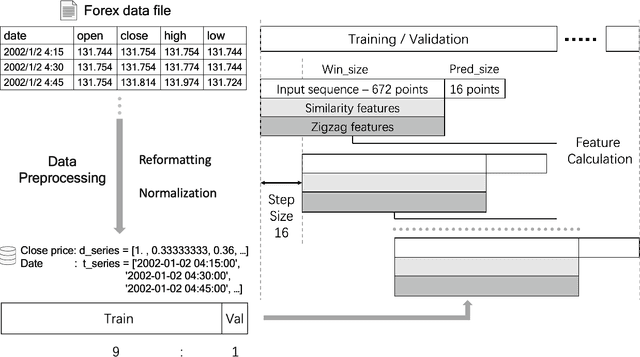

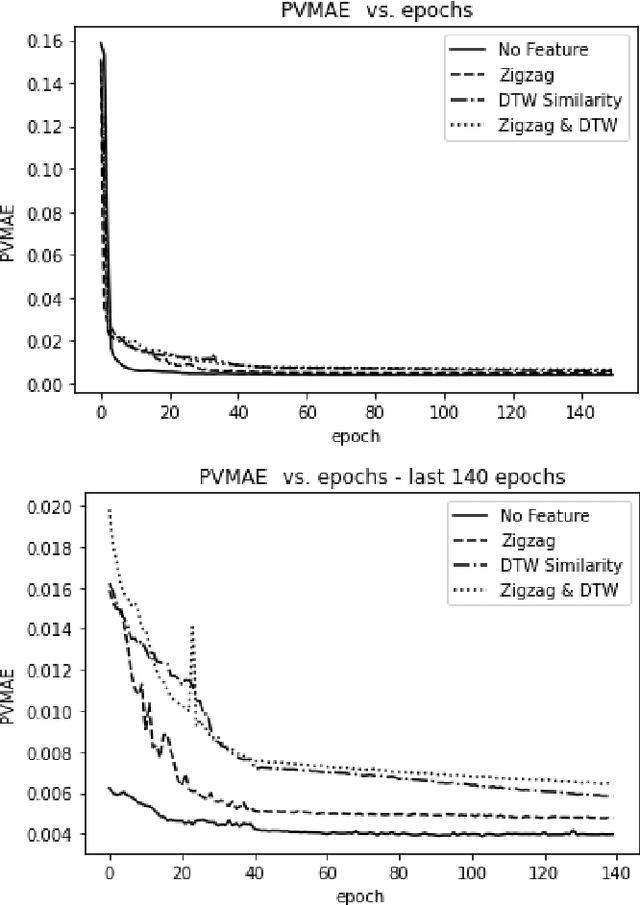

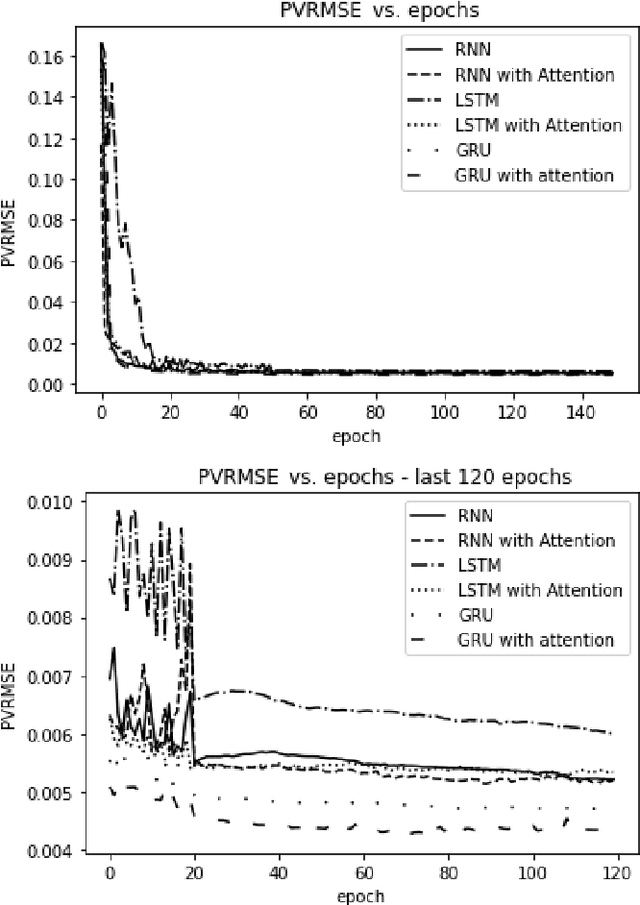

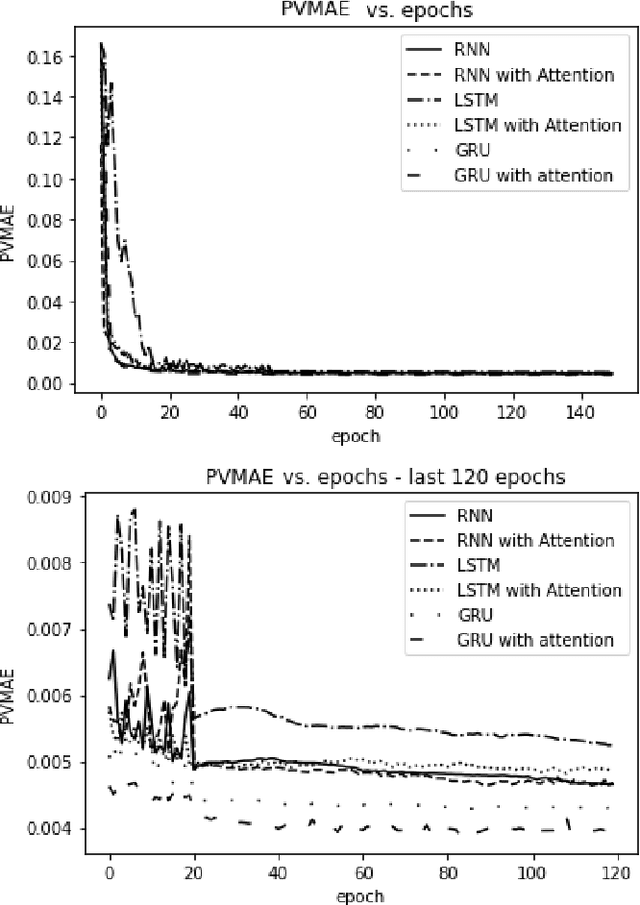

Abstract:The era of information explosion had prompted the accumulation of a tremendous amount of time-series data, including stationary and non-stationary time-series data. State-of-the-art algorithms have achieved a decent performance in dealing with stationary temporal data. However, traditional algorithms that tackle stationary time-series do not apply to non-stationary series like Forex trading. This paper investigates applicable models that can improve the accuracy of forecasting future trends of non-stationary time-series sequences. In particular, we focus on identifying potential models and investigate the effects of recognizing patterns from historical data. We propose a combination of \rebuttal{the} seq2seq model based on RNN, along with an attention mechanism and an enriched set features extracted via dynamic time warping and zigzag peak valley indicators. Customized loss functions and evaluating metrics have been designed to focus more on the predicting sequence's peaks and valley points. Our results show that our model can predict 4-hour future trends with high accuracy in the Forex dataset, which is crucial in realistic scenarios to assist foreign exchange trading decision making. We further provide evaluations of the effects of various loss functions, evaluation metrics, model variants, and components on model performance.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge