Hongwei Zhou

Cross-Modal ASR Post-Processing System for Error Correction and Utterance Rejection

Jan 10, 2022

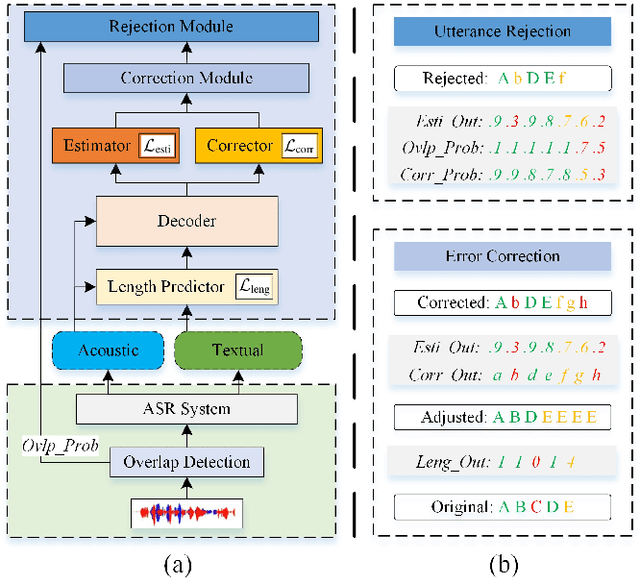

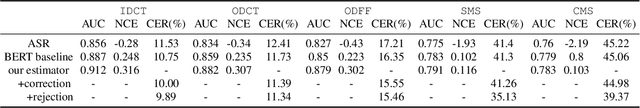

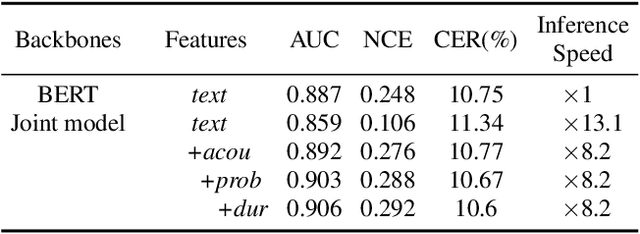

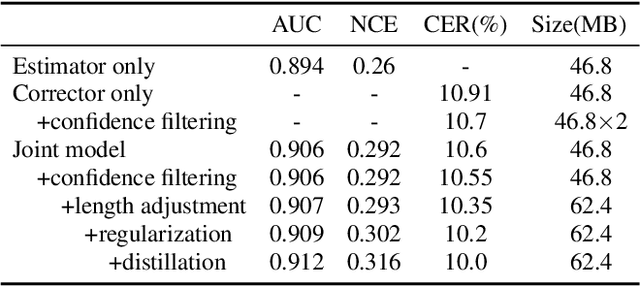

Abstract:Although modern automatic speech recognition (ASR) systems can achieve high performance, they may produce errors that weaken readers' experience and do harm to downstream tasks. To improve the accuracy and reliability of ASR hypotheses, we propose a cross-modal post-processing system for speech recognizers, which 1) fuses acoustic features and textual features from different modalities, 2) joints a confidence estimator and an error corrector in multi-task learning fashion and 3) unifies error correction and utterance rejection modules. Compared with single-modal or single-task models, our proposed system is proved to be more effective and efficient. Experiment result shows that our post-processing system leads to more than 10% relative reduction of character error rate (CER) for both single-speaker and multi-speaker speech on our industrial ASR system, with about 1.7ms latency for each token, which ensures that extra latency introduced by post-processing is acceptable in streaming speech recognition.

Financial Market Directional Forecasting With Stacked Denoising Autoencoder

Dec 02, 2019

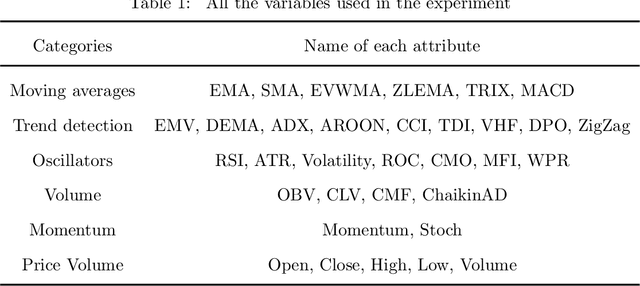

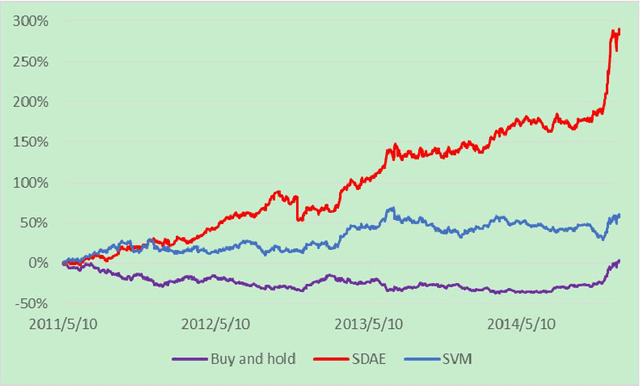

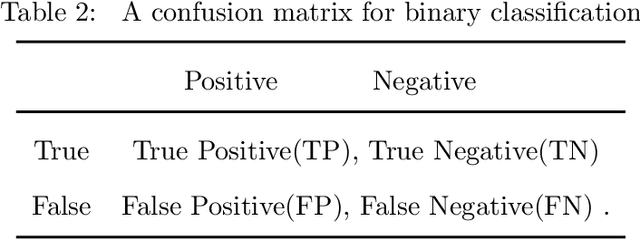

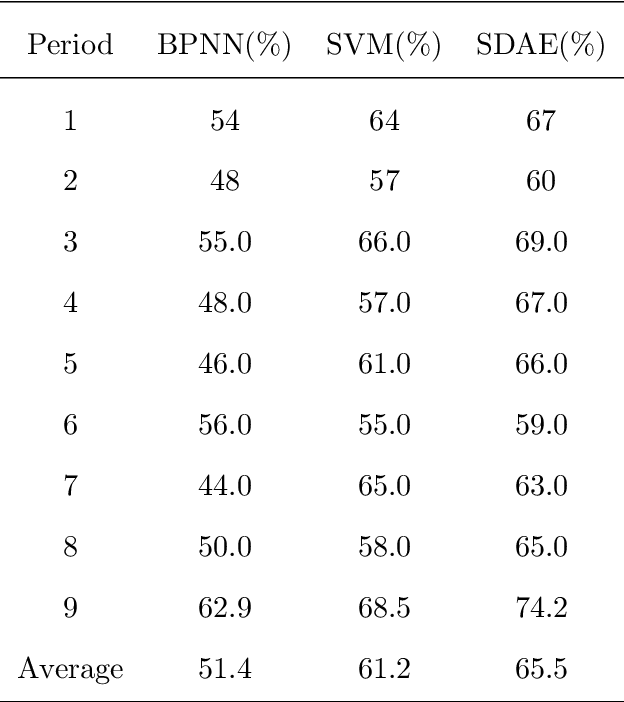

Abstract:Forecasting stock market direction is always an amazing but challenging problem in finance. Although many popular shallow computational methods (such as Backpropagation Network and Support Vector Machine) have extensively been proposed, most algorithms have not yet attained a desirable level of applicability. In this paper, we present a deep learning model with strong ability to generate high level feature representations for accurate financial prediction. Precisely, a stacked denoising autoencoder (SDAE) from deep learning is applied to predict the daily CSI 300 index, from Shanghai and Shenzhen Stock Exchanges in China. We use six evaluation criteria to evaluate its performance compared with the back propagation network, support vector machine. The experiment shows that the underlying financial model with deep machine technology has a significant advantage for the prediction of the CSI 300 index.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge